Did you know that Massachusetts has relatively low business tax levels compared with other states? Or that two elements of our state's corporate tax code result in a significant loss of its revenue? That's what you can learn and more in our new series of reports that examine how specific corporate taxes impact the Commonwealth.

The analysis shows that:

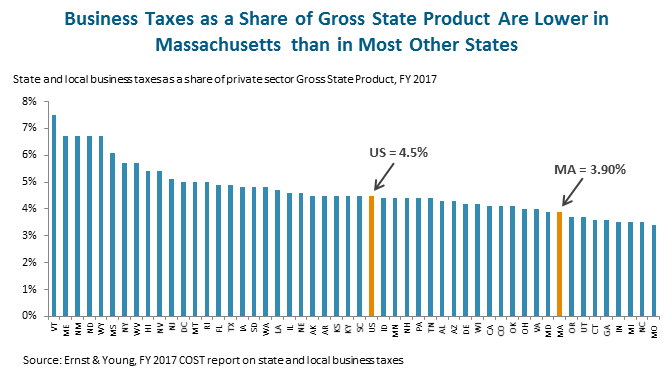

- At 3.9 percent, Massachusetts' total effective business tax rate is significantly below the national average of 4.5 percent.

- Only eight other states have lower total effective business tax levels than the Commonwealth.

- Massachusetts' business tax levels rank in the bottom fifth of all states by this measure.

Our other fact sheets analyze various elements of the corporate tax code. "Together, these reports help us understand that Massachusetts business taxes as a share our economy are relatively low compared to other states, and two business tax provisions that we highlight here appear outdated, ineffective, and unnecessarily costly to the Commonwealth," said Marie-Frances Rivera, MassBudget's President.

One special business tax break- The Single Sales Factor- changes the share of multi-state corporations' profits that are taxable in Massachusetts. This tax break, while showing no discernible benefit, reduces revenue that could be used to invest in our Commonwealth's economy.

As discussed in MassBudget's fact sheet, the Mass. Department of Revenue estimates this tax break will cost the state $400 million in Fiscal Year 2020. Champions of this tax break originally promised that it would be worth the expense by increasing manufacturing employment. But in the years since enactment, Massachusetts has lost about 40 percent of its manufacturing jobs. Only four states lost a larger percentage of their manufacturing jobs than Massachusetts between 2000 and 2014.

Our other new report in this series focuses on the corporate minimum tax in Massachusetts. Corporate Minimum Taxes in Massachusetts Could Be Better Targeted as in Other States, explains how states have long established minimum corporate excise taxes as a backstop to ensure all corporations pay some income tax, regardless of how much they report in profits. The report shows that Massachusetts' corporate minimum tax has not been changed in 30 years.

Since 1989:

- $456 is the minimum amount corporations are required to pay in Massachusetts, regardless of their size.

- 70% percent of all businesses that filed corporate excise taxes in Massachusetts paid this in 2015 - including many, very large corporations.

- According to the Department of Revenue, in 2004, over 2,000 corporations with gross receipts over $50 million paid only the $456 minimum tax.

- More recent studies show that even many Fortune 500 companies pay no state income tax other than this minimum.

Several states have targeted their minimum corporate taxes so that businesses with larger volumes of sales pay larger minimum amounts. In New York, for example, the minimum corporate tax tops out at $200,000 for companies with over $1 billion in New York receipts.

Interested in reading the full tax series? Check out our three latest reports on our website here and look for our upcoming reports on corporate taxes in the Commonwealth.

|