"In a surprise, Baker says taxpayers could receive ‘north of $2.5 billion’ in tax relief under little-known law"

"With state coffers overflowing, Massachusetts taxpayers could receive nearly $3 billion in tax relief under an obscure 36-year-old law, Governor Charlie Baker’s administration said Thursday, surprising lawmakers just as separate tax relief talks seemed to be reaching a crescendo.The likelihood of a decades-old law forcing the state to give back billions to taxpayers quickly shook Beacon Hill on the same day data showed the economy had edged closer to, if not officially in, a recession.It also complicated legislators’ negotiations over a $1 billion package of tax breaks and rebates — a mammoth proposal lawmakers pursued to help ease the pinch of ballooning inflation but were still scrambling to complete before their legislative session ends Sunday night.How much the state could ultimately hand back to taxpayers is unclear. But Baker said Thursday that the state appears poised to trigger a 1986 voter-passed law that seeks to limit state tax revenue growth to the growth of total wages and salaries in the state."

Continue reading the Boston Globe article (subscriptions may be required)

CommonWealth Magazine coverage

Mass. Senate president won’t voluntarily recognize staff union effort, doesn’t ‘see a path forward’

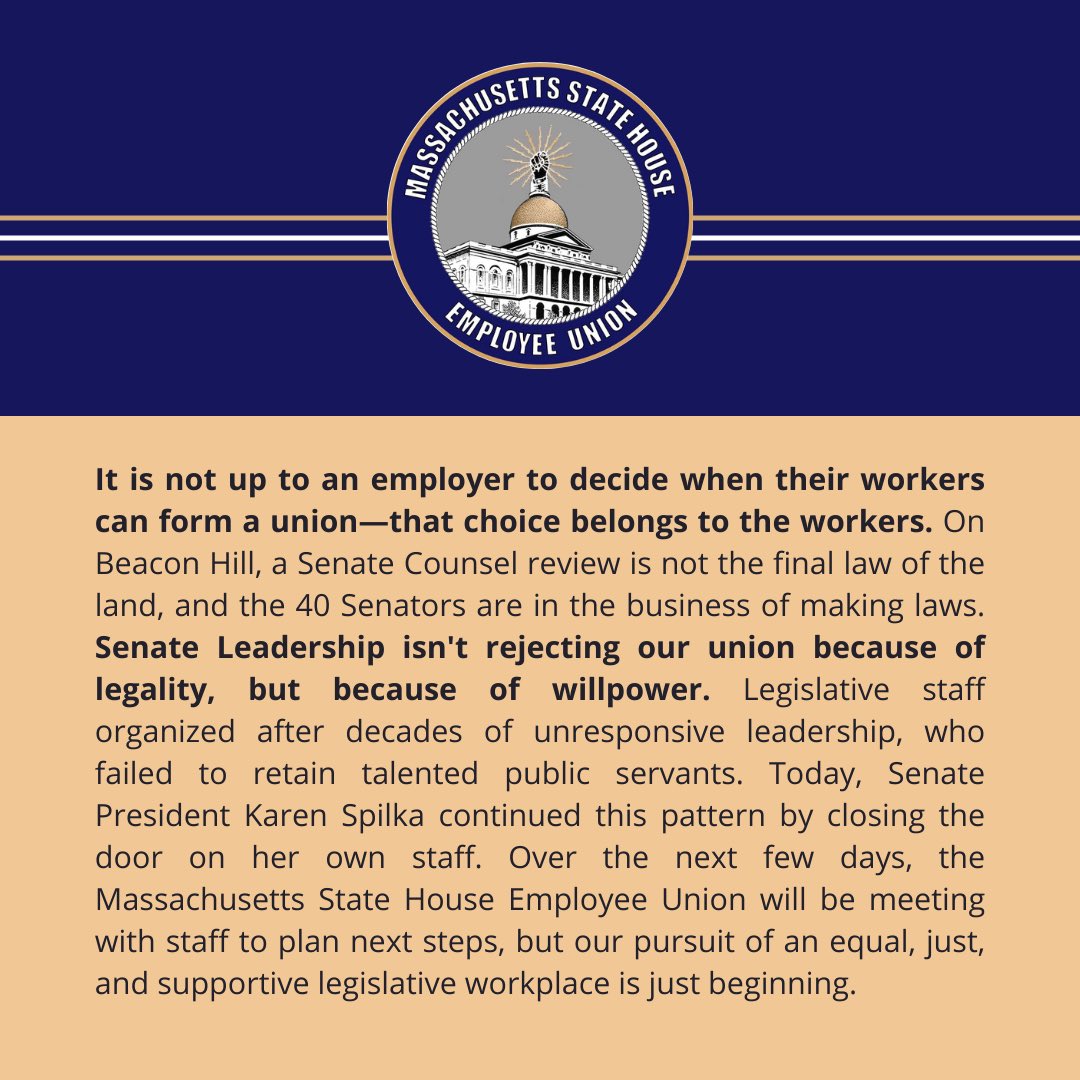

Nearly four months after legislative staff in the Massachusetts Senate formally asked President Karen E. Spilka to recognize them as an employee union, Spilka rejected the effort.“The Senate does not at this time see a path forward for a traditional employer-union relationship in the Senate as we are currently structured,” she wrote in a staff email on Thursday evening.Staffers expressed dismay at her decision.

Continue reading the Boston Globe article (subscriptions may be required)

The union responded Senate President Spilka's statement with their own: