Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Sunday, March 2, 2025

Dirty Dozen tax scams for 2025: IRS warns taxpayers to watch out for dangerous threats

Friday, February 28, 2025

Tax Time Guide: Use Where’s My Refund? tool to track refund status via IRS

|

| Tax Time Guide: Use Where’s My Refund? tool |

Friday, February 14, 2025

Tax season 2025: where to find help

|

|

| Tax season 2025: where to find help |

Wednesday, January 8, 2025

IRS Free File now open: Free tax filing service available to millions on IRS.gov

- Go to IRS.gov/freefile,

- Click on Explore Free Guided Tax Software button. Then select the Find a Trusted Partner tool for help in finding the right product, or

- Use the Browse All Trusted Partners tool to review each offer,

- Select the desired product, and

- Follow the links to the trusted partner's website to begin their tax return.

- 1040Now

- Drake (1040.com)

- ezTaxReturn.com

- FileYourTaxes.com

- On-Line Taxes

- TaxAct

- TaxHawk (FreeTaxUSA)

- TaxSlayer

Thursday, November 28, 2024

IRS provides transition relief for third party settlement organizations; Form 1099-K threshold is $5,000 for calendar year 2024

Tuesday, April 9, 2024

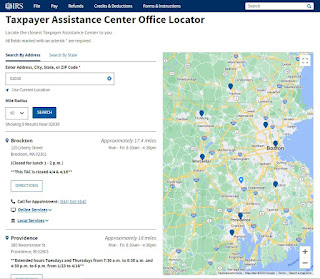

IR-2024-99: Special Saturday help available April 13 at 70 IRS Taxpayer Assistance Centers nationwide; no appointment needed

- Current government-issued photo identification, along with a second form of identification for identity verification services.

- Social Security or Individual Taxpayer Identification numbers for themselves and all members of their household, including their spouse and dependents (if applicable).

- Any IRS letters or notices received and related documents.

- A copy or digital image of the tax return in question if one was filed.

- A current mailing address,

- Proof of financial account information included on a tax return to receive payments or refunds by direct deposit.

Wednesday, October 18, 2023

Boston Globe: "IRS will offer a new option to file your tax return in 13 states — and Massachusetts is one of them"

"In 2024, some taxpayers will have for the first time a new filing option that many advocates have been demanding for years: A free tax preparation software program, like TurboTax or its competitors, created by the IRS.For its first filing season, the program, Direct File, will be available in only 13 states and won’t be suitable for all taxpayers, the IRS announced on Tuesday. If you want to be one of the first to try it out, you’ll need a special invitation.Selected taxpayers will get invitations around mid-February, an IRS official said, speaking on the condition of anonymity to discuss the program before Tuesday’s announcement.If all goes well with those early filers, the official said, the program will gradually open up to more users. By the time of the tax filing deadline in April, the IRS’s goal is that the program will be open to anyone who wants to use it in the 13 eligible states. The IRS said in an email Tuesday that the agency anticipates hundreds of thousands of users."

|

| The IRS plans to invite a select group of taxpayers across 13 states to try out the agency’s pilot electronic free file tax return system, beginning this January.PATRICK SEMANSKY/ASSOCIATED PRESS |

Sunday, April 9, 2023

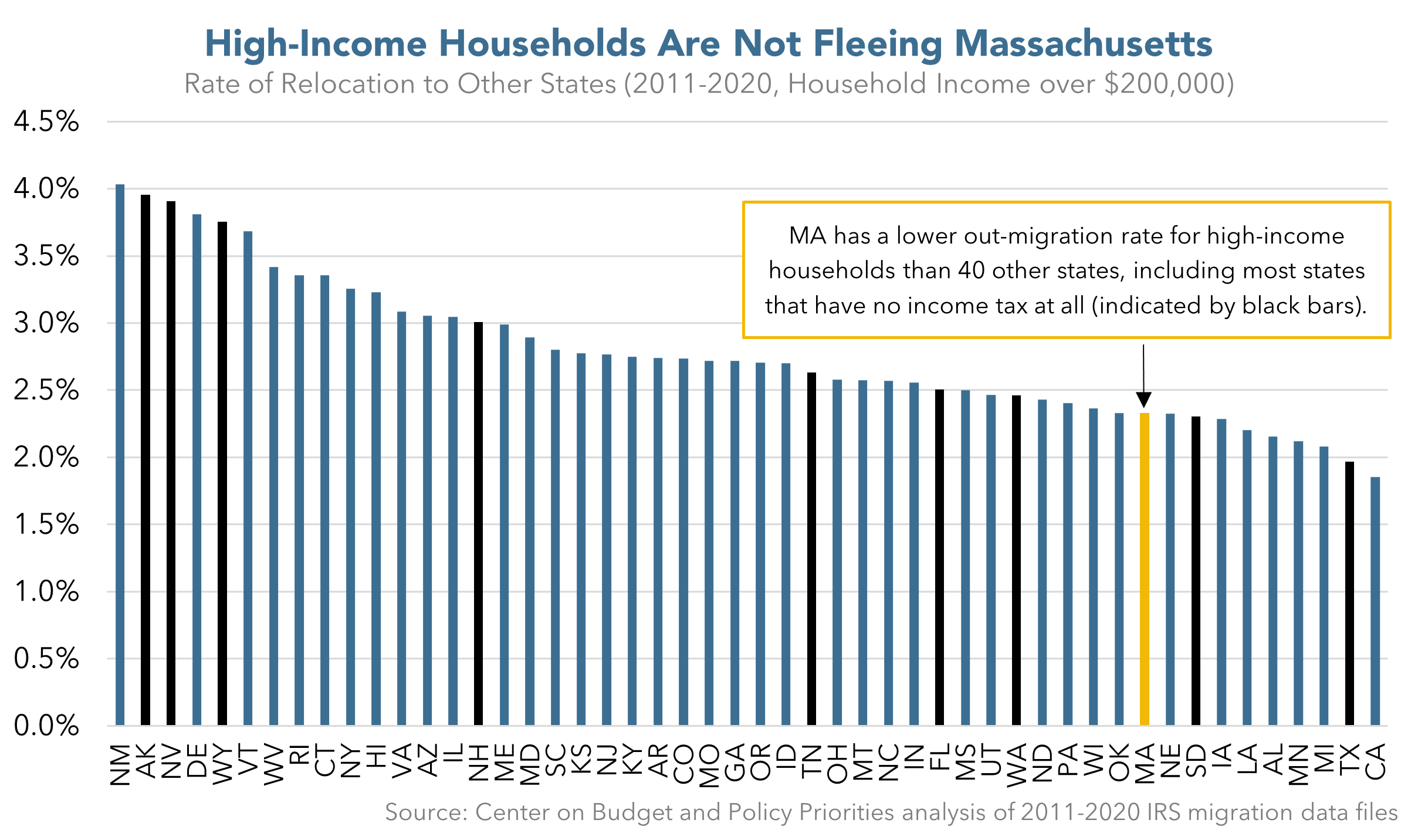

IRS data shows "High-Income Households Are Not Fleeing Massachusetts"

"Internal Revenue Service (IRS) data show that Massachusetts has low rates of out-migration among high-income households compared to other states. As a consequence, delivering large tax cuts to these few households to stem a non-existent exodus is misguided. Moreover, the best research shows that state tax levels have little impact on the decisions of high-income households about where to live.

At the same time, tax cuts aimed at these few households would sacrifice revenue needed for public investments that address the challenges working families in Massachusetts face. These include the high cost of housing, childcare, and post-secondary education, as well as unreliable transportation systems.A forthcoming review of IRS data from 2011-2020 (the most current such data available) by the Center on Budget and Policy Priorities shows that Massachusetts has a lower rate of out-migration among high-income households than all but nine other states.1 Notably, the Massachusetts average annual rate of out-migration among high-income households is lower than rates in seven of the nine states that have no income tax at all.

(Presenting out-migration data as rates – rather than simply by the total numbers of movers – allows a proper comparison among states, regardless of differences in the states’ overall population sizes. It also makes sense to look directly at out-migration separate from in-migration because there can be different issues driving these decisions.)"

Saturday, December 24, 2022

IRS: delay announced for implementation of $600 reporting threshold for third-party payment platforms

"The Internal Revenue Service said on Friday that it was delaying by one year a new tax policy that will require users of digital wallets and e-commerce platforms to start reporting small transactions to the tax collection agency.The delay followed bipartisan backlash from lawmakers and an uproar from small-business owners, who only recently became aware of the tax change.The I.R.S. said the delay was intended to provide a smooth transition period for taxpayers to comply with the policy, which was part of the American Rescue Plan of 2021 and was supposed to take effect this year. Many users of services such as Venmo, PayPal, Zelle, Cash App, StubHub and Etsy only recently became aware that they would be receiving I.R.S. tax forms associated with their transactions, sowing fears of surprise tax bills."

|

| The Etsy Inc. website on a laptop computer arranged in Saint Thomas, Virgin Islands on Feb. 19, 2021.GABBY JONES/BLOOMBERG |

Tuesday, December 13, 2022

IRS reminds those over age 72 to start withdrawals from IRAs and retirement plans to avoid penalties

The Internal Revenue Service today (Dec 12, 2022) reminded those who were born in 1950 or earlier that funds in their retirement plans and individual retirement arrangements face important upcoming deadlines for required minimum distributions to avoid penalties.

Required minimum distributions

IRAs: The RMD rules require traditional IRA, and SEP, SARSEP, and SIMPLE IRA account holders to begin taking distributions at age 72, even if they're still working. Account holders reaching age 72 in 2022 must take their first RMD by April 1, 2023, and the second RMD by December 31, 2023, and each year thereafter.

Retirement Plans: In 401(k), 403(b) and 457(b) plans; profit-sharing and other defined contribution plans; and defined benefit plans, the first RMD is due by April 1 of the later of the year they reach age 72, or the participant is no longer employed (if allowed by the plan). A 5% owner of the employer must begin taking RMDs at age 72.

RMDs may not be rolled over to another IRA or retirement plan. See the RMD Comparison Chart that highlights some of the basic RMD rules that apply to IRAs and defined contribution plans. Roth IRAs do not require distributions while the original owner is alive.

RMD Calculations and 50% tax on missed distributions

An IRA trustee, or plan administrator, must either report the amount of the RMD to the IRA owner or offer to calculate it. An IRA owner, or trustee, must calculate the RMD separately for each IRA owned. They may be able to withdraw the total amount from one or more of the IRAs. However, RMDs from workplace retirement plans must be taken separately from each plan.

Not taking a required distribution, or not withdrawing enough, could mean a 50% excise tax on the amount not distributed. The IRS has worksheets to calculate the RMD and payout periods.

Inherited IRAs

An RMD may be required for an IRA, retirement plan account or Roth IRA inherited from the original owner. Retirement Topics - Beneficiary has information on taking RMDs from an inherited IRA or retirement account and reporting taxable distributions as part of gross income. Publication 559, Survivors, Executors and Administrators, can help those in charge of the estate complete and file federal income tax returns, and explains their responsibility to pay any taxes due on behalf of the decedent or person who has died.

2020 coronavirus-related distribution

Since 2020 RMDs were waived, an account owner or beneficiary who received an RMD in 2020 had the option of returning it to their IRA or other qualified plan to avoid paying taxes on that distribution. A 2020 RMD that qualified as a coronavirus-related distribution may be repaid over a 3-year period or have the taxes due on the distribution spread over three years.

A 2020 withdrawal from an inherited IRA could not be repaid to the inherited IRA but may be spread over three years for income inclusion. For more information see the Coronavirus Relief for Retirement Plans and IRAs page.

Taxpayers can find forms, instructions, publications, Frequently Asked Questions regarding Required Minimum Distributions and other easy-to-use tools at IRS.gov.

Friday, November 25, 2022

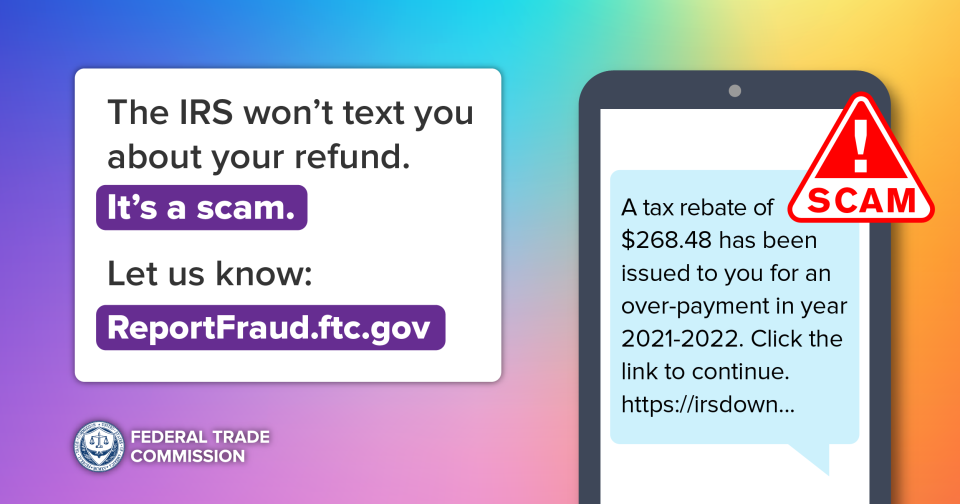

No, that’s not the IRS texting about a tax refund or rebate. It’s a scam.

|

|

| No, that’s not the IRS texting about a tax refund or rebate. It’s a scam |

Tuesday, June 7, 2022

IRS continues with Dirty Dozen this week

The Internal Revenue Service today kicked off the week with the 5th item on its 2022 annual Dirty Dozen scams warning list, with a sad reminder that criminals still use the COVID-19 pandemic to steal people's money and identity with bogus emails, social media posts and unexpected phone calls, among other things.

These scams can take a variety of forms, including using unemployment information and fake job offers to steal money and information from people. All of these efforts can lead to sensitive personal information being stolen, with scammers using this to try filing a fraudulent tax return as well as harming victims in other ways.

"Scammers continue using the pandemic as a device to scare or confuse potential victims into handing over their hard-earned money or personal information," said IRS Commissioner Chuck Rettig. "I urge everyone to be leery of suspicious calls, texts and emails promising benefits that don't exist."

The IRS has compiled the annual Dirty Dozen list for more than 20 years as a way of alerting taxpayers and the tax professional community about scams and schemes. The list is not a legal document or a literal listing of agency enforcement priorities. It is designed to raise awareness among a variety of audiences that may not always be aware of developments involving tax administration.

"Caution and awareness are our best lines of defense against these criminals," Rettig added. "Everyone should verify information on a trusted government website, such as IRS.gov."

A common scam the IRS continues to see during this period involves using crises that affect all or most people in the nation, such as the COVID-19 pandemic. Some of the scams for which people should continue to be on the lookout include:

Economic Impact Payment and tax refund scams: Identity thieves who try to use Economic Impact Payments (EIPs), also known as stimulus payments, are a continuing threat to individuals. Similar to tax refund scams, taxpayers should watch out for these tell-tale signs of a scam:

Any text messages, random incoming phone calls or emails inquiring about bank account information, requesting recipients to click a link or verify data should be considered suspicious and deleted without opening. This includes not just stimulus payments, but tax refunds and other common issues.

Remember, the IRS won't initiate contact by phone, email, text or social media asking for Social Security numbers or other personal or financial information related to Economic Impact Payments. Also be alert to mailbox theft. Routinely check your mail and report suspected mail losses to postal inspectors.

Reminder: The IRS has issued all Economic Impact Payments. Most eligible people already received their stimulus payments. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. Taxpayers should remember that the IRS website, IRS.gov, is the agency's official website for information on payments, refunds and other tax information.

Unemployment fraud leading to inaccurate taxpayer 1099-Gs: Because of the pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

Taxpayers should also be on the lookout for a Form 1099-G reporting unemployment compensation they didn't receive. For people in this situation, the IRS urges them to contact their appropriate state agency for a corrected form. If a corrected form cannot be obtained so that a taxpayer can file a timely tax return, taxpayers should complete their return claiming only the unemployment compensation and other income they actually received. See Identity Theft and Unemployment Benefits for tax details and DOL.gov/fraud for state-by-state reporting information.

Fake employment offers posted on social media: There have been many reports of fake job postings on social media. The pandemic created many newly unemployed people eager to seek new employment. These fake posts entice their victims to provide their personal financial information. This creates added tax risk for people because this information in turn can be used to file a fraudulent tax return for a fraudulent refund or used in some other criminal endeavor.

Fake charities that steal your money: Bogus charities are always a problem. They tend to be a bigger threat when there is a national crisis like the pandemic.

Taxpayers who give money or goods to a charity may be able to claim a deduction on their federal tax return. Taxpayers must donate to a qualified charity to get a deduction. To check the status of a charity, use the IRS Tax Exempt Organization Search tool.

Here are some tips to remember about fake charity scams:

- Individuals should never let any caller pressure them. A legitimate charity will be happy to get a donation at any time, so there's no rush. Donors are encouraged to take time to do the research.

- Potential donors should ask the fundraiser for the charity's exact name, web address and mailing address, so it can be confirmed later. Some dishonest telemarketers use names that sound like large well-known charities to confuse people.

- Be careful how a donation is paid. Donors should not work with charities that ask them to pay by giving numbers from a gift card or by wiring money. That's how scammers ask people to pay. It's safest to pay by credit card or check — and only after having done some research on the charity.

For more information about avoiding fake charities, visit the Federal Trade Commission website

Shared from the IRS -> https://www.irs.gov/newsroom/irs-continues-with-dirty-dozen-this-week-urging-taxpayers-to-continue-watching-out-for-pandemic-related-scams-including-theft-of-benefits-and-bogus-social-media-posts

|

| IRS continues with Dirty Dozen this week |

Friday, April 15, 2022

Try IRS.gov first for last-minute tax help and tips

Today's Internal Revenue Service website provides millions with the tax solutions they need 24 hours a day and eliminates unnecessary calls or trips to an IRS office. On IRS.gov, waiting in line is never a problem and there's no appointment needed.

The many online tools and resources range from tax preparation and refund tracking to tax law research tools like the Interactive Tax Assistant and answers for Frequently Asked Questions on dozens of subjects.

File taxes, view accounts, make payments – all online!

Taxpayers can use the "File" tab on the IRS.gov home page for most federal income tax needs. The IRS Free File program offers 70% of all taxpayers the choice of several brand-name tax preparation software packages to use at no cost. Those who earned less than $73,000 in 2021 can choose which package is best for them. Some even offer free state tax return preparation.

To see their tax account, taxpayers can use the View Your Account tool. They'll find information such as a payoff amount, the balance for each tax year owed, up to 24 months of their payment history and key information from their current tax year return as originally filed.

Taxpayers can find the most up-to-date information about tax refunds using the "Where's My Refund?" tool on IRS.gov and on the official IRS mobile app, IRS2Go. Within 24 hours after the IRS acknowledges receipt of an e-filed return taxpayers can start checking on the status of their refund.

Those who owe can use IRS Direct Pay to pay taxes for the Form 1040 series, estimated taxes or other associated forms directly from a checking or savings account at no cost.

Taxpayers can also use the Get Transcript tool to view, print or download their tax transcripts after the IRS processes their return or payment.

File complete and accurate returns to avoid processing delays

To avoid situations that can slow a refund, taxpayers should be careful to file a complete and accurate tax return. If a return includes errors or is incomplete, it may require further review.

Taxpayers should be sure to have all their year-end statements in hand before filing a return. This includes Forms W-2 from employers, Form 1099-G from state unemployment offices, Forms 1099 from banks and other payers, and Form 1095-A from the Health Insurance Marketplace for those claiming the Premium Tax Credit.

Individuals should refer to Letter 6419 for advance Child Tax Credit payments and Letter 6475 for third Economic Impact Payment amounts they received– or their Online Account – to prepare a correct tax return. Claiming incorrect tax credit amounts can not only delay IRS processing, but can also lead to adjusted refund amounts.

Assistive technology options

At the online Alternative Media Center (AMC), taxpayers will find a variety of accessible products like screen reading software, refreshable Braille displays and screen magnifying software. These products include tax forms, instructions and publications that can be downloaded or viewed online as Section 508 compliant PDF, HTML, eBraille, text and large print. Please note that every product is not available in all formats. For example, tax forms are not available as HTML documents.

Prevent fraud with an Identity Protection PIN

An Identity Protection PIN (IP PIN) is a six-digit number that prevents someone from filing a tax return using another taxpayer's Social Security number. The IP PIN is known only to the real taxpayer and the IRS and helps the IRS verify the taxpayer's identity when they file their electronic or paper tax return.

Starting in 2021, any taxpayer who can verify their identity can voluntarily opt into the IP PIN program. See Get an IP PIN for details and to access the online tool. There are options for those who cannot verify their identities online.

Find free, local tax preparation

The IRS's Volunteer Income Tax Assistance (VITA) program has operated for over 50 years. It offers free basic tax return preparation to qualified individuals:

- People who generally make $58,000 or less,

- People with disabilities and

- Limited English-speaking taxpayers.

The Tax Counseling for the Elderly (TCE) program also offers free tax help for taxpayers, particularly those age 60 and older.

The VITA/TCE Site Locator can help eligible taxpayers find the nearest community-based site staffed by IRS-trained and certified volunteers. Demand is high for this service so taxpayers may experience longer wait times for appointments. Taxpayers can use the locator tool to find an available site near them. It's updated throughout the tax season, so individuals should check back if they don't see a nearby site listed.

And MilTax, Military OneSource's tax service, offers online software for eligible military members, veterans and their families to electronically file a federal return and up to three state returns for free.

Adjust withholding now to avoid tax surprises next year

Now is a perfect time for taxpayers to check their withholding and avoid a tax surprise next filing season. Life events like marriage, divorce, having a child or a change in income can all impact taxes.

The Withholding Estimator on IRS.gov helps employees assess their income tax, credits, adjustments and deductions, and determine whether they need to change their withholding by submitting a new Form W-4, Employee's Withholding Allowance Certificate. Taxpayers should remember that, if needed, they should submit their new W-4 to their employer, not the IRS.

Phone assistance and in-person appointments during COVID-19

The IRS works hard to provide quality service to taxpayers while actively responding to the impacts of the pandemic and focusing on the safety and health of taxpayers and employees.

The IRS encourages people to use existing electronic tools available on IRS.gov as much as possible before calling and continues its efforts to develop more resources to help meet taxpayer needs.

For example, voice bots helped people calling the Economic Impact Payment (EIP) toll-free line, providing general procedural responses to frequently asked questions. As of April 9, 2022, nearly 2.5 million taxpayers had their questions answered through electronic assistance. The IRS also added voice bots for the Advanced Child Tax Credit (AdvCTC) toll-free line this year to provide similar assistance to callers who need help reconciling the credits on their 2021 tax return. As of April 9, 2022, almost 200,000 taxpayers' queries were answered through these bots.

The IRS also continues to provide face-to-face tax assistance at Taxpayer Assistance Centers by appointment when necessary and at walk-in Saturday events. The IRS follows Centers for Disease Control social distancing guidelines for COVID-19 at all office appointments.

|

| Try IRS.gov first for last-minute tax help and tips |

Thursday, April 7, 2022

“In the year 2022, this doesn’t just seem crazy. It is crazy."

"Here, at last, is the real reason your tax return is delayed: It’s not the pandemic. It’s that the IRS handles too much paper and has failed to adopt scanning technology that could have significantly reduced the current backlog of returns.

The way the agency processes paper is “archaic” and was a problem that was fixable long before the coronavirus shut things down, National Taxpayer Advocate Erin M. Collins wrote in her latest blog about the 2022 tax season.

Last year, the IRS received nearly 17 million paper 1040 forms, more than 4 million individual amended returns and millions of paper business returns, according to Collins.

I’m still trying to wrap my head around it: Employees transcribe all of those millions of paper tax returns manually."

https://www.washingtonpost.com/business/2022/04/01/irs-backlog-scanning-technology/

Tuesday, February 15, 2022

IRS launches resource page on IRS.gov with latest details and information for taxpayers during filing season

To help taxpayers and tax professionals, the Internal Revenue Service today announced a special new page on IRS.gov to provide the latest details and information affecting the 2022 filing season and ongoing efforts by the agency to address the inventory of previously filed tax returns.

During this tax season, taxpayers face a number of issues due to critical tax law changes that took place in 2021 and ongoing challenges related to the pandemic. To raise awareness about these issues and provide people with the latest timely information, the IRS has created a special tax season web page. This page will provide people with a quick overview of information to help people filing tax returns as well as those who have previous year tax returns awaiting processing by the IRS.

"The IRS is taking numerous steps to keep this tax season going smoothly while also taking additional action to address the inventory of tax returns filed last year," said IRS Commissioner Chuck Rettig. "We're off to a good start processing tax returns and issuing refunds. But we want people to have an easy way to see the latest information. This new page provides a one-stop shop for the latest key information people and the tax community may need."

The "special tax season alerts" page will be available through the IRS.gov home page and shared through social media and other channels.

The page will include the latest filing season updates. The IRS began tax season on January 24, and in less than two weeks more than 4 million tax refunds have gone out worth nearly $10 billon. Millions more will go out in the weeks ahead as the IRS enters an important period of the tax season.

The page also includes links to important information related to ongoing efforts by the IRS to address the inventory of unprocessed tax returns filed before this year. This includes steps to stop more than a dozen common letters to taxpayers, and updates on IRS operations and the number of unprocessed tax returns.

"The combination of the pandemic, new tax laws and numerous other factors led to an unprecedented amount of unprocessed tax returns and correspondence remaining in the IRS inventory during 2021," Rettig said. "We must continue pursuing innovative strategies while supporting the hard work and dedication of our employees to fulfill our commitment to return inventories to a healthy level before entering the 2023 filing season. These steps are making a difference. Refunds for tax returns and amended tax returns in the inventory continue to flow out to taxpayers."

The IRS continues to urge taxpayers to carefully review their tax filings for accuracy and file electronically with direct deposit to speed refunds. Special tips are available in several places on IRS.gov, including these top 5 tips; basics on the 2022 tax season and IRS Tax Time Guide.

Shared from the IRS page -> https://www.irs.gov/newsroom/irs-launches-resource-page-on-irsgov-with-latest-details-and-information-for-taxpayers-during-filing-season

|

| IRS launches resource page on IRS.gov |