Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Wednesday, February 18, 2026

Saturday, January 24, 2026

You're invited to a one-hour webinar on how to help protect yourself and the older adults in your life from identity theft

|

Sunday, January 18, 2026

This Identity Theft Awareness Week, find tools and events just for you

Sunday, January 4, 2026

Planning for 2026? Add Identity Theft Awareness Week to your calendar

|

Saturday, February 22, 2025

Did someone use your SSN to file taxes? Here’s what to do

|

|

| Did someone use your SSN to file taxes? Here’s what to do |

Friday, January 10, 2025

Identity Theft Awareness Week 2025 is coming! (JAN 27)

|

|

| Identity Theft Awareness Week 2025 is coming! (JAN 27) |

Sunday, August 25, 2024

FTC Reveals "Five ways to keep scammers and hackers away"

|

|

| FTC Reveals "Five ways to keep scammers and hackers away" |

Saturday, February 5, 2022

Stolen identity? Get help at IdentityTheft.gov

|

|

| Stolen identity? Get help at IdentityTheft.gov |

Thursday, February 3, 2022

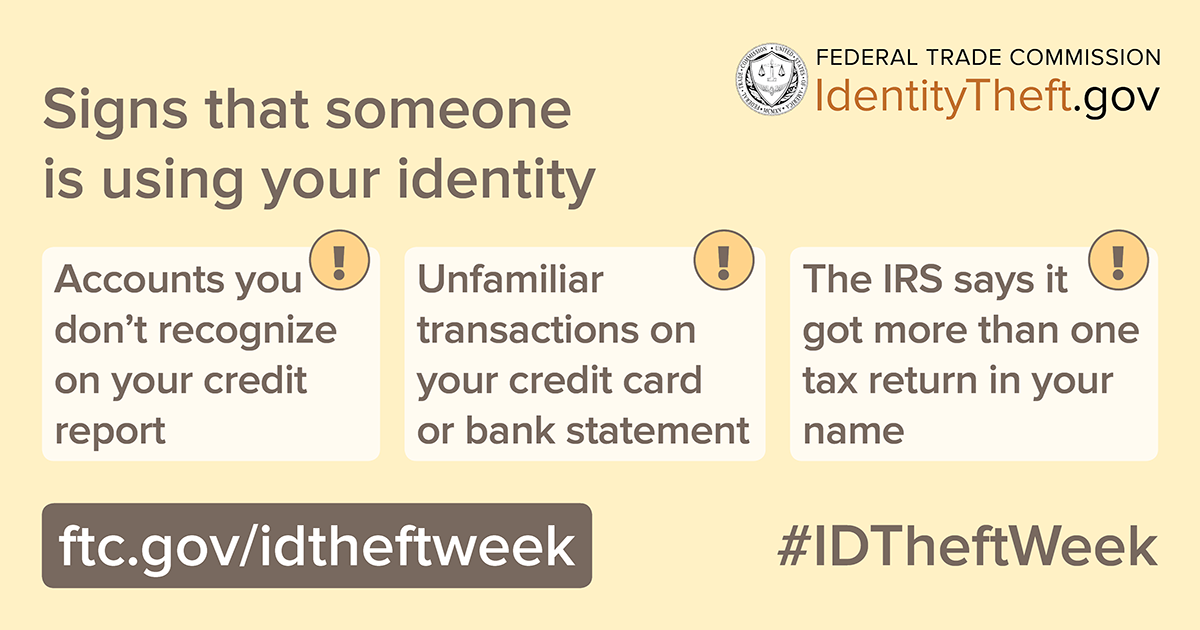

How to tell if someone is using your identity

|

Wednesday, February 2, 2022

Identity theft can happen to anyone

"It’s the second day of Identity Theft Awareness Week and today we’re talking about steps that can help reduce your risk of identity theft.

Many of us access our online accounts — credit cards, investments, insurance, or checking and savings accounts — nearly every day. In our digital world, bits of our personal information are everywhere. Identity thieves know this and look for ways — both high-tech, like lifting our passwords, or low-tech, like stealing our mail — to get their hands on our money and personal information. "

|

| Identity theft can happen to anyone |

Sunday, January 31, 2021

FTC Marks Identity Theft Awareness Week with Events to Help Consumers Identify Risks of Identity Theft During the COVID-19 Pandemic

The Federal Trade Commission is launching Identity Theft Awareness Week, February 1-5, 2021, with a series of events to highlight steps consumers can take to help reduce their risk of identity theft and recover if identity theft occurs.

Identity theft happens when someone steals personal information about you such as your Social Security number or credit card information, and uses it to commit fraud. Reports about any type of identity theft topped the list of consumer complaints(link is external) submitted to the FTC through the third quarter of 2020.

As part of Identity Theft Awareness Week, the FTC will participate in webinars and other events to highlight what you can do to protect your personal information, red-flag warning signs of possible identity theft, and steps to take if identity theft happens to you.

Events include a webinar on Monday, February 1, with Identity Theft Resource Center and FTC experts discussing identity theft during the pandemic, and a Facebook Live discussion on Thursday, February 4, hosted by the AARP Fraud Watch Network, focused on COVID-19-related identity theft, current trends, and ways to protect yourself.

You can find the full list of events at ftc.gov/IDtheftweek, along with details on how to participate and tips on how to reduce the risk of identity theft.

The Federal Trade Commission works to promote competition and to protect and educate consumers. You can learn more about consumer topics and report scams, fraud, and bad business practices online at ReportFraud.ftc.gov.

Like the FTC on Facebook (https://www.facebook.com/federaltradecommission), follow us on Twitter (https://twitter.com/FTC), get consumer alerts, read our blogs, and subscribe to press releases for the latest FTC news and resources.

|

| FTC Marks Identity Theft Awareness Week |

Wednesday, January 13, 2021

IRS: All taxpayers now eligible for Identity Protection PINs

The Internal Revenue Service today expanded the Identity Protection PIN Opt-In Program to all taxpayers who can verify their identities.

The Identity Protection PIN (IP PIN) is a six-digit code known only to the taxpayer and to the IRS. It helps prevent identity thieves from filing fraudulent tax returns using a taxpayers' personally identifiable information.

"This is a way to, in essence, lock your tax account, and the IP PIN serves as the key to opening that account," said IRS Commissioner Chuck Rettig. "Electronic returns that do not contain the correct IP PIN will be rejected, and paper returns will go through additional scrutiny for fraud."

The IRS launched the IP PIN program nearly a decade ago to protect confirmed identity theft victims from ongoing tax-related fraud. In recent years, the IRS expanded the program to specific states where taxpayers could voluntarily opt into the IP PIN program. Now, the voluntary program is going nationwide.

About the IP PIN Opt-In Program

Here are a few key things to know about the IP PIN Opt-In program:

- This is a voluntary program.

- You must pass a rigorous identity verification process.

- Spouses and dependents are eligible for an IP PIN if they can verify their identities.

- An IP PIN is valid for a calendar year.

- You must obtain a new IP PIN each filing season.

- The online IP PIN tool is offline between November and mid-January each year.

- Correct IP PINs must be entered on electronic and paper tax returns to avoid rejections and delays.

- Never share your IP PIN with anyone but your trusted tax provider. The IRS will never call, text or email requesting your IP PIN. Beware of scams to steal your IP PIN.

- There currently is no opt-out option but the IRS is working on one for 2022.

How to get an IP PIN

Taxpayers who want an IP PIN for 2021 should go to IRS.gov/IPPIN and use the Get an IP PIN tool. This online process will require taxpayers to verify their identities using the Secure Access authentication process if they do not already have an IRS account. See IRS.gov/SecureAccess for what information you need to be successful. There is no need to file a Form 14039, an Identity Theft Affidavit, to opt into the program

Once taxpayers have authenticated their identities, their 2021 IP PIN immediately will be revealed to them. Once in the program, this PIN must be used when prompted by electronic tax returns or entered by hand near the signature line on paper tax returns.

All taxpayers are encouraged to first use the online IP PIN tool to obtain their IP PIN. Taxpayers who cannot verify their identities online do have options.

Taxpayers whose adjusted gross income is $72,000 or less may complete Form 15227, Application for an Identity Protection Personal Identification Number (https://www.irs.gov/pub/irs-pdf/f15227.pdf), and mail or fax to the IRS. An IRS customer service representative will contact the taxpayer and verify their identities by phone. Taxpayers should have their prior year tax return at hand for the verification process.

Taxpayers who verify their identities through this process will have an IP PIN mailed to them the following tax year. This is for security reasons. Once in the program, the IP PIN will be mailed to these taxpayers each year.

Taxpayers who cannot verify their identities online or by phone and who are ineligible for file Form 15227 can contact the IRS and make an appointment at a Taxpayer Assistance Center (https://www.irs.gov/help/contact-your-local-irs-office) to verify their identities in person. Taxpayers should bring two forms of identification, including one government-issued picture identification.

Taxpayers who verify their identities through the in-person process will have an IP PIN mailed to them within three weeks. Once in the program, the IP PIN will be mailed to these taxpayers each year.

No change for confirmed identity theft victims

Taxpayers who are confirmed identity theft victims or who have filed an identity theft affidavit because of suspected stolen identity refund fraud will automatically receive an IP PIN via mail once their cases are resolved. Current tax-related identity theft victims who have been receiving IP PINs via mail will experience no change.

See IRS.gov/IPPIN for additional details.

The IRS also encourages tax professionals and employers to share information with taxpayers about the availability of the IP PIN. Tax professionals and employers can print or email Publication 5367 or share IRS social media/e-poster products.

Friday, December 4, 2020

National Tax Security Awareness Week, Day 4: Security Summit urges businesses to tighten security, offers new protections against identity theft

The partners, operating cooperatively as the Security Summit (https://www.irs.gov/newsroom/security-summit) to fight identity theft, marked the fourth day of National Tax Security Awareness Week with a warning to businesses to enact the strongest measures possible to protect their data and systems. The IRS also is planning additional steps to help businesses combat cybercriminals trying to steal their data.

“As the IRS and our partners have strengthened our security standards, identity thieves have looked for new ways to find sources of information, and businesses need to stay alert,” said IRS Commissioner Charles Rettig. “Businesses, just like individuals, can be victims of identity theft. Thieves may steal enough information to file a business tax return for refund or use other scams using the company’s identity.”

More than 70% of cyberattacks are aimed at businesses with 100 or fewer employees. Thieves may be targeting credit card information, the business identity information or employee identity information.

Business are encouraged to follow best practices from the Federal Trade Commission include:

- Set your security software to update automatically

- Back up important files

- Require strong passwords for all devices

- Encrypt devices

- Use multi-factor authentication

More information is available at FTC’s Cybersecurity for Small Businesses (https://www.ftc.gov/tips-advice/business-center/small-businesses/cybersecurity).

Businesses should especially be alert to any COVID-19 or tax-related phishing email scams that attempt to trick employees into opening embedded links or attachments. IRS related scams may be sent to phishing@irs.gov.

Starting Dec. 13, 2020, the IRS will begin masking sensitive information from business tax transcripts, the summary of corporate tax returns, to help prevent thieves from obtaining identifiable information that would allow them to file fake business tax returns.

Only financial entries will be fully visible. All other information will have varying masking rules. For example, only the first four letters of each first and last name – of individuals and businesses – will display. Only the last four digits of the Employer Identification Number will be visible.

The IRS also has publicly launched the Form 14039-B, Business Identity Theft Affidavit (https://www.irs.gov/pub/irs-pdf/f14039b.pdf), that will allow companies to proactively report possible identity theft to the IRS when, for example, the e-filed tax return is rejected.

Businesses should file the Form 14039-B if it receives a:

- Rejection notice for an electronically filed return because a return already is on file for that same period.

- Notice about a tax return that the entity didn't file.

- Notice about Forms W-2 filed with the Social Security Administration that the entity didn't file.

- Notice of a balance due that is not owed.

This form will enable the IRS to respond to the business much faster than in the past and work to resolve issues created by a fraudulent tax return. Businesses should not use the form if they experience a data breach but see no tax-related impact. For more information, see Identity Theft Central’s Business section (https://www.irs.gov/identity-theft-central).

Although the tax scams can come and go, all employers should remain alert to Form W-2 theft schemes. In the most common version, a thief poses as a high-ranking company executive who emails payroll employees and asks for a list of employees and their W-2s. Businesses often don’t know they’ve been scammed until a fraudulent return shows up in employees’ names.

There is a special reporting procedure for employers who experience the W-2 scam. It also may be found at Identity Theft Central’s Business section (https://www.irs.gov/identity-theft-central).

Finally, Security Summit partners urge businesses to keep their EIN application information current. Changes of address or responsible party may be reported using Form 8822-B (https://www.irs.gov/forms-pubs/about-form-8822-b).

The IRS, state tax agencies, the private sector tax industry, including tax professionals, work in partnership as the Security Summit to help protect taxpayers from identity theft and refund fraud. This is the third in a week-long series of tips to raise awareness about identity theft. See IRS.gov/securitysummit for more details.

Thursday, October 29, 2020

How You Can Protect Yourself from Hackers and Scammers

|