Lawmakers reach agreement on Soldiers’ Home governance

"LEGISLATIVE NEGOTIATORS have come to an agreement on how to overhaul the governance of the state’s two Soldiers’ Homes in Holyoke and Chelsea.A bill released Wednesday evening lays out a new administrative structure for the homes, which elevates the Secretary of Veterans Services to a cabinet-level position while also creating a new independent Office of a Veterans Advocate. The bill represents a major bureaucratic restructuring with multiple levels of oversight and administration aimed at improving the management of the homes. "

Continue reading the article online

With time short, lawmakers seek to reshape local public health

"THE LEGISLATURE is poised to dramatically reshape Massachusetts’ local public health landscape, after the COVID-19 pandemic spotlighted just how inadequate it is.“I’ve been doing this work for almost 25 years and it’s just astounding to me the opportunity that we’re being presented with here, and the fact that the Legislature really understands the importance of delivering services fairly and equitably throughout the Commonwealth,” said Cheryl Sbarra, executive director of the Massachusetts Association of Health Boards. “It’s something those of us involved in local public health have been dreaming for our whole careers.”

Continue reading the article online

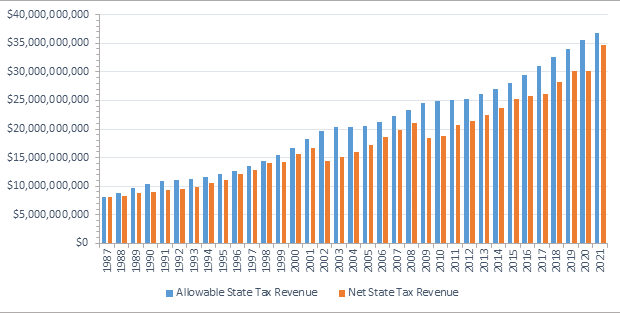

Long-forgotten tax cap about to be triggered

"WHILE LAWMAKERS scramble to put together a package of tax breaks in the final days of the legislative session, a little-known law from the mid-1980s is about to alter the Beacon Hill debate over tax relief.Record tax revenues in fiscal 2021 are expected to trigger the state’s tax cap for the first time in more than 30 years, setting the stage for Massachusetts taxpayers to claim sizable credits on their 2022 returns.The exact size of the credits is unclear because some of the information needed to calculate them is not yet available. But sources say the amount of money at stake could be significant. It’s also unclear whether the return of the money under the tax cap will affect ongoing discussions about a package of tax breaks and cash payments to residents totaling roughly $1 billion.The tax cap is one of those laws that has largely faded from memory. It was passed by voters in 1986, in the midst of the so-called Massachusetts Miracle. Put forward by Citizens for Limited Taxation and the Massachusetts High Technology Council, the ballot question sought to restrict how much tax revenue the state could take in, limiting the growth in revenues to no more than the growth in total wages and salaries."

Continue reading the article online