FM #1049 = This is the Franklin Matters radio show, number 1049 in the series.

This session of the radio show shares some Mass Property Tax Data Insights as analyzed by Max Morrongiello. We had our conversation in the Franklin TV studio on Thursday, August 10, 2023.

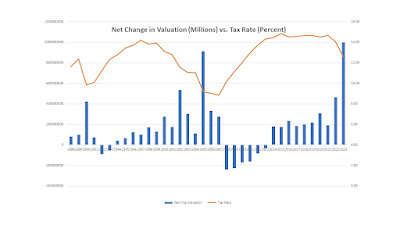

Max shares some insights from the linear regression analysis he performed with the available data from the US Census and Mass Dept of Revenue among other resources.

For example, Franklin property tax bills are about 4% less than the linear regression analysis would predict them to be.

The recording runs about 28 minutes. Let’s listen to my conversation with Max on Thursday, August 10, 2023

Audio file -> https://franklin-ma-matters.captivate.fm/episode/fm-1049-property-tax-data-insights-08-10-23

--------------

Policy Brief on per pupil spending

https://drive.google.com/file/d/1LP5fI1Gm0NKkUuAYaWTKF2HSadjfinNY/view?usp=drive_link

Are Franklin’s taxes low?

https://drive.google.com/file/d/1LJHukt7tGB3-dTLWyX5NoIJE8J8jZib3/view?usp=drive_link

Data files used for the analysis

Microsoft Excel format ->

Comma Separated Value format (CSV)

https://drive.google.com/file/d/1E90EFjLb0GkMrAFy75zXR7wqHHh5XgTV/view?usp=drive_link

Info on JASP -> https://en.wikipedia.org/wiki/JASP and https://jasp-stats.org/jasp-materials/

Max’s LinkedIn profile -> https://www.linkedin.com/in/maxmorrongiello/

And specifically on metrics and statistical analysis -> Maxwell Metrics: Policy Analytics & Consulting

You can contact Max via email -> Max.Morrongiello @ gmail dot com

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

-

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley" . The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"