Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Friday, August 8, 2025

Biennial Election Candidate Nomination Papers Filing - Aug 7, 2025

Saturday, April 5, 2025

Town of Franklin hiring for Assessors, Planning, Public Works, Senior Center, Facilities

Town of Franklin hiring

It's time to get Frank(lin) about your future! We've got positions that are civic-minded, community focused and benefits-loaded.

Whether you are looking to build a career, serve your neighbors or make an impact in your community - we have roles that will help you grow, serve and shine.

#PunandPublicService #Franktalk #NowHiring #PublicServicewithPurpose #JoinUs #CareerOpportunity

Friday, October 11, 2024

Yes, the Town of Franklin has a Job Opportunity in Assessors, Public Works, Police Dept, & Facilities

Job Opportunities

To apply for a vacant position, please submit a resume and cover letter to apply@franklinma.gov. Please put the job title in the subject line of your email.

Appraiser - Board of Assessors

Crew Leader / Lead Pesticide Applicator (Tuesday - Saturday) - Department of Public Works

Administrative Assistant - Department of Public Works

Heavy Motor Equipment Operator (Tuesday - Saturday) - Department of Public Works

Patrol Officer (academy trained) - Franklin Police Department

Junior Building Custodian - Facilities Department

Part Time and Substitute Custodians - Facilities Department

Updated 10/10/2024

If you do not have a resume, you may send a completed Application for Employment instead.

Shared from -> https://www.franklinma.gov/human-resources/pages/job-opportunities

|

| Yes, the Town of Franklin has a Job Opportunity in Assessors, Public Works, Police Dept, & Facilities |

Thursday, February 8, 2024

Annual Report Of The Board Of Assessors: FY 2023 Report

|

| Annual Report Of The Board Of Assessors: FY 2023 Report |

Sunday, December 24, 2023

"Talk Franklin" Special Year End Episode combines with Town Council Quarterbacking - 12/21/23 (audio)

FM #1117 = This is the Franklin Matters radio show, number 1117 in the series.

This session of the radio show shares a special year end episode combining "Talk Franklin'' with Town Administrator Jamie Hellen, Deputy Administrator Amy Frigulietti and “Town Council Quarterbacking” with Town Council Chair Tom Mercer. We had our conversation via the Zoom Conference Bridge on Thursday, December 21, 2023.

Topics for this session

Proclamation: William “Ken” Norman - Ken was recognized with a Town proclamation and State House of Representative resolution for many years of service on the Board of Assessors (16 years) and many other committees.

2024 Annual Alcohol License Renewals - all approved, 8 being held for payment and final inspection completion

Resolution 23-71: Town Council Approval of County ARPA Funds - Council approved application to Norfolk County for ARPA awards in the total amount of $1,359,000

Police Dept - $559,000

Sewer projects - $500,000

Franklin Food Pantry - $100,000

SAFE Coalition - $100,000

YMCA Bernon Family Branch - $100,000

ARPA Direct funds announced for

$1M to reconstruct Baron Road

$420,000 for replacement & construction of visitor bleachers at the high school field

Bylaw Amendment 23-902: A Bylaw to Amend the Code of the Town of Franklin by Inserting Chapter 147, Snow and Ice, Removal Of - Second Reading - approved by 7-2 vote (Jones, Dellorco voted no)

Bylaw Amendment 23-903: A Bylaw to Amend the code of the Town of Franklin at Chapter 82, Fees, Municipal Service - Second Reading - mattress fee raised to $65, unanimously approved (9-0)

2023 year in review, January 3, hit the ground working on 2024

The recording runs about 38 minutes. Let’s listen to my conversation with Jamie, Amy & Tom on Thursday, December 21, 2023. Audio link -> https://franklin-ma-matters.captivate.fm/episode/fm-1117-talk-franklin-special-year-end-episode-12-21-23

--------------

Town Administrator page -> https://www.franklinma.gov/administrator

Talk Franklin podcast page -> https://anchor.fm/letstalkfranklin

Town Council agenda for Dec 20, 2023 meeting ->

https://www.franklinma.gov/sites/g/files/vyhlif10036/f/agendas/town_council_agenda_12.20.23_0.pdf

Recap & video for Town Council session 12/20/23 -> https://www.franklinmatters.org/2023/12/town-council-closes-out-calendar-year.html

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

|

| "Talk Franklin" Special Year End Episode combines with Town Council Quarterbacking - 12/21/23 (audio) |

Wednesday, November 22, 2023

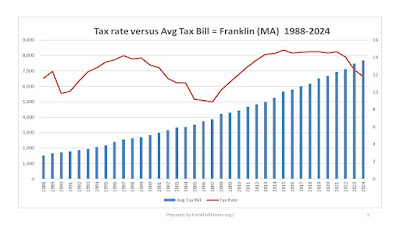

Franklin's tax rate will decrease to $11.79/thousand for FY 2024 (video)

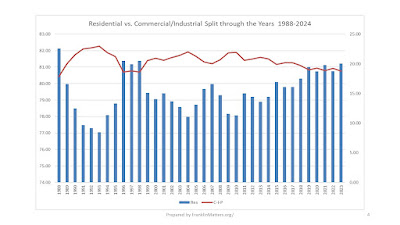

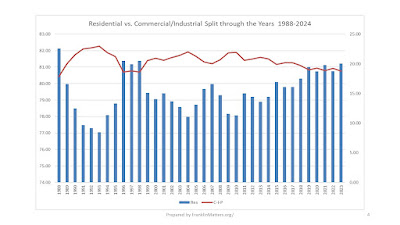

"A single tax rate means that all property classes (residential, commercial, industrial and personal) are taxed at the same tax rate. A dual tax rate means the commercial-industrial-personal tax rate is increased while the residential rate is decreased. In other words, some of the residential tax burden is shifted towards commercial, industrial and personal properties.Please note that a dual tax rate does not produce more tax revenue, it simply shifts the burden." (Bold added for emphasis)

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |

Tuesday, November 21, 2023

Tax Rate Hearing - Charts to help understand the Town of Franklin rate, tax bill, and assessed valuation relationship

|

| cover page for FranklinMatters.org explanation |

|

| historical tax rate shown |

|

| as the assessed valuation increases, the rate decreases, and vice versa |

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |

Tuesday, November 7, 2023

Please vote today, the polls are open from 6 AM to 8 PM. This local election determines how Franklin's dollars are spent.

Sunday, August 27, 2023

What is the ONE question would you ask of each candidate for the Town of Franklin 2023 Election?

The candidates are in their final days to gather signatures for the November 2023 Biennial Town of Franklin Election. The nomination papers are due to the Town Clerk by September 6.

It is now time for us (together) to prepare the set of interview questions.

- Which one question would you ask of a Town Council candidate? School Committee candidate? etc...

-------------