"The US’s biggest oil companies pumped out record profits over the last few months as Americans struggled to pay for gasoline, food and other basic necessities.On Friday, ExxonMobil reported an unprecedented $17.85bn (£14.77bn) profit for the second quarter, nearly four times as much as the same period a year ago, and Chevron made a record $11.62bn (£9.61bn). The sky-high profits were announced one day after the UK’s Shell shattered its own profit record.Soaring energy prices have rattled consumers and become a political flashpoint. “We’re going to make sure everybody knows Exxon’s profits,” Joe Biden said in June. “Exxon made more money than God this year.”The record profits came after similarly outsized gains in the first quarter when the largest oil companies made close to $100bn in profits."

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Saturday, July 30, 2022

"Oil company profits boom as Americans reel from high fuel prices"

Sunday, July 10, 2022

The Hill: "US on ‘cusp’ of falling gas prices"

Gasoline futures fell more than 10 percent Tuesday and are down more than 22 percent since June, raising hopes that the high price of gas across the country might soon fall.The national average price for a gallon of gasoline now stands at $4.78, according to the American Automobile Association (AAA), down from a recent peak above $5 per gallon. A year ago, the national average was only $3.13, representing a 50-percent annual spike in the price of gas.

- The price of U.S. crude oil fell more than 8 percent and international benchmark Brent crude fell nearly 10 percent on Tuesday.

- “We’re on the cusp of seeing more savings,” said Patrick De Haan, head of petroleum analysis at gas price tracking site GasBuddy. “I’m trying to be a little bit optimistic here that this relief could make its entire way to the pump in the weeks ahead.”

Continue reading the Energy update from The Hill -> https://thehill.com/policy/energy-environment/overnights/3548202-energy-environment-why-gas-prices-may-finally-be-on-the-way-down/

|

| A motorist fills up a vehicle at a Shell gas station Monday, July 4, 2022, in Commerce City, Colo. (AP Photo/David Zalubowski) |

Tuesday, April 26, 2022

The Guardian: Oil company execs raking in the cash; "‘What we now know … they lied"

"While gas prices soar for consumers, one group of people isn’t faring so badly.

Chief executives from the largest oil and gas companies received nearly $45m more in combined total compensation in 2021 as compared to 2020 amid the steep rise in gasoline prices across the US over the last year, a new report states.

Twenty-eight major oil and gas companies, such as Shell, Exxon, BP and Marathon Petroleum, gave out $394m in total to their chief executives in 2021, according to an exclusive analysis provided to the Guardian."

"There is a moment in the revelatory PBS Frontline docuseries The Power of Big Oil, about the industry’s long campaign to stall action on the climate crisis, in which the former Republican senator Chuck Hagel reflects on his part in killing US ratification of the Kyoto climate treaty.In 1997, Hagel joined with the Democratic senator Robert Byrd to promote a resolution opposing the international agreement to limit greenhouse gases, on the grounds that it was unfair to Americans. The measure passed the US Senate without a single dissenting vote, after a vigorous campaign by big oil to mischaracterize the Kyoto protocol as a threat to jobs and the economy while falsely claiming that China and India could go on polluting to their heart’s content.The resolution effectively put a block on US ratification of any climate treaty ever since."

|

| A sign displays the price of gas at an Exxon gas station in Washington DC, in March. Photograph: Stefani Reynolds/AFP/Getty Images |

Saturday, December 11, 2021

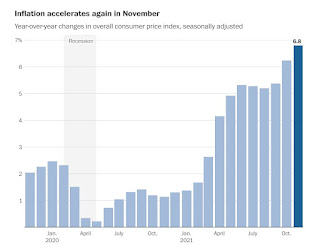

Washington Post: "Five charts explaining why inflation is at a near 40-year high" (3 min video)

"The bumpy economic recovery has had policymakers, economists and American households grappling with greater price hikes for groceries, gas, cars, rent and just about everything else we need.The latest inflation data, released by the Bureau of Labor Statistics, showed prices in November rose to a nearly 40-year high, climbing 6.8 percent compared with the year before.For months, officials at the Federal Reserve and White House argued that pandemic-era inflation will be temporary. But they’ve had to back away from that message, which was increasingly hard to square with what was happening in the economy — and the way Americans experience it.Persistent supply chain backlogs and high consumer demand for goods have kept prices elevated. There is no clear answer for when that will change, leaving Americans to feel the strain in their pocketbooks in the meantime. This is a breakdown of how we got here."

|

| Year-over-year changes in overall consumer price index, seasonally adjusted |

Tuesday, October 26, 2021

"Natural gas leaks in Boston are vastly underreported"

"Six times more natural gas is leaking into the skies of Boston than is officially reported, new research shows. The study, published in the Proceedings of the National Academy of Sciences, also suggests that gas could be escaping not only from distribution pipelines but from inside businesses and homes as well — a finding that some say may be overstated.Natural gas is made up primarily of methane, which — when released directly into the atmosphere instead of being burned first — has more than 80 times the warming potential of carbon dioxide over a 20-year period.The study monitored natural gas methane emissions in the Boston area between 2012 and 2020. It found that an average of 49,000 tons of methane leaked into the air each year. That amounts to an estimated 2.5 percent of all gas delivered to the metro area and is equivalent to the carbon dioxide emissions of roughly a quarter-million cars operating for a year."

https://www.washingtonpost.com/climate-environment/2021/10/25/methane-leaks-natural-gas-boston/

Tuesday, February 16, 2021

Washington Post: What is "the future of transportation funding?"

"Bruce Starr spotted the problem right away: The hydrogen-powered cars General Motors was showing off on the Oregon Capitol grounds wouldn’t need gas. And if they didn’t need gas, drivers wouldn’t be paying gas taxes that fund the state’s roads.It was 2001, and the problem seemed urgent. GM predicted the cars would be on the market in a few years. Starr, then a Republican state representative, created a task force to figure out the future of transportation funding."

Sunday, November 3, 2019

In the News: two articles on alternatives for gas tax and infrastructure revenues

"Just think about it: congestion pricing, managed lanes, tolling on routes other than just the Massachusetts Turnpike, money drawn from drivers being invested back into public transit, and a transportation system that could adapt to meet future needs.Continue reading the article online (subscription may be required)

That’s what most of a coalition of business groups supports asking the Legislature to tell the smartest minds in the state: start thinking seriously about the options for reducing congestion on roads, improving accessibility and service on public transportation, limiting greenhouse gas emissions and raising the money to pay for it in a fair and geographically-equitable way.

But in the meantime, get to raising the revenue necessary to take care of immediate needs - like structurally deficient bridges and poor roadway conditions - by taxing customers a little more for gasoline and increasing the fee built into ride service fares, much of the Massachusetts Business Coalition on Transportation agrees.

The consensus ranges from agreement among all but one group that the state needs additional revenue for transportation to very narrow majority support for specific approaches to raising that revenue. It came as the result of months of talks among the statewide group of chambers of commerce, research and planning firms, and industry associations."

https://www.milforddailynews.com/news/20191102/biz-groups-support-gas-tax-rideshare-fee-increases

"Members of a powerful advocacy coalition are mounting an effort to include business tax measures in a revenue package designed to bankroll transportation investments, saying proposals that add to the costs of gasoline and tolls are too regressive and will only put a heavier burden on low-income and middle class residents.

House leaders are assembling a revenue plan for debate sometime in the next three weeks, but have not unveiled any specific revenue-raising proposals.

In a letter to supporters, Raise Up Massachusetts officials argued that any revenue package should include proposals to create a tiered corporate minimum tax, address offshore tax shelters used by businesses, and require businesses to publicly disclose their tax burdens. The group, which estimates its ideas would generate at least $250 million, says businesses need to kick in contributions toward needed investments."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20191102/coalition-seeks-new-biz-taxes-to-fund-transportation

Friday, November 1, 2019

MassBudget: Statement on Proposed Gas Tax Increase

|

|

Saturday, October 19, 2019

MassBudget: Gas Tax Hikes May Challenge Long-Term Revenue Sustainability and Equity

|

|

Tuesday, October 16, 2018

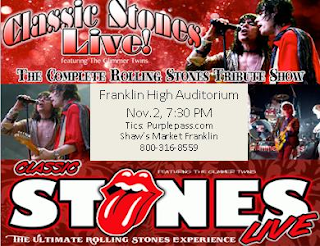

In the News: FHS preparing for Rolling Stones tribute concert; self-serve gas coming to Milford

"The golden age of rock ‘n’ roll is alive and well at the Franklin High School as the band, orchestra, and chorus rehearse for the upcoming Rolling Stones tribute concert.

Last year, the school hired a Beatles cover band to rock the class out to the new year, but now they’re shifting the rock spectrum to their 60s competitors, The Rolling Stones. On Nov. 2, at 7:30 p.m. at Franklin High School, a Rolling Stones cover band will be rocking out for the school’s benefit. A few of their songs will also be accompanied by the Franklin high school, band, chorus, and orchestra.

Last year’s BeatleMania concert raised about $5,000 from the community, and they’re hoping to attract the same attention this year.

Music director at the Franklin High School, Diane Plouffe, said money from the show will be put towards their major trip, which occurs every four years. Plouffe said that BeatleMania was such a big success last year, and they were hoping for a similar outcome through their efforts."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20181015/franklin-high-to-roll-with-stones

|

| Classic Stones Live |

"Drivers stopping in Milford will soon be able to pump their own gas, thanks to overwhelming approval from Town Meeting members Monday night.

“In 2018, we live in an automatic world,” resident R.J. Sheedy said. “I don’t know why, in an automatic world, we would not accept self-service gas stations in town.”

The town has been the longtime home of full-serve-only gas stations, meaning an attendant pumps your gas."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20181015/milford-gas-stations-now-allowed-self-serve

Saturday, September 9, 2017

In the News: suicide prevention; gas prices

"For some, a cry for help can come from a few taps on a touch screen.

While suicide prevention phone lines have long provided an outlet for people seeking help in times of crisis, text-based help lines have become increasingly common in recent years.

“We had kicked around the idea for a number of years because we had seen an ongoing transition of younger people who prefer to communicate by texting instead of with their voice over the phone,” said Steve Mongeau, executive director of Samaritans Inc. “For younger people, not just teens but people under the age of 30, we thought a text option might open up more of an opportunity.”

Since October 2015, Boston-based Samaritans has provided text messaging support on the Massachusetts Statewide Helpline, 1-877-870-HOPE (4673). Helpline staff and trained volunteers have responded to more than 6,000 text messages, an average of close to 500 per month and growing."Continue reading the article online (subscription may be required)

http://www.milforddailynews.com/news/20170908/suicide-prevention-text-lines-open-new-doors-to-help

|

Take a walk on the Town Common - World Suicide Prevention Day - Sep 10 |

"It could take several more weeks for gas prices to come back down to earth as oil refineries begin coming back online after Hurricane Harvey battered the Texas coast.

“Harvey’s geographic path looks like it was crafted by the devil himself in terms of the impact on the refineries, said Tom Kloza, the global head of energy analysis for the Oil Price Information Service. “It lead to precautionary shutdowns of all Texas refineries, and, at worst, reduced about 40 percent of capacity east of the Rockies. In terms of scale, it was unprecedented.”

In Massachusetts, gas prices surged 44 cents in the course of a week, according to AAA Northeast’s Sept. 5 survey of fuel prices. The $2.70 statewide average was the highest average price recorded in Massachusetts in two years, and the spike represents the sharpest increase since Hurricane Katrina lashed Louisiana in 2005."

Continue reading the article online (subscription may be required)

http://www.milforddailynews.com/news/20170908/gas-prices-expected-to-remain-high-for-several-weeks-following-hurricane

Saturday, July 25, 2015

MA gas tax is just below National average

The MA total gas tax is 26.54 cents and including the Federal tax (18.4), the total per gallon is 44.94 cents. The national average is 48.88 cents.

Here is a summary report on gasoline and diesel taxes. This report is updated quarterly. API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average.

API's chart reflects a weighted average for each state, meaning that any taxes which can vary across a state's jurisdiction are averaged according to the population of the local areas subject to each particular tax rate. Where appropriate, the weighted average also takes into consideration the typical percentages of premium, midgrade, and regular fuel purchased in each state.

In states where taxes vary depending upon the price of the motor fuel (for example, where the tax rate is set as a percentage of the sales price rather than a cents per gallon method), the state average listed on the chart is a snapshot based upon the price of fuel (as reported by AAA) on the date the chart is updated. Be sure to also look at the "Notes" attachment for a detailed explanation of the various taxes included in our chart.

|

| screen grab of API gas tax map |

You can find the full report here

http://www.api.org/oil-and-natural-gas-overview/industry-economics/fuel-taxes

the interactive map here

http://www.api.org/oil-and-natural-gas-overview/industry-economics/fuel-taxes/gasoline-tax

and the MA data here:

Thursday, July 2, 2015

Atlantic Bridge Project - Letter to Franklin

Dear Town of Franklin:

Algonquin Gas Transmission, LLC, ("Algonquin") previously informed you of its intent to develop the proposed Atlantic Bridge Project ("Project") by expanding its interstate natural gas pipeline system. In that earlier communication, we described new and replacement pipeline facilities that were being considered as determined by system design studies based upon expressions of interest from customers to move new volumes of needed natural gas along Algonquin's pipeline system. In the earlier mailing, we informed you that the proposed Atlantic Bridge Project may involve your property and that we had identified your property within the initial study corridor.

Since that time, Algonquin has finalized its commercial agreements which has resulted in a reduced scope of the previously proposed expanded pipeline facilities in New York, Connecticut and Massachusetts. Based on the revised project design, your property, as identified above, is no longer under consideration for the Atlantic Bridge Project.

Atlantic Bridge Project - image from Spectra Energy webpage

However, you should know that Algonquin continues to consider separate and unrelated pipeline expansion projects that are currently in the development phase. If Algonquin ultimately determines that one of these projects may involve your property in the future, there may be a need to contact you if and when a project proposal moves forward. Nevertheless, with respect to the Atlantic Bridge Project, we presently do not have the need to access your property as previously requested outside of the existing Algonquin rights-of-way.

We appreciate your patience and cooperation in this process with regard to our earlier request for survey permission. Please feel free to call our toll free number (888) 331-6553 if you have any questions.

This was shared from the Franklin webpage

http://franklin.ma.us/Pages/FranklinMA_News/0213DF1E-000F8513

The full PDF of the doc can also be found here

https://drive.google.com/file/d/0B0wjbnXDBhczdDhVNFd0emVuaUE/view?usp=sharing

Monday, April 6, 2015

"10 miles of pipeline through towns like Franklin"

"The pipeline is still in a preliminary phase and if everything goes as planned, construction wouldn't be complete until 2017. Spectra Energy is looking for federal permission to add 10 miles of pipeline through towns like Franklin and Millis. Residents say they want to know what's in store for them before construction begins."

Boston News, Weather, Sports | FOX 25 | MyFoxBoston

|

| a sign truck parked outside the Keller School at the information session here on March |

Related posts

http://www.franklinmatters.org/2015/03/concerns-with-spectra-atlantic-bridge.htmlTuesday, March 31, 2015

Concerns with the Spectra Atlantic Bridge Pipeline - Apr 2, 7:30 PM

I want you to know that concerned Franklinites are meeting this Thursday, April 2, to discuss concerns with the Spectra Atlantic Bridge Pipeline.

The meeting is at the First Universalist Society of Franklin, 262 Chestnut St. at 7:30PM.

The informational meeting on the Atlantic Bridge Pipeline had been held at Keller School on Monday, March 16.

http://www.franklinmatters.org/2015/03/what-is-story-about-pipeline-coming.html

|

| sign truck parked outside the informational meeting at Keller Elementary |

A new pipeline passing through Franklin is both unnecessary and a bad idea. An informational meeting will be held at FUSF Church (262 Chestnut St) Thursday April 2nd, 7:30pm. Please attend and become informed.

The details outlined in this posting: 7 Reasons to Oppose New Gas Pipelines in MA will be among the topics discussed on Thursday.

Friday, May 6, 2011

Gas tax collections holding steady; rate of increase slowing

Sent to you by Steve Sherlock via Google Reader:

The two months' combined collection is $96.8 million, which is $200,000 more than the same two months a year ago. Through the end of April, year-to-date gas tax collection is at $493 million. up $6.4 million from a year ago.

It is fair to say, however, that the rate of increase in gas consumption, as measured by gasoline tax collection, has slowed down. In the first six months of FY11, collections were up $5 million. In the ensuing four months (January-April of 2011) which correspond to the period in which gasoline prices have gone up, the increase over a year ago is just a little over $1 million.

Those interested in pouring over these numbers should visit DOR's Blue Book, published monthly, to review individual month and year-to-date collections of a variety of tax collections and other revenue sources. (The April edition should be up in a few days.)

This is probably a good time to review how gas tax revenues are used. As a result of reform of the state's transportation system in 2009, gasoline excise tax revenue goes into the Commonwealth Transportation Fund, along with registry fees and .385 percent of the sales tax. The fund is used to pay debt service associated with highway maintenance and construction projects and provides funding for the operation of the Massachusetts Department of Transportation (MassDOT).

Revenue from the gasoline tax, which is 21-cents per gallon, goes almost entirely (99.85 percent) into the Commonwealth Transportation Fund. The balance of fifteen-hundreths of one percent is credited to the Inland Fish and Game Fund.

One of the best explainers of the new MassDOT and its funding sources appeared in Gov. Patrick's FY11 budget proposal.

The state gasoline tax of 21-cents per gallon is not the only tax paid at the pump. The state also collects 2.5-cents per gallon to help fund the cleanup of underground storage tanks; this money goes into the state's General Fund from which the Legislature makes appropriations to pay for cleanups. And the federal government collects a federal gas tax of 18.4-cents per gallon.

The Tax Foundation publishes annually a ranking of gasoline taxes by state. Massachusetts is ranked 27th from the top out of the 50 states.

Things you can do from here:

- Subscribe to Commonwealth Conversations: Revenue using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Sunday, July 13, 2008

In the News - McGann Jr, Brick, Gas prices

FRANKLIN —

Joseph McGann Jr. hasn't slowed down much since nailing two

state championships in wrestling at Franklin High School and a national title at

Blair Academy in Blairstown, N.J., in 2001.After wrestling for North Carolina

State, McGann kept a low profile, training in Eastern-style fighting at United

States Mixed Martial Arts in Bellingham, under Ultimate Fighting Championship

professional Jorge Rivera.

Read the full article here

Franklin -

Supporters of the Red Brick School are continuing their

efforts to keep the historically distinctive building open for classes this

year.Members of Brick School Association plan to "have a very visible presence''

at the School Committee's July 15 meeting, said association treasurer Herbert

Hunter. "We'll certainly provide plenty of input,'' Hunter said. The group is

not officially part of that meeting's agenda.The School Committee's Subcommittee

on Building Use has said it will likely recommend declaring the Red Brick as

surplus and return it the town, essentially ending the building's standing as a

one-room red brick school in continuous operation, recognized by the National

Historic Register. The School Department has announced there is no money in its

budget to continue running a kindergarten class there. About 1,000 residents

celebrated the school's 175th anniversary this June, said Deborah Pellegri, town

clerk and Brick School Association member.

Read the full article here

Franklin -

In Franklin, developer John Marini is mixing downtown

apartments with shops and office space, all a stone's throw from a downtown

commuter rail stop. Westborough's Bay State Commons, which opened last year,

combines everything from a Roche Brothers supermarket to 44 luxury

condominiums.

Read the full article here