The Internal Revenue Service today kicked off the week with the 5th item on its 2022 annual Dirty Dozen scams warning list, with a sad reminder that criminals still use the COVID-19 pandemic to steal people's money and identity with bogus emails, social media posts and unexpected phone calls, among other things.

These scams can take a variety of forms, including using unemployment information and fake job offers to steal money and information from people. All of these efforts can lead to sensitive personal information being stolen, with scammers using this to try filing a fraudulent tax return as well as harming victims in other ways.

"Scammers continue using the pandemic as a device to scare or confuse potential victims into handing over their hard-earned money or personal information," said IRS Commissioner Chuck Rettig. "I urge everyone to be leery of suspicious calls, texts and emails promising benefits that don't exist."

The IRS has compiled the annual Dirty Dozen list for more than 20 years as a way of alerting taxpayers and the tax professional community about scams and schemes. The list is not a legal document or a literal listing of agency enforcement priorities. It is designed to raise awareness among a variety of audiences that may not always be aware of developments involving tax administration.

"Caution and awareness are our best lines of defense against these criminals," Rettig added. "Everyone should verify information on a trusted government website, such as IRS.gov."

A common scam the IRS continues to see during this period involves using crises that affect all or most people in the nation, such as the COVID-19 pandemic. Some of the scams for which people should continue to be on the lookout include:

Economic Impact Payment and tax refund scams: Identity thieves who try to use Economic Impact Payments (EIPs), also known as stimulus payments, are a continuing threat to individuals. Similar to tax refund scams, taxpayers should watch out for these tell-tale signs of a scam:

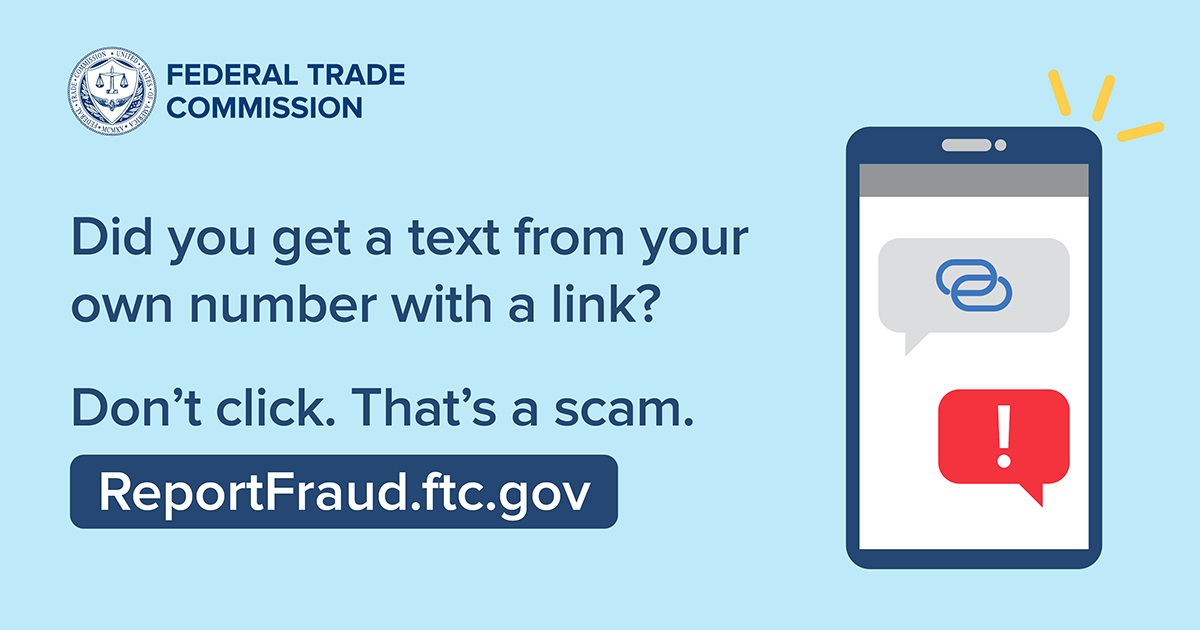

Any text messages, random incoming phone calls or emails inquiring about bank account information, requesting recipients to click a link or verify data should be considered suspicious and deleted without opening. This includes not just stimulus payments, but tax refunds and other common issues.

Remember, the IRS won't initiate contact by phone, email, text or social media asking for Social Security numbers or other personal or financial information related to Economic Impact Payments. Also be alert to mailbox theft. Routinely check your mail and report suspected mail losses to postal inspectors.

Reminder: The IRS has issued all Economic Impact Payments. Most eligible people already received their stimulus payments. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. Taxpayers should remember that the IRS website, IRS.gov, is the agency's official website for information on payments, refunds and other tax information.

Unemployment fraud leading to inaccurate taxpayer 1099-Gs: Because of the pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

Taxpayers should also be on the lookout for a Form 1099-G reporting unemployment compensation they didn't receive. For people in this situation, the IRS urges them to contact their appropriate state agency for a corrected form. If a corrected form cannot be obtained so that a taxpayer can file a timely tax return, taxpayers should complete their return claiming only the unemployment compensation and other income they actually received. See Identity Theft and Unemployment Benefits for tax details and DOL.gov/fraud for state-by-state reporting information.

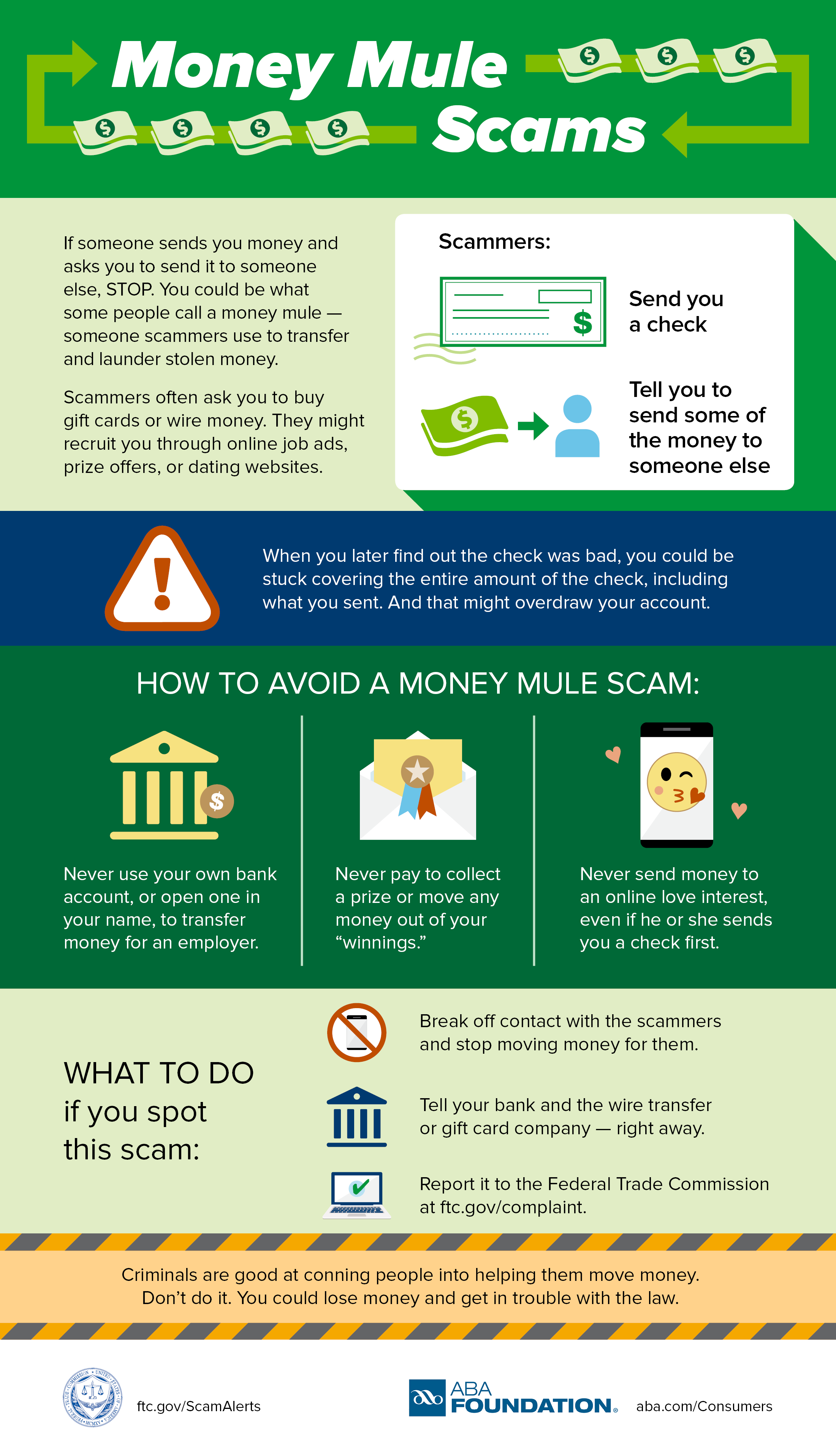

Fake employment offers posted on social media: There have been many reports of fake job postings on social media. The pandemic created many newly unemployed people eager to seek new employment. These fake posts entice their victims to provide their personal financial information. This creates added tax risk for people because this information in turn can be used to file a fraudulent tax return for a fraudulent refund or used in some other criminal endeavor.

Fake charities that steal your money: Bogus charities are always a problem. They tend to be a bigger threat when there is a national crisis like the pandemic.

Taxpayers who give money or goods to a charity may be able to claim a deduction on their federal tax return. Taxpayers must donate to a qualified charity to get a deduction. To check the status of a charity, use the IRS Tax Exempt Organization Search tool.

Here are some tips to remember about fake charity scams:

- Individuals should never let any caller pressure them. A legitimate charity will be happy to get a donation at any time, so there's no rush. Donors are encouraged to take time to do the research.

- Potential donors should ask the fundraiser for the charity's exact name, web address and mailing address, so it can be confirmed later. Some dishonest telemarketers use names that sound like large well-known charities to confuse people.

- Be careful how a donation is paid. Donors should not work with charities that ask them to pay by giving numbers from a gift card or by wiring money. That's how scammers ask people to pay. It's safest to pay by credit card or check — and only after having done some research on the charity.

For more information about avoiding fake charities, visit the Federal Trade Commission website

Shared from the IRS -> https://www.irs.gov/newsroom/irs-continues-with-dirty-dozen-this-week-urging-taxpayers-to-continue-watching-out-for-pandemic-related-scams-including-theft-of-benefits-and-bogus-social-media-posts

|

| IRS continues with Dirty Dozen this week |