Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Saturday, February 7, 2026

Joe Landry: Industry in Franklin (video)

Wednesday, November 22, 2023

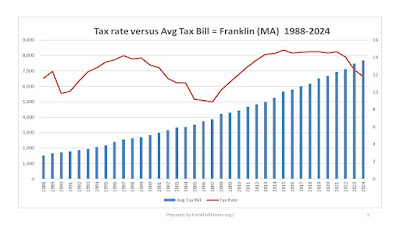

Franklin's tax rate will decrease to $11.79/thousand for FY 2024 (video)

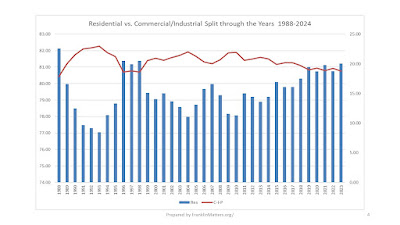

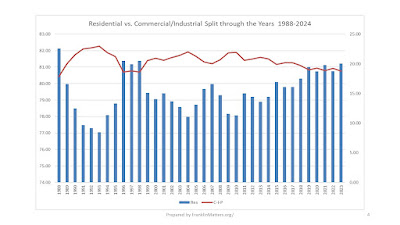

"A single tax rate means that all property classes (residential, commercial, industrial and personal) are taxed at the same tax rate. A dual tax rate means the commercial-industrial-personal tax rate is increased while the residential rate is decreased. In other words, some of the residential tax burden is shifted towards commercial, industrial and personal properties.Please note that a dual tax rate does not produce more tax revenue, it simply shifts the burden." (Bold added for emphasis)

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |

Tuesday, November 21, 2023

Tax Rate Hearing - Charts to help understand the Town of Franklin rate, tax bill, and assessed valuation relationship

|

| cover page for FranklinMatters.org explanation |

|

| historical tax rate shown |

|

| as the assessed valuation increases, the rate decreases, and vice versa |

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |

Monday, January 23, 2023

Register O'Donnell Reports on 2022 Annual Real Estate Activity in Norfolk County

In 2022, there were 130,051 documents recorded at the Norfolk County Registry of Deeds, a 33% decrease from 2021.

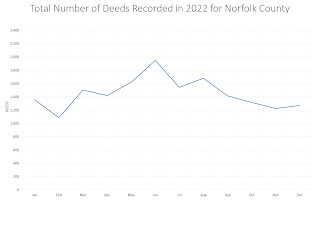

"The real estate market is feeling the effects of inflation and steadily rising interest rates, which is limiting how much money customers can save," said Register O'Donnell. "The total number of documents is much lower in 2022 than it was in 2021, but the change from month to month is less pronounced. The number of recorded deeds, which is one measure of document volume, shows a drop in real estate sales from the previous year."

Average Annual Sale Price Commercial-Residential

The number of deeds for 2022, which reflect real estate sales and transfers, both commercial and residential, was 17,398—a decrease of 17% from 2021.

Sale prices for 2022 appear to have increased slightly compared to 2021. The average sale price for all of Norfolk County, both commercial and residential, this year was $1,173,256, a 10% increase from 2021. However, the total dollar volume of commercial and residential sales is down, decreasing 10% from one year ago.

"With the average sales price showing increases for the year as a whole and the total volume of sales decreasing, indicates that in 2022 there were fewer homes being sold, but at a higher price," said Register O'Donnell.

Total Number of Deeds Recorded in 2022 for Norfolk County

According to numbers from the Consumer Financial Protection Bureau, the median interest rate of a 30-year fixed-rate conventional loan started at 4.14% in January 2022 and grew to 6.61% by December 2022, a more than 63% increase.

"The increasing cost of living and rising interest rates that the country is currently experiencing have an effect on the local real estate market," noted O'Donnell. "With interest rates more than double what there were at the start of 2022, consumers appear to be less inclined to borrow, and the decline in average sales prices suggests sellers are lowering pricing to compensate,"

Overall lending activity showed a continued downward trend. A total of 23,265 mortgages were recorded at the Registry in 2022, 50% fewer than a year earlier.

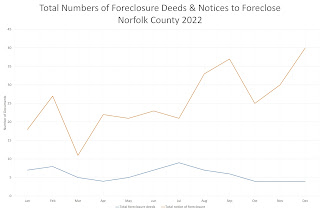

"This year, month to month, the registry figures show significant increases in the number of pending foreclosures, with as many as 40 in one month," said O'Donnell.

Total Numbers of Foreclosure Deeds & Notices to Foreclose

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In 2022, there were 68 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in 2021 there were 52 recorded. However, in 2022, there were 308 notices to foreclose, the first step in the foreclosure process, significantly more than the 141 recorded in December of 2021.

"The substantial increase in the number of notices to foreclose is troubling. This suggests that more of our neighbors may have financial difficulties in the future," said O'Donnell. "We have seen this number more than double this year and will continue to monitor these figures in 2023."

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General's Consumer Advocacy and Response Division (CARD) at 617-727-8400.

"If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance," said Register O'Donnell.

Register O'Donnell concluded, "Inflation in the US has been increasing since mid-2021, and it hit a 40-year high exceeding 8% in September 2022. The Federal Reserve raised interest rates many times in 2022 in an effort to slow the rise in inflation. As a result, borrowing money now costs more. This year, mortgage rates have doubled, which has led some buyers to pause their home searches, and, on average, fewer offers are being made to sellers."

To learn more about these and other Registry of Deeds events and initiatives, "like" us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.

Sunday, December 4, 2022

Industrial revolution not sustainable

"Something to think about:Shared from Twitter https://t.co/sqQKxvPl4H

The Earth is 4.6 billion years old. Let's scale that to 46 years.

We have been here for 4 hours. Our industrial revolution began one minute ago.

In that time, we have destroyed 50% of the world's forests. This is not sustainable."

Saturday, October 29, 2022

Finance Committee hears of the assessment process which accounts for about 60% of the Town of Franklin revenue (audio)

FM #867 = This is the Franklin Matters radio show, number 867 in the series.

This session of the radio show shares the Finance Committee meeting held on Wednesday, Oct 26, 2022.

The meeting was conducted in a hybrid format: 6 members of the Finance Committee were in the Council Chambers along with some of the public, 1 member was remote along with some members the public via conference bridge, all to adhere to the ‘social distancing’ requirements of this pandemic period.

The primary discussion was with Kevin Doyle, Assessor and Chris Feeley, Chair of the Board of assessors as the assessment process was covered at a high level. How are residential homes assessed? How are commercial/industrial properties assessed?

Interesting fact, the assessment process produces about 60% of the Town of Franklin revenue.

The meeting recording runs about seventy minutes, so let’s listen to the Finance Committee meeting Oct 26, 2022.

Audio file -> https://franklin-ma-matters.captivate.fm/episode/fm-867-franklin-ma-finance-cmte-mtg-10-26-22

--------------

Meeting agenda document -> https://www.franklinma.gov/sites/g/files/vyhlif6896/f/agendas/10-26-22_finance_committee_meeting.pdf

My notes -> https://drive.google.com/file/d/1qvpZtcz3JE529S9wN1tkJJ3FB9w92B8N/view?usp=sharing

Link to Finance Committee => https://www.franklinma.gov/finance-committee

YouTube recording => https://youtu.be/OaibaQ9dOBk

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

Monday, November 15, 2021

Franklin, MA: Industry in Franklin - video by Joe Landry

Friday, July 2, 2021

Franklin, MA: Industry in Franklin (video)

This is a video that highlights the rich history of Franklin's industrial past.

Video link = https://youtu.be/B8E2ztPoHWM

Tuesday, February 16, 2021

new webpage to explore -> Industrial History New England

"This new website is a celebration of New England as a landscape of work and innovation and a portal for exploring the American birthplace of a revolution that triggered the most profound set of social and environmental changes in human history."

Shared from Twitter: https://t.co/A6zJj5rzrU

|

| new webpage -> Industrial History New England |

Monday, November 23, 2020

What about a Marshall Plan for today?

The writers are the mayors of Pittsburgh; Youngstown, Ohio; Dayton, Ohio; Columbus, Ohio; Cincinnati; Huntington, W.Va.; Morgantown, W.Va.; and Louisville.

"Every four years, voters in Pennsylvania, Ohio, West Virginia and Kentucky are told how important they are to American industry, but once the election is over, nothing happens. The United States now has a president-elect who comes from our region originally and is more likely to understand what we need to revive it. We, the mayors of eight cities, are banding together to demand real investment in our shared region, which has fueled the U.S. economy for generations yet never gets the attention it deserves.

It’s why we’re asking for an ambitious federal response to save our industries and communities from destruction: a Marshall Plan for Middle America.

In the post-World War II recovery period, the Marshall Plan was a $13 billion ($143 billion today) investment strategy to rebuild Europe and foster economic and democratic institutions. Like postwar Europe, Middle America faces similar issues of decline — a shared crisis of aging infrastructure, obsolescence of business and government institutions, and the need for upskilling and reskilling the workforce."Continue reading the article online (subscription may be required)

Wednesday, September 16, 2020

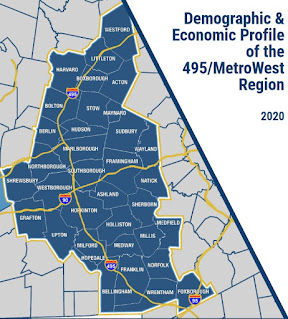

In the News: "One challenge the region faces due to its economic success is traffic congestion"

From the Milford Daily News, articles of interest for Franklin:

"The MetroWest region’s unemployment rate has been consistently lower than the statewide numbers for the past three decades thanks in part to an influx of biopharmaceutical, information technology and analytics as well as medical device companies moving to the area.

But the increase in new businesses coming to the region has created some challenges, such as increased traffic congestion, according to a new profile of economic and demographic trends released Monday.

The Westborough-based 495/MetroWest Partnership and the Public Policy Center at UMass Dartmouth released the new profile, which indicates the region continues to enjoy a number of strategic advantages while continuing to confront challenges related to transportation and housing."

Sunday, April 5, 2020

Once Upon a Town: Industries of Franklin MA

"Franklin boomed in the 19th and 20th century thanks to industry as entrepreneurs launched new businesses making straw hats, felt, shoes, other textiles and even sugar"

https://youtu.be/RPjNer1iIls

Wednesday, November 20, 2019

Franklin Economic Development Survey - your chance to provide input

Please click on this link to access the survey form:

https://forms.gle/6SJpXeWPvg2H37A96

This survey will be available until December 13.

There are hard copies available in the Town Administrator's office if needed. Thank you in advance for your input, ideas and feedback!

|

| Franklin Economic Development Survey - Provide your input! |

Sunday, November 3, 2019

Franklin Economic Development Survey - Provide your input!

Please click on this link to access the survey form:

https://forms.gle/6SJpXeWPvg2H37A96

This survey will be available until December 13.

There are hard copies available in the Town Administrator's office if needed. Thank you in advance for your input, ideas and feedback!

|

| Franklin Economic Development Survey - Provide your input! |

Saturday, July 8, 2017

QinetiQ North America expands to Franklin

"Transwestern Consulting Group (TCG) brokered the $6.4 million sale of 130 Constitution Blvd. in Franklin, Ma, on behalf of Novaya Real Estate Ventures.

The 59,970-square-foot industrial building was purchased by Albert Milstein, Barry Kirschenbaum and Sanford Bokor. TCG Partners John Lashar and Chris Skeffington, along with Vice President Roy Sandeman, represented the seller and assisted in sourcing the buyer.

Novaya purchased the building in 2013 as part of a two-building portfolio in a transaction also brokered by TCG and has since launched a significant capital improvement campaign. Novaya completed a full “vacancy preparation” repositioning of the building, which included painting the warehouse, a floor strip and seal, installing new lighting, and upgrading the dock doors with new levelers. In addition, a new roof and upgraded HVAC units were installed as part of the overall improvement campaign.

“Novaya did an outstanding job repositioning 130 Constitution Blvd. into a first-class flex/manufacturing facility that really stands out in one of Greater Boston’s strongest submarkets,” said Skeffington. “The new ownership is purchasing a well-located asset that is 100 percent leased to a long-term, well-capitalized tenant.”

Continue reading the full article online

http://bostonrealestatetimes.com/transwestern-consulting-group-brokers-building-sale-on-behalf-of-novaya-real-estate-ventures/

The "well-capitalized tenant" is QinetiQ North America. From the company webpage:

"QinetiQ North America (QNA) shapes the future with innovative products, advanced engineering and research and development for government, civilian, utility and commercial customers worldwide. We pride ourselves on developing, delivering and supporting a portfolio of industry-leading products that have been used and tested for decades.

We are the world leaders in unmanned systems with proven innovations in military protection technology including ground and aircraft armor, RPG protection, and soldier protection systems. We also offer innovative technologies and products for the maritime, utility and commercial safety market. Together, our products aid in situational awareness, protect customer assets, increase mission effectiveness, reduce operational costs and save lives."Find out more about their products https://www.qinetiq-na.com/products/

Visit their YouTube channel https://www.youtube.com/channel/UC1ZtYN59WSfHOPKCy5y1exg

|

| https://twitter.com/QinetiQNorthAm |

Saturday, October 22, 2016

Tri-County Regional to host Manufacturing and Robotics Open House to celebrate Manufacturing Month

| image from Tri-County webpage |

Thursday, September 4, 2014

In the News: new high school, STEM roundtable, clean water grant

Every student has been assigned a Google Chromebook — affordable laptops — to use in class, Waite noted, saying it’s one of the things she’s been most excited about.

Bates and Waite, as well as the other members of the student-led transition teams, were integral in preparing the school for the first day, Light said.

"It was impressive work by a group of kids who were so enthusiastic and positive and willing to do all of the hard work behind the scenes to get the school up and running," he said. "That, to me, is really the most exciting thing: This is a place for the students, and we’re trying to create a culture where it’s led by the students, as well."Continue reading the article in the Milford Daily News (subscription maybe required)

http://www.milforddailynews.com/article/20140904/NEWS/140908725/1994/NEWS

Sparking interest in science and engineering early at the middle school level is one way to build a stronger workforce in the high-tech manufacturing fields, according to officials in the industry.

Executives from four such companies on Wednesday met with U.S. Rep. Joseph Kennedy III and state Rep. John Fernandes, D-Milford, for a roundtable discussion on potential solutions to the problems the industry faces.

Kennedy, a Democrat who represents the state’s 4th Congressional district, organized the session in part to update leading manufacturers on his bill that aims to establish regional manufacturing institutes across the country for education and research. The government would dole out funding for the centers through a competitive grant system.Continue reading the article in the Milford Daily News (subscription maybe required)

http://www.milforddailynews.com/article/20140904/NEWS/140908721/1994/NEWS

The town has received $117,650 in state funds to improve storm water runoff, the state Department of Environmental Protection announced today.

The money will aid the town in "mitigating the effects of polluted storm water," according to a press release..

"Clean lakes and streams mean thriving communities and healthy ecosystems," said Massachusetts Department of Environmental Protection Commissioner David W. Cash.Continue reading the article in the Milford Daily News (subscription maybe required)

http://www.milforddailynews.com/article/20140902/NEWS/140909473

Saturday, August 30, 2014

Barrett Distribution Centers has been honored again

For the third consecutive year, Barrett Distribution Centers has been honored as a part of the 2014 Inc. 500 | 5000 list of fastest growing private companies in the nation. This is Barrett’s sixth appearance on the list. Prior honors include 2007, 2008, 2009, 2012 and 2013.

“Barrett Distribution Centers is proud to be in the company of so many of the most respected companies in America. We are grateful to our customers and team for making this achievement possible for a sixth time.”

|

| Barrett Distribution Centers |

Continue reading the article on the Barrett Distribution webpage here

http://www.barrettdistribution.com/blog/barrett-distribution-centers-named-to-the-2014-inc.-500-5000-fastest-growing-companies-list

|

| Barrett Distribution Centers |

Sunday, July 13, 2014

VWR Internaional marks the 10th anniversary of its Franklin, MA Distribution Center

VWR International, LLC, a global solutions provider of laboratory supplies, equipment and services today announces the 10th anniversary of its Franklin, Mass. Distribution Center. Serving the Greater New England area, this location supports customers in the pharmaceutical, biotech and healthcare industry. Over the last decade, this location has provided a variety of services to help VWR customers maximize supply chain security by providing reliable and transparent solutions to critical research, process development and manufacturing process applications.

A special capability provided by the Franklin facility is production chemical services and supply chain solutions through regulatory compliance, operational efficiency and supply chain assurance. These special services including sampling in an ISO Class 8 Cleanroom and other unique services meets the specific needs of VWR's biotech and pharmaceutical customers. The facility is compliant with International Pharmaceutical Excipient Council's (IPEC) Guidelines for current Good Distribution Practices (cGDP) and has been recognized by Avantor Performance Materials, Inc. as Certified Excipient Distributor (CED) facility. In addition, the facility is ISO 9001:2008 registered, and a licensed Massachusetts Board of Pharmacy (BOP) warehouse.

Besides traditional distribution other services conducted at this 55,000 square foot facility include custom pallet programs, storage and warehousing of customer dedicated, pre-reserved or customer owned inventory, custom bar-code labeling, and furnishing product certifications with shipments.

"The Franklin facility is an integral and valuable asset to our supply chain. The local support we've received over the years has significantly contributed to the success of our manufacturing operations in many ways," shared Alex Malgieri, Associate Director of Logistics for Alexion Rhode Island Manufacturing Facility. "On behalf of Alexion Pharmaceuticals, we would like to say thanks for the exceptional level of support."

"VWR continues to focus on providing superior service to our customers by minimizing complexity and increasing their productivity," said Tim Wedemyer, SVP, North America Operations for VWR. "With the many special services our Franklin facility can offer to our customers, especially in the area of research and production chemicals, we look forward to many more years of serving our customers in key geographies like New England."

| VWR International, LLC |

About VWR International, LLC

VWR International, LLC, headquartered in Radnor, Pennsylvania, is a global solutions provider of laboratory supplies, equipment and services with worldwide sales in excess of $4.1 billion in 2013. VWR enables the advancement of the world's most critical research by providing product and service solutions to laboratories and production facilities in the pharmaceutical, biotech, industrial, educational, governmental and healthcare industries. With over 160 years of industry experience, VWR offers a well-established network that reaches thousands of specialized labs and facilities spanning the globe. VWR has over 8,000 associates around the world working to streamline the way scientists, researchers, medical professionals and engineers across the Americas, Europe and Asia Pacific stock and maintain their facilities. In addition, VWR further supports its customers by providing onsite services, storeroom management, product procurement, supply chain systems integration and technical services.

For more information on VWR, visit www.vwr.com.

VWR and design are registered trademarks of VWR International, LLC.

http://investors.vwr.com/releasedetail.cfm?ReleaseID=859165