Blocking new development doesn't "preserve" your town—it drains your wallet.

No new homes = no new taxpayers… but guess what does grow? School budgets, potholes, annual maintenance costs and legacy pension requirements.

Fewer people to split that bill = higher taxes for you. https://t.co/PXUVh5dlAG

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Sunday, June 8, 2025

Math problem: "Fewer people to split that bill = higher taxes for you"

Wednesday, June 4, 2025

Watch "US Federal Income Taxes: How the US Federal Government is Funded & How Your Share is Calculated" on YouTube

Via USA Facts:

"The US federal government collected $4.9 trillion in revenue in 2024 -- 99% of it from taxes. 49% came from federal income tax and 35% came from payroll taxes (for social security and medicare). The US has a progressive tax system, which means that you pay more taxes on each income tier (in 2024 for single filers, 10% on your first $11,600, 12% on $11,604 to $47,150 and so on). And you can deduct some expenses (like mortgage interest) from your taxable income amount. More Americans are in the 12% tax bracket than any other. Learn more about how personal federal income taxes work, as well as corporate taxes, state and local taxes, and tax changes over time. "

Saturday, February 22, 2025

Did someone use your SSN to file taxes? Here’s what to do

|

|

| Did someone use your SSN to file taxes? Here’s what to do |

Friday, February 14, 2025

Tax season 2025: where to find help

|

|

| Tax season 2025: where to find help |

Monday, February 3, 2025

Venn diagram on the intersection of services, housing, and taxes

intersection of services, housing, and taxes

"the consequence for showing up at a village meeting to complain about new homes being built in your community should be having to memorize this Venn diagram"

Saturday, February 10, 2024

Tax preparation help available at Library

Friday, September 29, 2023

MA House & Senate send FY 2024 tax relief bill to Gov Healey

"The House and Senate have passed a compromise tax relief bill that would provide $561 million in tax breaks and credits this year, with the value growing to approximately $1 billion once the law is fully implemented in 2027.The House overwhelmingly approved the bill on Sept. 27, and the Senate did the same on Sept. 28. The governor, who has 10 days to review and sign the bill, has indicated her strong support.Provisions that would affect municipalities include property tax relief and housing incentives. The bill would:• Increase the maximum annual property tax deduction for seniors who provide volunteer services to a municipality from $1,500 to $2,000• Increase the maximum available “senior circuit breaker” property tax credit from $750 per year to $1,500 per year, prior to adjusting for inflation• Create a local-option property tax exemption for residential properties that are rented to households earning no more than 200% of area median income, and allow municipalities to determine the amount of the exemption and adopt ordinances and bylaws implementing these provisions• Increase the cap on Housing Development Incentive Program tax credits from $10 million to $30 million annually and allow for the distribution of any portion of the annual cap on credits that were not authorized in previous years, or of any credits that were returned"

Continue reading the article online at MMA -> https://www.mma.org/house-senate-send-tax-relief-bill-to-governors-desk/

|

| https://malegislature.gov/Bills/193/H4104 |

Wednesday, February 23, 2022

MA State House News: Baker differs on tax breaks; Auditor says communities should get support to run elections

Via CommonWealth Magazine, we find these share worthy:

"GOV. CHARLIE BAKER told lawmakers on Tuesday that Massachusetts can easily afford his package of $700 million in tax cuts, and the state needs some of the changes benefitting higher-income taxpayers to prevent them from moving elsewhere.

“Not only can we afford this tax relief proposal, we believe it’s time to give Massachusetts families back some of the tax revenue that they created through their hard work,” Baker told the Legislature’s Revenue Committee at a hybrid hearing held in person and virtually on the first day the State House was open in nearly two years.

The tax relief package in some sense pits a Republican governor against a Democrat-controlled Legislature whose leaders to date have not made reducing taxes a high priority. During the hearing, Democratic lawmakers focused most of their attention on the governor’s proposed reductions in the estate tax and the income tax on short-term capital gains — two taxes that benefit wealthier individuals. They suggested the money for those tax breaks could be better spent on reducing taxes paid by lower-income taxpayers."

"THE STATE WILL OWE cities and towns more than $2 million to keep polling places open for additional mandated voting hours during the September 2022 state primary and November 2022 general elections, Auditor Suzanne Bump said Tuesday.Under the 1983 Uniform Polling Hours Law, cities and towns must keep polling locations open for at least 13 hours on primary and general election days, an increase from the previously-required 10 hours of voting. The law also directs the auditor to certify what offering the extra hours will cost municipalities with the costs to be paid through the secretary of state’s office."

https://commonwealthmagazine.org/politics/auditor-says-expanded-voting-hours-will-cost-2m/

Thursday, December 30, 2021

Notice from the Treasurer/ Collector: FY 22 Third Quarter Real Estate and Personal Property Tax Bills

Notice from the Treasurer/ Collector: FY 22 Third Quarter Real Estate and Personal Property Tax Bills

Treasurer Collector Kerri A. Bertone has mailed the fiscal 2022 third quarter real estate and personal property tax bills. Payment is due by February 1, 2022. Payments received after the due date are charged 14% interest.

|

| Notice from the Treasurer/ Collector: FY 22 Third Quarter Real Estate and Personal Property Tax Bills |

Monday, October 25, 2021

Town Council Meeting - 10/20/21 - three audio segments

FM #646-647-648 = This is the Franklin Matters radio show, number 646-647-648 in the series.

This session shares part of the Franklin, MA Town Council meeting held on Wednesday, October 20, 2021.

The meeting was conducted in a hybrid format: members of the Town Council and Town Administration personnel, the Police retirement and promotion individuals, along with their guest and family members were in the Council Chambers, some members of the public participated in person, some via the Zoom conference bridge, all to adhere to the ‘social distancing’ requirements of this pandemic period.

I’ve split the just about two hours and forty minutes ( 2:40 total elapsed time) into three (3) logical segments:

- Part 1 -> covers the opening, citizen comments, appointment/swearing in of new firefighter/paramedic and the update on ARPA funding (~54 mins) https://player.captivate.fm/episode/58eae587-351d-46ca-9e11-8f6c5e6523a4

- Part 2 -> covers the Census 2020 data and the reprecincting presentation and Q&A session (~ 40 minutes) https://player.captivate.fm/episode/7e79c518-913e-4002-99b9-1ccce36d5b3e

- Part 3 -> covers the Legislation for Action, Council Comments and meeting close. (~ 52 minutes) https://player.captivate.fm/episode/c578b0eb-36c0-4d2e-bb40-6ea793864b56

The show notes contain links to the meeting agenda. Let’s listen to this segment of the Town Council meeting of Oct 20, 2021

--------------

Agenda document -> https://www.franklinma.gov/sites/g/files/vyhlif6896/f/agendas/october_20_2021_town_council_agenda.pdf

Agenda folder -> https://www.franklinma.gov/town-council/agenda/october-20-town-council-agenda

My notes from the meeting ->

https://www.franklinmatters.org/2021/10/recap-town-council-approves-creation-of.html

Town Council Quarterbacking session (a short recap with Council Chair Tom Mercer) ->

https://www.franklinmatters.org/2021/10/town-council-quarterbacking-with-chair.html

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit www.Franklinmatters.org or www.franklin.news

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

|

| Town Council Meeting - 10/20/21 - three audio segments |

Thursday, April 16, 2020

Attention Franklin Residents: Important Notice to Taxpayers

Under “An Act to Address Challenges Faced by Municipalities and State Authorities Resulting From COVID-19,” Chapter 53 of the Acts of 2020, the Town Administrator has adopted two (2) local options to extend the due date for Real Estate and Personal Property (RE/PP) tax payments through June 1, 2020, as well as a waiver of interest on certain municipal tax and other bills (water, sewer, trash & excise), which are paid late, but on or before June 30, 2020.

1. Local Option #1: The due date for Real Estate and Personal Property tax bills has been extended to June 1, 2020. June 1, 2020 is the new due date even if the due date for payment on your enclosed or previously mailed tax bill is April 1, 2020 or May 1, 2020.

What does this Mean?

- a. Every property owner in Franklin has one additional month to pay their RE/PP bill.

- b. Beginning June 2, 2020, late fees and penalties will be assessed.

2. Local Option #2: The town has also optioned “to waive interest and other penalty for late payment of any excise, tax, betterment assessment or apportionment thereof, water rate or annual sewer use, or other charge, added to a tax for any payments with a due date on or after March 10, 2020 where payment is made late but before June 30, 2020.”

This waiver applies to late payments of bills that have a due date of March 10, 2020 or after when such bills are paid late, but paid on, or before, June 30. This waiver of late fees and penalty does not apply to bills with due dates before March 10, 2020 or if the bill is not paid by June 30

What does this mean?

- a. The waiver of late fees and penalties applies to only water, sewer, trash & excise bills.

- b. Late fees and penalties will be waived; provided payment is made on or before June 30, 2020.

- c. Due dates for all water, sewer, trash and excise bills originally due after March 10 will be due on or before June 30 regardless of the bill due date.

- d. On July 1, 2020, late fees and penalties will begin being assessed.

How Can I Pay My Bills?

● White dropbox - residents can drop off payments by check and money order only, census forms, etc. in the white dropbox (mailbox) located on the side of the Municipal Building at 355 East Central Street.

● Online Payment - Permitting and Online Payments (property and real estate, water/sewer/trash, excise taxes) can also be found online: Online payments at

www.franklinma.gov/files

Who Do I Contact With Questions?

If any citizen has a question, they should contact the Treasurer-Collector’s Office. The best method right now is to email Treasurer-Collector Kerri Bertone at kbertone@franklinma.gov

Citizens may also call the general office phone line, leave a voicemail and a member of the staff will return your phone call. The phone number is (508) 520-4950.

Please find the PDF of this on the Town of Franklin page:

https://www.franklinma.gov/sites/franklinma/files/uploads/2020-04-15_tax_delay_psa.pdf

|

| Attention Franklin Residents: Important Notice to Taxpayers |

Friday, January 17, 2020

Get up-to-date information this tax filing season with redesigned IRS e-News Subscriptions

The e-News Subscription Service has been redesigned and updated in recent months to make it easier to subscribe to specific areas that people and organizations are interested in. Among others, the IRS offers subscription services tailored to tax exempt and government entities, small and large businesses and individuals.

The IRS currently has 20 registration-based e-News options, including:

- IRS Tax Tips – These brief, concise tips in plain language that cover a wide-range of topics of general interest to taxpayers. They include the latest on tax scams and schemes, tax reform, tax deductions, filing extensions and amending a return. IRS Tax Tips are distributed daily during tax season and periodically throughout the year. https://service.govdelivery.com/accounts/USIRS/subscriber/topics

- IRS Newswire − Subscribers to IRS Newswire receive news releases the day they are issued. These cover a wide range of tax administration issues ranging from breaking news to details related to legal guidance.

- IRS News in Spanish (Noticias del IRS en Español) − Readers get IRS news releases, tax tips and updates in Spanish as they are released. Subscribe at Noticias del IRS en Español. https://service.govdelivery.com/accounts/USIRS/subscriber/new

- e-News for Tax Professionals − Includes a weekly roundup of news releases and legal guidance specifically designed for the tax professional community. Subscribing to e-News for Tax Professionals gets tax pros a weekly summary, typically delivered on Friday afternoons.

- IRS Outreach Connection − This newest IRS subscription offering delivers up-to-date materials for tax professionals and partner groups inside and outside the tax community. The material for Outreach Connection is specifically designed so subscribers can share the material with their clients or members through email, social media, internal newsletters, e-mails or external websites. Subscribe by visiting IRS.gov/outreachconnect.

The resources will help taxpayers and organizations keep up with the latest information during and after filing season.

|

| For more information and other IRS subscriptions designed for specific groups, visit IRS e-News Subscriptions |

Tuesday, September 17, 2019

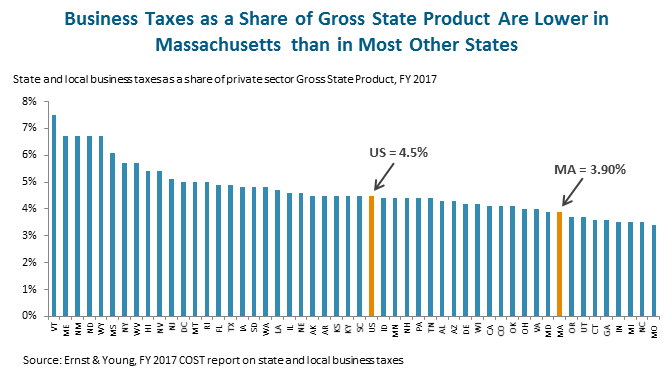

MassBudget: How Do Mass. Business Taxes Compare to Other States?

|

|

Saturday, June 15, 2019

IRS reminder: Taxpayers should do a Paycheck Checkup now

The Internal Revenue Service encourages taxpayers to look at their tax withholding now to take charge of their tax situation and avoid a surprise at tax time next year. Doing a Paycheck Checkup now using the IRS Withholding Calculator means taxpayers have the majority of the year to spread out any changes they make to their withholding.

Paycheck Checkup: https://www.irs.gov/paycheck-checkup

Withholding Calculator: https://www.irs.gov/individuals/irs-withholding-calculator

The agency said the average tax refund was $2,729 for tax year 2018. While some taxpayers may find it advantageous to get a large tax refund, others may wish to have more of their money in their paychecks throughout the year. Whatever the goal, the IRS wants taxpayers to know that while taxes must be paid as income is earned during the year, either through withholding or estimated tax payments, they can make adjustments that will influence the size of their refund.

Tax reform changes

The Tax Cuts and Jobs Act of 2017 made significant changes that affected almost every taxpayer. Most changes took effect in 2018 and taxpayers first noticed them on the tax return they filed earlier this year.

The new law increased the Child Tax Credit from $1,000 to $2,000 per qualifying child, while also raising the income limits for the credit. This means more people will now qualify for the Child Tax Credit. There is also a new $500 credit for older dependent children and qualifying relatives. While the tax-law changes nearly doubled the standard deduction, they also suspended personal and dependency exemptions that existed in the past. Because of these changes, fewer taxpayers itemize their deductions, and new limits apply to many of these deductions. These restrictions apply to state and local taxes, mortgage interest and miscellaneous itemized deductions, and higher limits apply to charitable contributions.

As a result, many taxpayers ended up receiving 2018 refunds that were larger or smaller than expected. Others found they owed additional tax when they filed. For that reason, taxpayers may need to raise or lower the amount of tax they have taken out of their pay.

While a withholding check is a good idea any year, the IRS also encourages taxpayers who have a change in life circumstances to do a Paycheck Checkup. Personal changes that may affect taxes include marriage or divorce, birth or adoption of a child, or the ‘aging out’ or loss of a dependent.

Using the Withholding Calculator

The Withholding Calculator helps taxpayers get their tax withholding right by making sure these and other tax changes are taken into account. Taxpayers enter their deductions and credits into the online tool, as well as estimate income from other sources, such as a spouse, bank interest, second jobs and gig-economy employment. To use the Withholding Calculator most effectively, taxpayers should have a copy of their 2018 tax return, as well as a recent paystub for themselves and their spouse if married and filing jointly.

The Withholding Calculator will recommend the number of allowances that a taxpayer should claim on a Form W-4. In some instances, it will recommend that the employee also have an additional flat-dollar amount withheld from each paycheck.

Form W-4 https://www.irs.gov/forms-pubs/about-form-w-4

While the Withholding Calculator is primarily designed for taxpayers who earn wages, it can also benefit those with pension and annuity income.

If the Withholding Calculator suggests a change, the employee should fill out a new Form W-4 and give it to their employer as soon as possible. Similarly, recipients of pensions and annuities can make a change by filling out Form W-4P and giving it to their payer. They should not send these forms to the IRS. For more information, visit the Withholding Calculator, available on IRS.gov

Form W-4P https://www.irs.gov/forms-pubs/about-form-w-4-p

Estimated taxes

Some workers are considered self-employed and are responsible for paying taxes directly to the IRS. Often, this includes people involved in the gig or sharing economy. One way to pay taxes directly to the IRS is by making estimated tax payments during the year. The next deadline for tax year 2019 estimated taxes is June 17.

Gig or Sharing economy https://www.irs.gov/businesses/small-businesses-self-employed/sharing-economy-tax-center

The TCJA also changed the way tax is calculated for those with substantial income not subject to withholding. As a result, many taxpayers may need to raise or lower the amount of tax they pay each quarter through the estimated tax system.

The revised estimated tax package, Form 1040-ES, on IRS.gov is designed to help taxpayers figure these payments correctly. The package includes a quick rundown of key tax changes, income tax rate schedules for 2019 and a useful worksheet for figuring the right amount to pay.

More information:

FS-2019-4: Tax withholding: How to get it right

https://www.irs.gov/newsroom/tax-withholding-how-to-get-it-right

FS-2019-6: Basics of estimated taxes for individuals

https://www.irs.gov/newsroom/basics-of-estimated-taxes-for-individuals

Wednesday, November 21, 2018

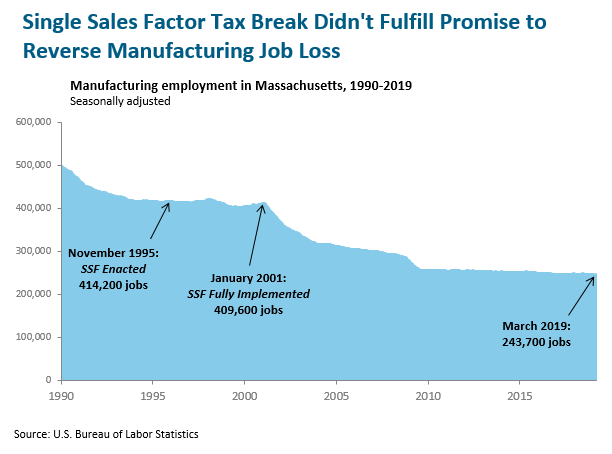

MassBudget: Massachusetts taxes on par with U.S. average

|

|