The Massachusetts Senate voted today to approve a final $40.202B billion budget for Fiscal Year 2018. The budget makes reductions in spending from the originally proposed Senate budget due to revised revenue forecasts, but maintains a strong commitment to Chapter 70 education funding and preserving local aid to cities and towns.

"This budget was negotiated in a tough fiscal environment, as projected revenues fell short for a variety of complex reasons," said Senator Karen E. Spilka (D-Ashland), Chair of the Senate Committee on Ways and Means. "We have worked hard to balance fiscal responsibility with our longstanding commitment to the residents of our Commonwealth. Our fiercest commitment is to our children, and so the final budget contains an overall increase in Chapter 70 education funding. We also increased local aid to cities and towns, and fought to ensure that the Governor's late-proposed healthcare package was not adopted without the proper public process and transparency."

The FY 2018 budget includes $40.202B in total spending with investments in education, local aid, health care, substance addiction services, developmental services and children and families. It also deposits $100M into the state's Stabilization Fund.

"This is the harshest state budget since the last recession. It would have been somewhat better had it contained the Senate's modest revenue proposals including those on Airbnb, internet hotel resellers, flavored cigars, film tax, and the CPA," said Senate President Stan Rosenberg (D-Amherst). "We can take some measure of pride in what we were able to do for local aid, children, and veterans, but too many were left behind."

"Despite difficult fiscal challenges, this year's budget still includes critical investments in many of our most valuable services and programs," said Senator Sal DiDomenico, Vice Chair of the Senate Committee on Ways and Means. "I was proud to work with my colleagues on the conference committee to create a comprehensive final budget that protects many of our communities' top priorities, while also remaining financially responsible. I am confident that the budget we have produced will address the needs of our residents and will continue moving our entire Commonwealth forward."

"This budget makes important strides toward recognizing a fiscal reality that demands both reform and spending restraint," said Senate Minority Leader Bruce Tarr (R-Gloucester). "Difficult choices, maintaining priorities like education and local aid, and the absence of a host of new tax initiatives make it a workable document to move forward, yet there is still much to be done in the future."

In response to below benchmark FY2017 revenue, the conference committee took the following steps to close the budget gap:

· $400M in spending reductions relative to the House and Senate budgets, including a $150M reduction to MassHealth because of efficiencies and enhanced program integrity and $250M in reductions in other areas of the budget

· $205M in anticipated department efficiencies

· $83M in additional revenue because the income tax rollback will not be triggered

· $50M in non tax revenue increase from agencies, departments, trusts or federal resources

The conference committee reviewed and considered the package of proposals submitted by the Baker/Polito Administration regarding the employer assessment and MassHealth benefit and eligibility changes. The final budget proposes:

· Including the targeted two-tiered EMAC contribution to generate $200M in revenue

· Modifying the unemployment insurance schedule that will allow employers to pay approximately $334M less over 2 years than they would have paid under the current schedule

· Not including any of the new reforms at MassHealth requiring federal waiver changes, other changes to eligibility and benefits, or commercial market reforms

Significant final investments include:

· $4.74B in Chapter 70 education funding, a $118.9M increase, which amounts to a $30 per pupil increase, 85% effort reduction, and a significant down payment on foundation budget health care rate increases

· $1.061B for Unrestricted Local Aid to Cities and Towns – a $40M increase

· $15M for Early Education and Care (EEC) rate reserve

· $132.5M for the Bureau of Substance Addiction Services to continue to fund beds, treatment centers, life-saving medications and recovery options

· $61.7M increase to developmental services, particularly in support of the growing Turning 22 population

· $36M increase in overall DCF funding to continue important initiatives designed to ensure that every family has a healthy, supportive environment

Further recommendations preserved in the conference committee report include:

· Expansion of the Housing Court, to stabilize housing and keep residents in their homes

· Creation of a dedicated reserve for CPCS to ensure that these attorneys will be paid regularly for their crucial work moving forward

· Maintenance of $2M in the budget for the cannabis commission so that the will of voters continues to move forward in a smooth and transparent manner

The FY 2018 conference committee report passed the Senate with a vote of 36 to 2. The budget will now go to Governor Baker for his signature.

|

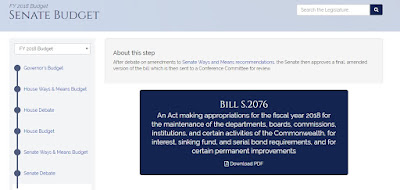

| link to Senate Fiscal Year 2018 Budget |