In about 35 minutes, the Franklin (MA) Town Council heard the tax assessor's update and voted on the series of resolutions to approve setting the tax rate for FY 2024 as $11.79/thousand.

The tax rate is in and of itself a simple calculation: how much revenue do we need to raise from the total assessed value of Franklin? As most folks would realize, the valuations have been rising recently.

The table here depicts the last 5 years 2020-2024 for assessed value by property classification.

Residential Commercial Industrial Personal Property Total

2020 4,506,862,400 384,322,107 502,632,510 188,319,520 5,582,136,537

2021 4,684,479,315 385,565,160 515,163,940 188,874,770 5,774,083,185

2022 5,037,676,355 415,756,887 568,964,110 216,250,290 6,238,647,642

2023 5,876,670,670 471,504,398 657,052,300 230,364,400 7,235,591,768

2024 6,473,395,910 523,347,555 734,290,380 259,381,120 7,990,414,965

The combination of new growth and the 'automatic' 2.5% increase allowed provides the revenue allowed to be raised to fund the budget approved by the Town Council. The final adjustment for the FY 2024 budget was approved by the Finance Committee on Nov 8 and then by the Council Nov 15.

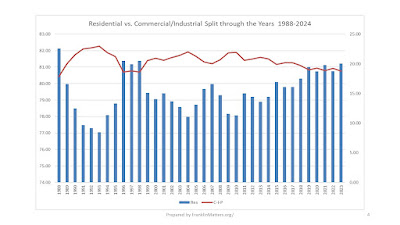

The key decision at the tax rate hearing is to maintain the single tax rate or move to a split tax rate. The Board of Assessors memo to the Council lays out the argument distinctly:

"A single tax rate means that all property classes (residential, commercial, industrial and personal) are taxed at the same tax rate. A dual tax rate means the commercial-industrial-personal tax rate is increased while the residential rate is decreased. In other words, some of the residential tax burden is shifted towards commercial, industrial and personal properties.Please note that a dual tax rate does not produce more tax revenue, it simply shifts the burden." (Bold added for emphasis)

Franklin has historically had an approximate 80-20 split between residential and commercial/industrial as shown in the following chart.

|

| the residential vs. commercial/industrial split has been in the 80-20 range over time |

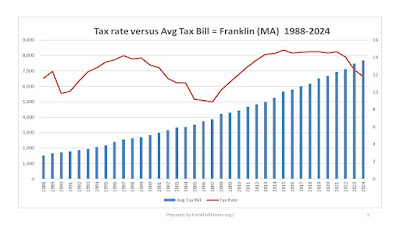

As the assessed valuation increases over time, the tax rate will drop. As the valuation decreases, the tax rate will increase. The tax rate is a good talking point but is simply the result of math driven by the assessed values and the amount to be raised to meet the budget.

The rate means little to the average home owner. Whether the rate goes up or down, it is more important to know what the valuation of the residence is. The chart here shows that over time, the tax rate can go up or down but the average tax bill will continue to increase.

The Town Council agenda includes the tax rate hearing information from which these charts were created. https://www.franklinma.gov/sites/g/files/vyhlif10036/f/agendas/november_21_2023_town_council_tax_hearing_agenda.pdf

Download the charts as one PDF -> https://drive.google.com/file/d/1gJvC5DdCmmeU2tQ_bycWPJETpKvVuMtw/view?usp=drive_link

Franklin TV video link -> https://www.youtube.com/watch?v=1qrgc2zjfLE