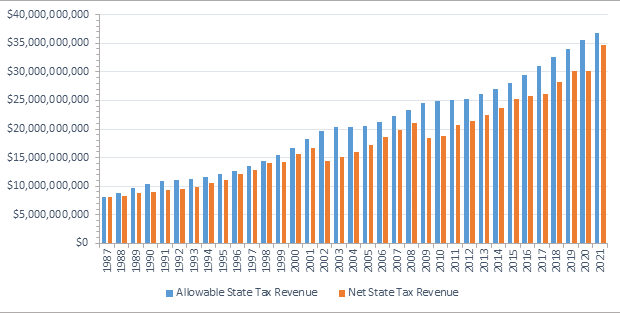

"THE STATE is preparing to pay out $1.4 billion in “illusory” funds under the tax cap law, giving wealthy taxpayers a huge windfall, according to a report from the left-leaning Massachusetts Budget and Policy Center.

Officials at the center say they are not accusing state officials of doing anything wrong or making a math error. Instead, they are saying a set of unusual circumstances are combining to inflate the amount of taxes collected in excess of the tax cap, and doing so in a way that shortchanges the state and allows wealthy taxpayers to gain an even bigger benefit than they normally would.

“The affluent win in every way,” said Phineas Baxandall, senior policy analyst and advocacy director at the Budget and Policy Center.

The broad outlines of the situation have been raised before, but the Budget and Policy Center report is the first time the dollar impact has been spelled out. The report calls on state leaders to address the situation, but they have shown little interest so far in intervening to change the tax cap law."

Reading between the lines, if the Governor wasn't so hasty in trying to the funds returned by check and used the tax rebate process, the 'illusion' might work itself out.

The State House News Service, shared via Franklin Observer, tries to focus on the issue as party based:

Q1 State Tax Take Surpasses Record FY `22 Pace, but No Tax Relief in Sight

|

| The golden dome of the State House. (Photo by Andy Metzger) |