ANNUAL REPORT OF THE BOARD OF ASSESSORS

Interim Revaluation

The interim revaluation of all real and personal property in the Town of Franklin was completed Fall 2019 in preparation for Actual Fiscal Year 2020 3rd quarter tax bills. Following is a brief review of that achievement.

Data Collection

Eighteen years have now passed since we installed the real estate valuation and assessment administration software developed by Patriot Properties, Inc. Because our start-up data was from a different form of valuation system and most of our data had not been refreshed in nearly ten years, it was necessary to complete a town- wide data recollection program prior to finalizing the FY 2005 valuations. Patriot Properties was hired for this task. Over the past 15 years, our appraisal staff has performed the on-going property exterior measuring and interior inspecting for all real estate classes. Such reviews are done for the Department of Revenue (DOR) required cyclical program, as well as for building permitted changes, pre-appraisal, abatement and sales verifications.

Field Review

In addition to individual property on-site review, field reviews are required periodically to check for obvious data accuracy and consistency. This drive-by review provides another level of assurance that when valuation schedules are applied, the results will be “Fair and Equitable”.

Commercial/Industrial/Apartment Valuations

Annually there are analyses of sales data as well as income & expense market data. The Board contracted Patriot to work with our Director to establish an income approach to value for each property. All requirements of the Massachusetts Department of Revenue were met through final approval of the FY 2020 valuations.

Sales Analysis

The majority of the sales analysis was completed by September 2019, and the interpretation of sales continued through the next two stages of valuation. The town-wide program resulted in a valuation system that was applied uniformly throughout the town, while reflecting all the adjustments warranted individually and by neighborhood, to result in “Full and Fair Cash Values” as per Massachusetts General Law.

Value Generation

A system of valuation was established based on valid property sales and where applicable the income approach to value. These schedules

concluded from the market were then uniformly applied to all taxable and exempt real property.

Final Value Review

Final reviews were completed in preparation for the DOR review. These include studies of various computer- generated reports to check for value consistency, final field checks required, and for DOR documentation and its analyses.

DOR Review & Final Approval

Any on-site and statistical reviews by the DOR took place from April to September 2019. The appraisal staff provided files, generated property records, answered questions and addressed any concerns. At the conclusion of the DOR review, we were granted approval authorizing public disclosure.

Public Disclosure

The DOR approved valuations were available for disclosure to the property owners. While the administrative staff provided property record cards and general data reviews, the appraisers conducted informal hearings on valuations.

Personal Property

Business assets and those of utilities are reviewed for valuation as taxable Personal Property. For nineteen fiscal years we have engaged the specialized services of Real Estate Research Consultants (RRC) in the discovery and valuation of these accounts. These services have served us well, resulting in DOR approval and consistently defendable valuations. Also, considerable new growth has been certified annually. Additionally, the RRC Personal Property Software installed in our office has benefited us. The personal property valuation formulas are very straightforward, and the administrative capabilities have met our needs.

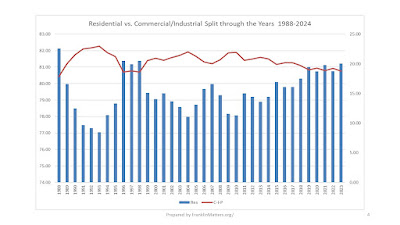

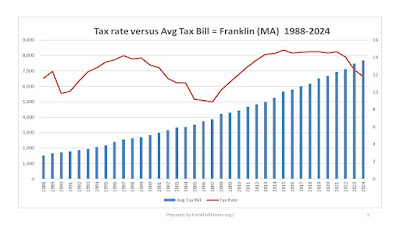

Classification Hearing & Tax Commitment

Following some discussion and a few presentations relative to single versus split tax rates, the Council approved a single tax rate at $14.51 per $1,000 of taxable value as calculated by the Board for all property classes. The tax commitment and mailing were timely for an actual 3rd quarter tax bill.

Abatement Reviews

Upon mailing of the tax bills and on or before the due date of the first actual bill, property owners have an opportunity to file an Abatement Application on the basis of overvaluation or misclassification. 60 abatements applications were filed of 11,681 taxable accounts, or just over 1/2 of 1%. Generally those with merit were resolved through our conducting a complete on-site exterior measuring and interior inspection. Usually a valuation discrepancy is the result of a data error or as a result of an inspection appointment not being arranged and thus the property data having been “estimated”.

Continue reading about the Board of Assessors

Prior Annual Reports can be found online

|

| Franklin Annual Report - 2020: Board of Assessors |