Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Monday, December 29, 2025

USA Facts on core inflation

Saturday, March 1, 2025

Joint Statement: School District Budget Challenges

Thursday, February 20, 2025

Why do prices feel high if inflation is down?

Friday, October 11, 2024

Washington Post: "Social Security issues 2.5% COLA increase"

"Social Security recipients will see a 2.5 percent increase in their monthly checks next year, the federal government announced Thursday. It’s a smaller hike than in recent years, which was expected given the cooling of inflation.Soaring prices in recent years brought unusually large cost-of-living increases in benefit checks, since Social Security payouts are automatically adjusted once a year based on a government measure of inflation. The annual adjustment, known as COLA, brought seniors a 5.9 percent boost in 2022, an 8.7 percent increase in 2023 (the largest in about 40 years) and a 3.2 percent increase in 2024."

|

| Washington Post: "Social Security issues 2.5% COLA increase" |

Saturday, July 27, 2024

Your food is more expensive – are US corporate profits to blame? | Inflation | The Guardian

"As inflation shot to its peak around mid-2022, Chipotle’s prices also rose, pushing up what customers paid for burritos and bowls by as much as several dollars. Since then, the fast casual restaurant’s costs have broadly fallen. Prices have not.Chipotle’s decision to maintain high prices helped boost profits 110% in recent years, while its executives boasted to investors that they raised prices higher than inflationary costs.Chipotle’s sparkling financials are representative of much of the food industry, according to a Guardian analysis of financial documents and earning calls transcripts from 36 top US food corporations.It reveals that while you may be feeling the pain from high prices at restaurants and supermarkets, many companies making and selling the products are doing remarkably well. Most have seen their profits jump as they continue raising prices on customers, the analysis found.Some companies say they have no choice but to pass inflationary pain on to consumers. Others, however, acknowledge they are exploiting the inflationary atmosphere to raise prices, or to shrink product sizes, a strategy dubbed “shrinkflation”.

|

| Your food is more expensive – are US corporate profits to blame? | Inflation | The Guardian |

Sunday, April 28, 2024

NEPM: "Massachusetts schools need more funds, some point to flaw in education finance law"

"Fix the funding flawA not common alliance is calling on education officials to fix a calculation in Chapter 70. That group, Novick’s MASCA, the Massachusetts Association of School Superintendents, the Massachusetts Teachers Association and the American Federation of Teachers Massachusetts created a FAQ to explain how inflation of the last two years, between 7% and 8 % is a factor."... the [Chapter 70] law caps the annual inflation adjustment of the foundation budget at 4.5 percent," the FAQ said. "As a result, districts did not receive funds to cover a significant portion of inflation that they had to pay for in expenses.”The way the Chapter 70 formula originally worked, the FAQ said, “that would not be a long-term problem because the lost inflation would automatically be added back into the foundation budget in the following year. But a technical change made almost a decade after the law was passed inadvertently changed that. Now when the cap reduces aid below the level needed to keep pace with inflation, that reduction is locked in forever and reduces future aid.”

Wednesday, March 13, 2024

Franklin is not alone in struggling to fund their schools & town budget

Via Boston Globe:

"Nearly five years after Massachusetts lawmakers overhauled the state’s school funding formula, districts are struggling to balance their budgets for the upcoming school year, prompting many to consider cutting programs and staff or asking taxpayers to dig deeper.

The chief culprit, district leaders and advocates say, is the high rate of inflation that hit the US economy in recent years, much higher than the adjustments used in the new funding formula that was revamped to reflect modern-day costs.

The failure of the new formula to accurately capture inflation could be collectively costing districts hundreds of millions of dollars in aid, according to Colin Jones, deputy policy director at the Massachusetts Budget and Policy Center, a nonpartisan research institute.

Voters in Belmont, Harvard, and Westford will be considering hefty property tax hikes at the polls this spring, which, if they fail to pass, could result in significant cuts to school and town services. In Belmont, for example, if voters reject an $8.4 million override on April 2, school leaders have said they will need to close the Mary Lee Burbank Elementary School, eliminate dozens of teaching and other positions, and make deep cuts to extracurricular activities."

|

| Franklin is not alone in struggling to fund their schools & town budget |

Saturday, January 20, 2024

Half of recent US inflation due to high corporate profits, report finds | Inflation | The Guardian

"A new report claims “resounding evidence” shows that high corporate profits are a main driver of ongoing inflation, and companies continue to keep prices high even as their inflationary costs drop.The report, compiled by the progressive Groundwork Collaborative thinktank, found corporate profits accounted for about 53% of inflation during last year’s second and third quarters. Profits drove just 11% of price growth in the 40 years prior to the pandemic, according to the report.Prices for consumers rose by 3.4% over the past year, but input costs for producers increased by just 1%, according to the authors’ calculations, which were based on data from the Bureau of Economic Analysis and National Income and Products Accounts.“Costs have come down substantially, and while corporations were quick to pass on their increased costs to consumers, they are surprisingly less quick to pass on their savings to consumers,” Liz Pancotti, a Groundwork strategic adviser and paper co-author, said."

Direct link to report referenced ->

|

| The Groundwork Collaborative thinktank found prices for consumers rose by 3.4% over the past year, but input costs for producers increased by just 1%. Illustration: The Guardian |

Sunday, December 11, 2022

CommonWealth Magazine: "Old laws, like Prop 2 1/2, need to adapt to times"

"I’VE BEEN STRUGGLING to find the right metaphor for our current economic situation. After the great recession of 2007-2009, my go-to was a staircase: the recession had knocked us down a flight of stairs and it took us a decade to climb back up.But that won’t do today. If COVID knocked us down the stairs, our response was to leap–like some superhero–up and out of the building. Only afterwards did we realize we don’t know how to land.Or how’s this analogy…to avoid a dangerous tangle on the highway, we successfully accelerated around it–only to discover that our brakes aren’t working well.You get the point. For the first time in decades, the problem with the US economy is that it’s running too hot, with plentiful job opportunities driving unsustainable wage growth and consumer demand keeping inflation above healthy levels.Fixing all this is mostly a job for the feds. But lawmakers here in Massachusetts have an important role to play: they need to adapt."

|

| CommonWealth Magazine: "Old laws, like Prop 2 1/2, need to adapt to times" |

Friday, July 29, 2022

From the heat to the proposed 'friendly 40b' process, to the 5 year fiscal outlook, we cover these and more in this Talk Franklin episode - 07/26/22

FM #832 = This is the Franklin Matters radio show, number 832 in the series.

This session of the radio show shares my "Talk Franklin" conversation with Town Administrator Jamie Hellen and Marketing & Communications Specialist Lily Rivera. We had our conversation at the Municipal Building in Jamie’s office.

Topics for this session

This heat wave broke, the drought is continuing

Weekly Farmers Market, Concert on the Common, food trucks, movie nights

Hydrant painting contest by DPW, applications due Aug 12, winner announcement in October

Friendly 40b

EDC to do their ‘short list’ for the MAPC recommendations at Aug 10 meeting

Green community presentation at August Town Council meeting

5 year fiscal outlook (not published yet but highlights covered)

Old South Meeting House

Davis Thayer deed processing underway, discussion in Fall on how best to use it

The conversation runs about 45 minutes. Let’s listen to my conversation with Jamie and Lily. Audio file -> https://anchor.fm/letstalkfranklin/episodes/The-End-of-the-Heat-Wave--Hydrant-Painting--and-the-New-Friendly-40b-Process-e1lrjsg/a-a8ak6mi

--------------

Hydrant painting contest https://www.franklinma.gov/public-works/news/hydrant-painting-starts-today

40b collection

https://www.franklinmatters.org/2022/07/what-is-40b-why-is-town-of-franklin.html

Beaver St collection

https://www.franklinmatters.org/2022/07/what-is-beaver-st-interceptor-why-does.html

Franklin for All webpage

https://www.mapc.org/resource-library/franklin-for-all/

Green Community story map https://www.franklinma.gov/administrator/pages/green-community

Town budget page https://www.franklinma.gov/town-budget

Community & Cultural District calendar https://www.franklinmatters.org/p/blog-page.html

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

Monday, April 25, 2022

Washington Post: "Five charts explaining why inflation is at a 40-year high"

"The bumpy economic recovery has had policymakers, economists and Americans households grappling with greater price hikes for groceries, cars, rent and other essentials.

The latest inflation data, released by the Bureau of Labor Statistics, showed that prices in March climbed 8.5 percent compared with the year before, the highest measure in over 40 years.

The Federal Reserve has launched a major series of interest rate increases to get inflation under control, penciling in seven hikes by the end of the year. But it’s unclear how quickly that action will be able to bring down the rising cost of living, or if the Fed will be spurred to even more aggressive action that risks thrusting the economy into a recession

Persistent supply chain backlogs and high consumer demand for goods have kept prices elevated. And more recently, Russia’s invasion of Ukraine has strained global energy markets and triggered higher gasoline prices. There is no clear answer for when that will change, leaving Americans to feel the strain in their pocketbooks in the meantime. This is a breakdown of how we got here."

|

| "Five charts explaining why inflation is at a 40-year high" |

Saturday, December 11, 2021

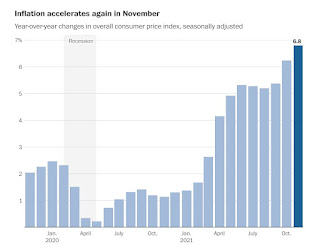

Washington Post: "Five charts explaining why inflation is at a near 40-year high" (3 min video)

"The bumpy economic recovery has had policymakers, economists and American households grappling with greater price hikes for groceries, gas, cars, rent and just about everything else we need.The latest inflation data, released by the Bureau of Labor Statistics, showed prices in November rose to a nearly 40-year high, climbing 6.8 percent compared with the year before.For months, officials at the Federal Reserve and White House argued that pandemic-era inflation will be temporary. But they’ve had to back away from that message, which was increasingly hard to square with what was happening in the economy — and the way Americans experience it.Persistent supply chain backlogs and high consumer demand for goods have kept prices elevated. There is no clear answer for when that will change, leaving Americans to feel the strain in their pocketbooks in the meantime. This is a breakdown of how we got here."

|

| Year-over-year changes in overall consumer price index, seasonally adjusted |