|

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Showing posts with label minimum wage. Show all posts

Showing posts with label minimum wage. Show all posts

Friday, December 28, 2018

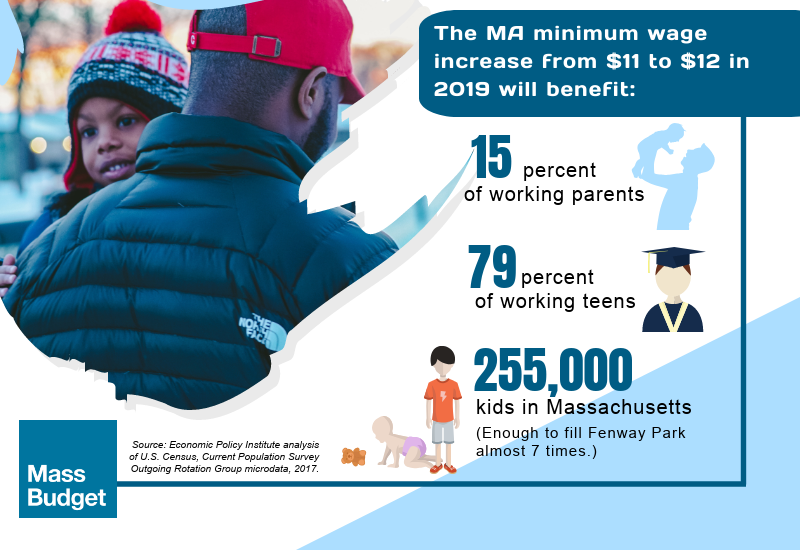

MassBudget: Minimum wage increase to $12 will benefit 662,000 workers

Monday, September 3, 2018

MassBudget: For Labor Day, a look at state policies that work for workers

$15 minimum wage, paid leave help Massachusetts workers

|

|

Sunday, July 1, 2018

When is a Grand Bargain Actually a Grand Problem?

In Massachusetts, politics is something of a blood sport, and nowhere has that been made more clear than in the recent “grand bargain” legislation to avert the placing on the ballot issues put forth by interest groups, many with the best of intentions. These would have had crippling effects on small business in the Commonwealth and a chilling effect on the potential recruitment of new companies to our state. The process is broken and must be addressed, and because some changes are constitutional in nature, ironically ballot reform may have to be addressed with yet another ballot measure.

The process for placing an item on the ballot on which the people will decide the result is relatively simple. First, one needs an idea for a problem they believe must be fixed that our representatives are not addressing. Ten registered voters later, the issue is presented to the Attorney General’s office for review of format and an initial assessment of legality and/or constitutionality. Then the organizers raise the money necessary to get 64,750 to sign the petition to place it on the ballot. They need not support the petition, but believe that it deserves a public vote.

From there, the issue goes merrily off to the Legislature which may adopt the question into law, propose a substitute or do nothing. Then, the issue proponents go out and gather an additional 10,792 signatures and the issue goes to the ballot. If there is a legislative substitute, both go to the ballot. Once on the ballot, the issue goes to the people who will, no doubt, be subject of well-funded campaigns put forth by organizers and opponents designed to cast the issue in its most or least favorable light. In November, the people decide – UNLESS there is some kind of Legislative compromise by which the proponents agree to pull off their question from the ballot. The gun is placed firmly at the Legislature’s head at this point, and regardless of the feasibility of the solution, only getting most of what proponents want will lead to the removal from the ballot.

What is wrong with this process? Mostly everything, sadly. The threshold to get something on the ballot is absurdly low. No policy is inherently all good or all bad, but there are reasons that these issues were not put forth by our elected legislators in the first place. The best they can do is make something “less bad” or from another perspective “less good”. We hire our legislators to make the best possible policy decisions for us. Sometimes they are right; sometimes they are wrong, but there are, and should be, consequences at the ballot box if they choose a disastrous change in the law.

This year, four particularly challenging ballot propositions came forward, three of which would have crippled small business in our state. The first, the millionaire’s tax, was struck down by the courts on constitutional grounds, but proponents vow to bring it back in a more constitutionally acceptable manner. The second, a sales tax reduction proposition, would have lowered the sales tax in Massachusetts from 6.25% to 5%, repealing what at one time was put forward as a temporary measure, but whenever government and revenue are involved, temporary has a way of turning permanent. And, if successful, the legislature would have sought to replace that revenue with some other tax or fee. The third, the paid family leave initiative would have placed a new tax on businesses and employees alike to fund a new government entity to ensure up to 26 weeks per year, a kindhearted gesture with real financial consequences that could have put small businesses out of businesses. The fourth was, for many small businesses, the most frightening - the increase in minimum wage to the highest in the nation, put forth by union groups with no members actually paid at minimum wage.

So, now we have a compromise. The sales tax remains the same but we will have a weekend sales tax holiday in August. Paid family leave has been cut back in length and small businesses (under 25 employees) are exempt from paying in – but their employees will have to pay in. And the minimum wage will go up to $15 per hour, with a gradual phase out of time and a half for Sundays. There will not be a teen or training wage component, virtually guaranteeing that no business will hire young people to learn the importance of work.

The so-called “grand bargain” gave proponents most of what they wanted, all of which have very real consequences for small businesses and large businesses alike. We citizens and taxpayers are held hostage by interest groups, and ballot initiative reform is a necessity in this state. Legislators are wary of addressing it for fear of being labeled as against the will of the people. Our legislators are forced to respond and compromise on issues they might otherwise never have addressed as remedies for the people of the Commonwealth.

Our citizens deserve a fair system, devoid of governance by special interests, and we welcome the opportunity to work with our legislators toward reforming the ballot initiative process and allowing them to do the job of fashioning good through a deliberative process.

The process for placing an item on the ballot on which the people will decide the result is relatively simple. First, one needs an idea for a problem they believe must be fixed that our representatives are not addressing. Ten registered voters later, the issue is presented to the Attorney General’s office for review of format and an initial assessment of legality and/or constitutionality. Then the organizers raise the money necessary to get 64,750 to sign the petition to place it on the ballot. They need not support the petition, but believe that it deserves a public vote.

From there, the issue goes merrily off to the Legislature which may adopt the question into law, propose a substitute or do nothing. Then, the issue proponents go out and gather an additional 10,792 signatures and the issue goes to the ballot. If there is a legislative substitute, both go to the ballot. Once on the ballot, the issue goes to the people who will, no doubt, be subject of well-funded campaigns put forth by organizers and opponents designed to cast the issue in its most or least favorable light. In November, the people decide – UNLESS there is some kind of Legislative compromise by which the proponents agree to pull off their question from the ballot. The gun is placed firmly at the Legislature’s head at this point, and regardless of the feasibility of the solution, only getting most of what proponents want will lead to the removal from the ballot.

What is wrong with this process? Mostly everything, sadly. The threshold to get something on the ballot is absurdly low. No policy is inherently all good or all bad, but there are reasons that these issues were not put forth by our elected legislators in the first place. The best they can do is make something “less bad” or from another perspective “less good”. We hire our legislators to make the best possible policy decisions for us. Sometimes they are right; sometimes they are wrong, but there are, and should be, consequences at the ballot box if they choose a disastrous change in the law.

This year, four particularly challenging ballot propositions came forward, three of which would have crippled small business in our state. The first, the millionaire’s tax, was struck down by the courts on constitutional grounds, but proponents vow to bring it back in a more constitutionally acceptable manner. The second, a sales tax reduction proposition, would have lowered the sales tax in Massachusetts from 6.25% to 5%, repealing what at one time was put forward as a temporary measure, but whenever government and revenue are involved, temporary has a way of turning permanent. And, if successful, the legislature would have sought to replace that revenue with some other tax or fee. The third, the paid family leave initiative would have placed a new tax on businesses and employees alike to fund a new government entity to ensure up to 26 weeks per year, a kindhearted gesture with real financial consequences that could have put small businesses out of businesses. The fourth was, for many small businesses, the most frightening - the increase in minimum wage to the highest in the nation, put forth by union groups with no members actually paid at minimum wage.

So, now we have a compromise. The sales tax remains the same but we will have a weekend sales tax holiday in August. Paid family leave has been cut back in length and small businesses (under 25 employees) are exempt from paying in – but their employees will have to pay in. And the minimum wage will go up to $15 per hour, with a gradual phase out of time and a half for Sundays. There will not be a teen or training wage component, virtually guaranteeing that no business will hire young people to learn the importance of work.

The so-called “grand bargain” gave proponents most of what they wanted, all of which have very real consequences for small businesses and large businesses alike. We citizens and taxpayers are held hostage by interest groups, and ballot initiative reform is a necessity in this state. Legislators are wary of addressing it for fear of being labeled as against the will of the people. Our legislators are forced to respond and compromise on issues they might otherwise never have addressed as remedies for the people of the Commonwealth.

Our citizens deserve a fair system, devoid of governance by special interests, and we welcome the opportunity to work with our legislators toward reforming the ballot initiative process and allowing them to do the job of fashioning good through a deliberative process.

The Southeastern Massachusetts Legislative Alliance of Chambers [SEMLAC] is comprised of the following chambers of commerce: Bristol County, Cape Cod Canal Region, Cranberry Country, Sandwich, SouthCoast, Taunton Area, Tri-Town and United Regional. SEMLAC represents the business interests of the communities each chamber serves and addresses policy issues of importance to the region as a whole.

|

| When is a Grand Bargain Actually a Grand Problem? |

Friday, June 29, 2018

MassBudget: Minimum wage increase would raise earnings of low- and middle-income families

Frequently asked questions

|

|

Friday, December 29, 2017

“We are working diligently to strike the right balance"

"Despite support from a majority of its members, legislation raising the Massachusetts minimum wage from $11 to $15 is ending 2017 the same way it began the year - pending before the Democrat-controlled Labor and Workforce Development Committee.

Meantime, citizen activists anxious to put a $15 wage floor on the lawbooks are moving forward with their plans to do so without any help from Beacon Hill.

Raise Up Massachusetts, the coalition behind an initiative petition on track for a vote in November 2018, noted Wednesday that the minimum wage will rise on Jan. 1 in 18 states, but will remain the same in Massachusetts for the first time in four years. Arizona, Colorado, Maine, Oregon and Washington have approved minimum wages that exceed $11 an hour, and California and New York are already on schedule to bring their minimum wages up to $15 an hour.

While minimum wage hike opponents have warned pay mandates will hold down job growth, the coalition said that since 2014, when the Massachusetts minimum wage was $8 an hour, employers have added more than 211,000 jobs in Massachusetts and the state’s low jobless rate points to a need for more workers."

Continue reading the article online (subscription may be required)

http://www.milforddailynews.com/news/20171228/no-bump-for-minimum-wage-earners-as-15-bill-hung-up-in-committee

Tuesday, December 26, 2017

MassBudget: Report finds wage increases do not relate to drops in teen employment

Working teens' wages account for 18% of low-income families' income

|

|

Friday, September 22, 2017

MassBudget: 29% of Mass workers would be affected by $15 minimum wage

Local estimates in new fact sheet

|

|

Subscribe to:

Posts (Atom)