Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Wednesday, February 18, 2026

Friday, January 10, 2025

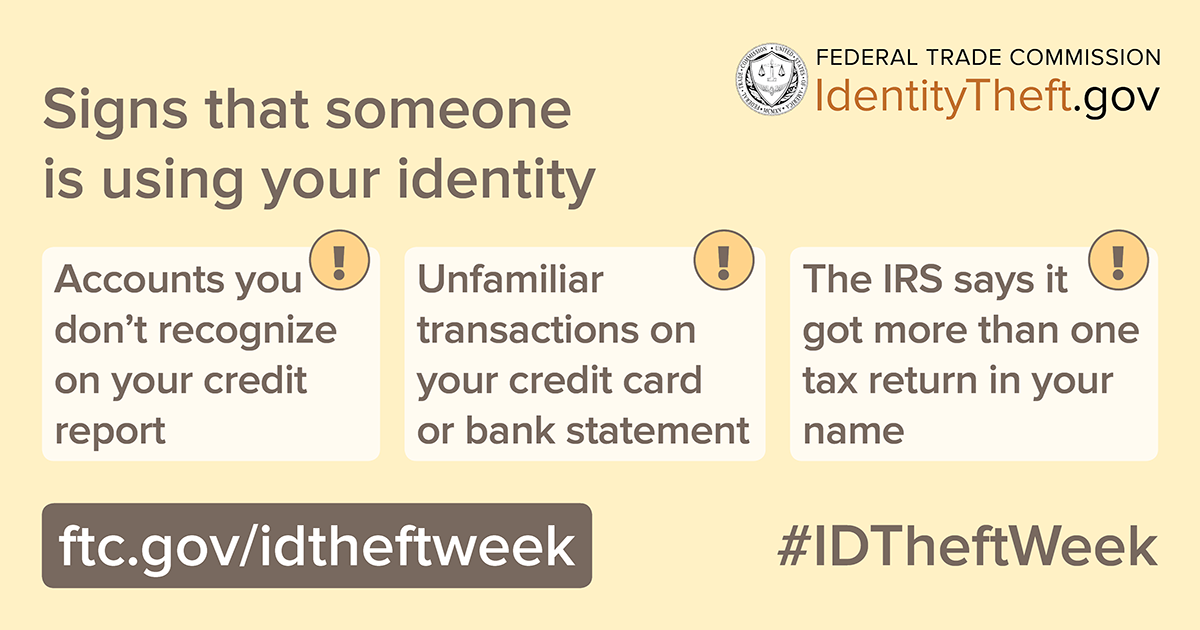

Identity Theft Awareness Week 2025 is coming! (JAN 27)

|

|

| Identity Theft Awareness Week 2025 is coming! (JAN 27) |

Saturday, December 10, 2022

What did you consent to do? Use of social media tools getting riskier - links to 3 articles

"This week, millions came face to face with AI-generated versions of themselves thanks to the app Lensa, which uses machine learning to spit out illustrations based on photos you provide. People took to social media to reflect on how the portraits made them feel — and who stands to lose when AI art goes mainstream.“I think I have a fairly decent self-image, but I looked at the images and I was like, ‘Why do I look so good?’” said James, a Twitch streamer who declined to give his last name to keep his social media presence separate from his day job. “I think it shaved off a lot of my rough edges.”

"Sure, that drunk selfie you posted on Instagram might be personally embarrassing. Now imagine that selfie is also training fuel for an artificial intelligence system that helps put an innocent person in jail.Welcome to the age of artificial intelligence. What you do with your face, your home security videos, your words and the photos from your friend’s art show are not just about you. Almost entirely without your true consent, information that you post online or that is posted about you is being used to coach AI software. These technologies could let a stranger identify you on sight or generate custom art at your command."

"Tens of thousands of websites belonging to government agencies, Fortune 500 companies and other organizations host Twitter computer code that sends visitor information to the social media giant, according to research first reported by The Cybersecurity 202.And virtually none of them have used a Twitter feature to put restrictions on what the company can do with that data, said digital ad analysis firm Adalytics, which conducted the study.The presence of Twitter’s code — known as the Twitter advertising pixel — has grown more troublesome since Elon Musk purchased the platform."

- Don't fall to any one of the meme's (What Game of Thrones character are you?) or tools like Lensa

- Install DuckDuckGo (https://duckduckgo.com) on your browser to prevent the tracking cookies from doing their thing

|

| Lensa interpretations of reporter Tatum Hunter. These images were created by AI. They were not taken by a camera. |

Friday, June 10, 2022

"Mass. lawmakers override Baker veto, allow driver’s licenses for residents without legal immigration status"

"After decades of activism, false starts, and failed efforts, advocates celebrated Thursday as a bill that allows driver’s licenses for residents without legal immigration status finally became law.Massachusetts legislators voted to override a veto from Governor Charlie Baker and made official a law backed by law enforcement groups, immigrant rights advocates, and insurance companies. It will take effect next summer."

"THE MASSACHUSETTS LEGISLATURE completed its override of Gov. Charlie Baker’s veto on Thursday, allowing immigrants without legal status to obtain a driver’s license in Massachusetts. The state is the 17th, in addition to Washington, DC, to adopt that policy.The House overrode Baker’s veto with a 119-36 vote on Wednesday. The Senate followed suit Thursday with a 32-8 vote, both bodies surpassing the two-thirds threshold needed to override a gubernatorial veto. "

|

| Immigrants rally in front of the Massachusetts State House in favor of the Work and Family Mobility Act. (Photo by Rose Lincoln) |

Saturday, May 28, 2022

“We are a nation of immigrants. We all benefit from increased public safety."

"One day after state legislators approved a bill to allow undocumented immigrants to get driver’s licenses in Massachusetts, Governor Charlie Baker vetoed the measure, saying it poses a risk to election security.

In a letter rejecting the legislation late Friday afternoon, Baker said the bill requires the Registry of Motor Vehicles “to issue state credentials to people without the ability to verify their identity” and “increases the risk that noncitizens will be registered to vote.”

He also expressed concern that the identification wouldn’t distinguish an undocumented person from a documented one."

|

| A Pass the Work and Family Mobility Act Rally was held on the steps of the Massachusetts State House on July 29, 2021. (Photo by Rose Lincoln) |

Saturday, February 5, 2022

Stolen identity? Get help at IdentityTheft.gov

|

|

| Stolen identity? Get help at IdentityTheft.gov |

Thursday, February 3, 2022

How to tell if someone is using your identity

|

Saturday, January 29, 2022

Social Security’s Top 5 Data Privacy Resources

From the Social Security Administration:

"Are you looking for better ways to stay safe online? As you know, Security is in our name. We are committed to protecting your personal information and take this responsibility seriously. We keep this commitment in mind when we collect information from you to carry out our mission.

As we celebrate Data Privacy Week, we are sharing our top five privacy resources:"

|

| Social Security’s Top 5 Data Privacy Resources |

Sunday, January 31, 2021

FTC Marks Identity Theft Awareness Week with Events to Help Consumers Identify Risks of Identity Theft During the COVID-19 Pandemic

The Federal Trade Commission is launching Identity Theft Awareness Week, February 1-5, 2021, with a series of events to highlight steps consumers can take to help reduce their risk of identity theft and recover if identity theft occurs.

Identity theft happens when someone steals personal information about you such as your Social Security number or credit card information, and uses it to commit fraud. Reports about any type of identity theft topped the list of consumer complaints(link is external) submitted to the FTC through the third quarter of 2020.

As part of Identity Theft Awareness Week, the FTC will participate in webinars and other events to highlight what you can do to protect your personal information, red-flag warning signs of possible identity theft, and steps to take if identity theft happens to you.

Events include a webinar on Monday, February 1, with Identity Theft Resource Center and FTC experts discussing identity theft during the pandemic, and a Facebook Live discussion on Thursday, February 4, hosted by the AARP Fraud Watch Network, focused on COVID-19-related identity theft, current trends, and ways to protect yourself.

You can find the full list of events at ftc.gov/IDtheftweek, along with details on how to participate and tips on how to reduce the risk of identity theft.

The Federal Trade Commission works to promote competition and to protect and educate consumers. You can learn more about consumer topics and report scams, fraud, and bad business practices online at ReportFraud.ftc.gov.

Like the FTC on Facebook (https://www.facebook.com/federaltradecommission), follow us on Twitter (https://twitter.com/FTC), get consumer alerts, read our blogs, and subscribe to press releases for the latest FTC news and resources.

|

| FTC Marks Identity Theft Awareness Week |

Wednesday, January 13, 2021

IRS: All taxpayers now eligible for Identity Protection PINs

The Internal Revenue Service today expanded the Identity Protection PIN Opt-In Program to all taxpayers who can verify their identities.

The Identity Protection PIN (IP PIN) is a six-digit code known only to the taxpayer and to the IRS. It helps prevent identity thieves from filing fraudulent tax returns using a taxpayers' personally identifiable information.

"This is a way to, in essence, lock your tax account, and the IP PIN serves as the key to opening that account," said IRS Commissioner Chuck Rettig. "Electronic returns that do not contain the correct IP PIN will be rejected, and paper returns will go through additional scrutiny for fraud."

The IRS launched the IP PIN program nearly a decade ago to protect confirmed identity theft victims from ongoing tax-related fraud. In recent years, the IRS expanded the program to specific states where taxpayers could voluntarily opt into the IP PIN program. Now, the voluntary program is going nationwide.

About the IP PIN Opt-In Program

Here are a few key things to know about the IP PIN Opt-In program:

- This is a voluntary program.

- You must pass a rigorous identity verification process.

- Spouses and dependents are eligible for an IP PIN if they can verify their identities.

- An IP PIN is valid for a calendar year.

- You must obtain a new IP PIN each filing season.

- The online IP PIN tool is offline between November and mid-January each year.

- Correct IP PINs must be entered on electronic and paper tax returns to avoid rejections and delays.

- Never share your IP PIN with anyone but your trusted tax provider. The IRS will never call, text or email requesting your IP PIN. Beware of scams to steal your IP PIN.

- There currently is no opt-out option but the IRS is working on one for 2022.

How to get an IP PIN

Taxpayers who want an IP PIN for 2021 should go to IRS.gov/IPPIN and use the Get an IP PIN tool. This online process will require taxpayers to verify their identities using the Secure Access authentication process if they do not already have an IRS account. See IRS.gov/SecureAccess for what information you need to be successful. There is no need to file a Form 14039, an Identity Theft Affidavit, to opt into the program

Once taxpayers have authenticated their identities, their 2021 IP PIN immediately will be revealed to them. Once in the program, this PIN must be used when prompted by electronic tax returns or entered by hand near the signature line on paper tax returns.

All taxpayers are encouraged to first use the online IP PIN tool to obtain their IP PIN. Taxpayers who cannot verify their identities online do have options.

Taxpayers whose adjusted gross income is $72,000 or less may complete Form 15227, Application for an Identity Protection Personal Identification Number (https://www.irs.gov/pub/irs-pdf/f15227.pdf), and mail or fax to the IRS. An IRS customer service representative will contact the taxpayer and verify their identities by phone. Taxpayers should have their prior year tax return at hand for the verification process.

Taxpayers who verify their identities through this process will have an IP PIN mailed to them the following tax year. This is for security reasons. Once in the program, the IP PIN will be mailed to these taxpayers each year.

Taxpayers who cannot verify their identities online or by phone and who are ineligible for file Form 15227 can contact the IRS and make an appointment at a Taxpayer Assistance Center (https://www.irs.gov/help/contact-your-local-irs-office) to verify their identities in person. Taxpayers should bring two forms of identification, including one government-issued picture identification.

Taxpayers who verify their identities through the in-person process will have an IP PIN mailed to them within three weeks. Once in the program, the IP PIN will be mailed to these taxpayers each year.

No change for confirmed identity theft victims

Taxpayers who are confirmed identity theft victims or who have filed an identity theft affidavit because of suspected stolen identity refund fraud will automatically receive an IP PIN via mail once their cases are resolved. Current tax-related identity theft victims who have been receiving IP PINs via mail will experience no change.

See IRS.gov/IPPIN for additional details.

The IRS also encourages tax professionals and employers to share information with taxpayers about the availability of the IP PIN. Tax professionals and employers can print or email Publication 5367 or share IRS social media/e-poster products.

Friday, December 4, 2020

National Tax Security Awareness Week, Day 4: Security Summit urges businesses to tighten security, offers new protections against identity theft

The partners, operating cooperatively as the Security Summit (https://www.irs.gov/newsroom/security-summit) to fight identity theft, marked the fourth day of National Tax Security Awareness Week with a warning to businesses to enact the strongest measures possible to protect their data and systems. The IRS also is planning additional steps to help businesses combat cybercriminals trying to steal their data.

“As the IRS and our partners have strengthened our security standards, identity thieves have looked for new ways to find sources of information, and businesses need to stay alert,” said IRS Commissioner Charles Rettig. “Businesses, just like individuals, can be victims of identity theft. Thieves may steal enough information to file a business tax return for refund or use other scams using the company’s identity.”

More than 70% of cyberattacks are aimed at businesses with 100 or fewer employees. Thieves may be targeting credit card information, the business identity information or employee identity information.

Business are encouraged to follow best practices from the Federal Trade Commission include:

- Set your security software to update automatically

- Back up important files

- Require strong passwords for all devices

- Encrypt devices

- Use multi-factor authentication

More information is available at FTC’s Cybersecurity for Small Businesses (https://www.ftc.gov/tips-advice/business-center/small-businesses/cybersecurity).

Businesses should especially be alert to any COVID-19 or tax-related phishing email scams that attempt to trick employees into opening embedded links or attachments. IRS related scams may be sent to phishing@irs.gov.

Starting Dec. 13, 2020, the IRS will begin masking sensitive information from business tax transcripts, the summary of corporate tax returns, to help prevent thieves from obtaining identifiable information that would allow them to file fake business tax returns.

Only financial entries will be fully visible. All other information will have varying masking rules. For example, only the first four letters of each first and last name – of individuals and businesses – will display. Only the last four digits of the Employer Identification Number will be visible.

The IRS also has publicly launched the Form 14039-B, Business Identity Theft Affidavit (https://www.irs.gov/pub/irs-pdf/f14039b.pdf), that will allow companies to proactively report possible identity theft to the IRS when, for example, the e-filed tax return is rejected.

Businesses should file the Form 14039-B if it receives a:

- Rejection notice for an electronically filed return because a return already is on file for that same period.

- Notice about a tax return that the entity didn't file.

- Notice about Forms W-2 filed with the Social Security Administration that the entity didn't file.

- Notice of a balance due that is not owed.

This form will enable the IRS to respond to the business much faster than in the past and work to resolve issues created by a fraudulent tax return. Businesses should not use the form if they experience a data breach but see no tax-related impact. For more information, see Identity Theft Central’s Business section (https://www.irs.gov/identity-theft-central).

Although the tax scams can come and go, all employers should remain alert to Form W-2 theft schemes. In the most common version, a thief poses as a high-ranking company executive who emails payroll employees and asks for a list of employees and their W-2s. Businesses often don’t know they’ve been scammed until a fraudulent return shows up in employees’ names.

There is a special reporting procedure for employers who experience the W-2 scam. It also may be found at Identity Theft Central’s Business section (https://www.irs.gov/identity-theft-central).

Finally, Security Summit partners urge businesses to keep their EIN application information current. Changes of address or responsible party may be reported using Form 8822-B (https://www.irs.gov/forms-pubs/about-form-8822-b).

The IRS, state tax agencies, the private sector tax industry, including tax professionals, work in partnership as the Security Summit to help protect taxpayers from identity theft and refund fraud. This is the third in a week-long series of tips to raise awareness about identity theft. See IRS.gov/securitysummit for more details.

Sunday, October 11, 2020

In the News: Identity theft problem with unemployment;

From the Milford Daily News, an article of interest for Franklin:

"John and Stephanie Jennings received quite a surprise during the coronavirus pandemic.

Early in the outbreak, Stephanie opened a letter from the state Department of Unemployment Assistance that said her unemployment benefits claim had been processed.

The problem is she never filed one, because she wasn’t out of work.

A few weeks later, John received a similar letter from the DUA. He was also employed, working remotely from home.

Someone — or some entity — stole the couple’s personal identification, and filed fraudulent claims with the DUA."

"Gov. Charlie Baker met with White House coronavirus response coordinator Dr. Deborah Birx on Friday after she met with a group of college presidents in Cambridge.Birx became a familiar face earlier this year when she regularly appeared with President Donald Trump at White House briefings on the coronavirus. Now she is on a nationwide tour of college campuses.Birx visited the Broad Institute on the campus of the Massachusetts Institute of Technology Friday for a roundtable discussion with college and university presidents from Massachusetts.Birx said Massachusetts and the rest of the Northeast are seeing what she called a “silent spread” with more and people catching the virus, but not showing symptoms."

Saturday, September 26, 2020

What to do when someone steals your identity

|

Tuesday, February 4, 2020

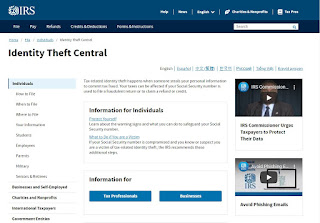

IRS launches Identity Theft Central

Focuses on needs of taxpayers, tax professionals and businesses

The Internal Revenue Service today launched Identity Theft Central, designed to improve online access to information on identity theft and data security protection for taxpayers, tax professionals and businesses.

Located on IRS.gov, Identity Theft Central is available 24/7 at irs.gov/identitytheft. It is a resource on how to report identity theft, how taxpayers can protect themselves against phishing, online scams and more.

Improving awareness and outreach are hallmarks of initiatives to combat identity theft coordinated by the IRS, state tax agencies and the nation's tax industry, all working in partnership under the Security Summit banner.

Since 2015, the Security Summit partners have made substantial progress in the fight against tax-related identity theft. But thieves are still constantly looking for ways to steal the identities of individuals, tax professionals and businesses in order to file fraudulent tax returns for refunds.

The partnership has taken a number of steps to help educate and improve protections for taxpayers, tax professionals and businesses. As part of this effort, the IRS has redesigned the information into a new, streamlined page − Identity Theft Central − to help people get information they need on ID theft, scams and schemes.

From this special page, people can get specific information including:

- Taxpayer Guide to Identity Theft, including what to do if someone becomes a victim of identity theft

- Identity Theft Information for Tax Professionals, including knowing responsibilities under the law

- Identity Theft Information for Businesses, including how to recognize the signs of identity theft

- The page also features videos on key topics that can be used by taxpayers or partner groups. The new page includes a video message from IRS Commissioner Chuck Rettig, warning signs for phishing email scams – a common tactic used for identity theft – and steps for people to protect their computer and phone.

Tax professionals and others may want to bookmark Identity Theft Central and check their specific guidance periodically for updates.

This is part of an ongoing effort by the IRS to share identity theft-related information with the public. The IRS continues to look for ways to raise awareness and improve education and products related to identity theft for taxpayers and the tax professional community.

|

| IRS launches Identity Theft Central |

Thursday, November 14, 2019

In the News: non-binary gender for state licenses; MA House votes to ban flavored cigarettes

"Massachusetts residents can now have a non-binary gender designation on state driver’s licenses.

The state’s Registry of Motor Vehicles says it now recognizes three gender designations: “male,” “female” and “non-binary.”

The change took effect Tuesday.

According to the state Department of Transportation, those designations are available for new credentials, renewals and amendments of licenses and IDs."Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20191113/non-binary-gender-designation-now-available-in-mass

"The Massachusetts House voted Wednesday to ban the sale of flavored vaping and tobacco products -- including mint and menthol cigarettes -- and to impose an excise tax on e-cigarettes.

Rep. Danielle Gregoire, D-Marlborough, a main proponent of flavor ban legislation, said the vote marked “a chance to put an unprecedented nail in the coffin of Big Tobacco.” The bill passed on a vote of 126-31.

The American Cancer Society Cancer Action Network said the bill would make Massachusetts the first state to restrict the sale of all flavored tobacco products, including menthol cigarettes. House Speaker Robert DeLeo described Wednesday’s vote as “a nation-leading step ... to modernize our laws that regulate tobacco.”

The action in the House came almost 16 months after Gov. Charlie Baker signed a law raising the tobacco-buying age from 18 to 21 in an effort to curb youth smoking. Spurred by high rates of youth e-cigarette use, anti-tobacco advocates have been pushing to go further by banning all flavored tobacco products, which they say are designed to appeal to children and, in the case of mint and menthol, mitigate the harsh effects of smoking traditional cigarettes."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20191113/house-votes-to-make-mass-first-to-ban-menthol-cigarettes