DATE: November 21, 2023

To: Town Council

FROM: Board of Assessors

Kevin W. Doyle, Director of Assessing

RE: FY 2024 Tax Rate Hearing

Please find attached our information related to the annual Tax Rate Hearing. The hearing is required by Law and is intended primarily for the Town Council to determine whether the FY 24 Tax Rate (July 1, 2023 - June 30, 2024) will be a single/uniform or a dual/split tax rate.

A single tax rate means that all property classes (residential, commercial, industrial and personal) are taxed at the same tax rate. A dual tax rate means the commercial-industrial-personal tax rate is increased while the residential rate is decreased. In other words, some of the residential tax burden is shifted towards commercial, industrial and personal properties.

PLEASE NOTE THAT A DUAL TAX RATE DOES NOT PRODUCE MORE TAX REVENUE, IT SIMPLY SHIFTS THE BURDEN.

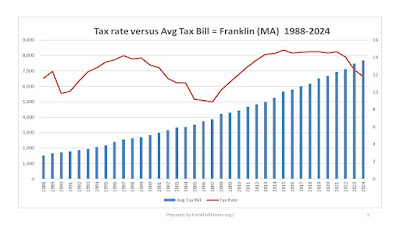

Currently the single tax rate for FY 23 is $12.58 and the proposed tax rate for FY 24 rate is $11.79. The average single family assessment value increased from $593,800 to $650,400 or $56,600 (9.5%). For the average single family assessed at $650,400, the tax bill will increase by $198 a year. Individual homes may increase or decrease depending on numerous other factors.

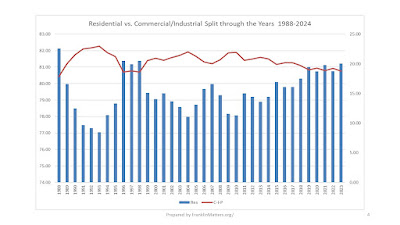

Approximately 81% of property tax valuation and thus tax revenue is from residential taxes and 19% from commercial, industrial and personal property (CIP) taxes. If the council voted for a duel tax rate then then the shift from Residential to CIP would be on a 4 to 1 basis. For example if the Residential tax rate was lowered by $1 per thousand dollars valuation, the CIP tax rate would need to increase by $4 to offset the reduction in taxes collected by Residential properties.

Franklin has always had a single rate; we're happy to answer any questions that you may have.

Special Note: We send out quarterly tax bills. The first two (July and October) are preliminary largely based on last fiscal year's bills. The final two tax bills in January and April are based on the Actual Tax Rate and Final Assessment of each property. Accordingly the four quarterly bills are usually different. The first two are generally lower while the last two are higher.

Simple Example - Your last year's tax bill was $6,000 and this year it goes up $200 for a total of $6,200. Your first two bills would be $1,500 each for a total of $3,000. The last two tax bills are the final actual total less the first two preliminary tax amounts ($6,200 minus $3,000 = $3,200) divided into the two (January and April) final installments ($1,600 each).

Many folks multiply their third quarterly $1,600 amount times four and think their new bill is $6,400 for the year. They need to look at the total annual tax as indicated on the actual 3rd Quarter Tax Bill, not just at one quarterly bill. Remember that valuations typically change annually in accordance with use of the State required data. The Total Tax Levy typically increases by 2 ½%(Proposition 2 ½), by New Growth Revenue (improvements and new properties added to the tax base), and by adjustments in the Debt Exclusion amount to be raised for payments on long-term capital projects (i.e. schools).

The full tax rate hearing package can be found -> https://www.franklinma.gov/sites/g/files/vyhlif10036/f/agendas/november_21_2023_town_council_tax_hearing_agenda.pdf

Download the charts as one PDF -> https://drive.google.com/file/d/1gJvC5DdCmmeU2tQ_bycWPJETpKvVuMtw/view?usp=drive_link

|

| cover page for FranklinMatters.org explanation |

|

| historical tax rate shown |

|

| as the assessed valuation increases, the rate decreases, and vice versa |

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |