The Town Council gets to formally approve the tax rate for Fiscal Year 2023 at the Council meeting on Wednesday, Nov 30, 2022. This annual event formally closes the cycle on the Fiscal Year calendar as it approves the tax rate for the budget approved in June and adjusted in October.

The tax rate hearing portion of the agenda doc can be found here ->

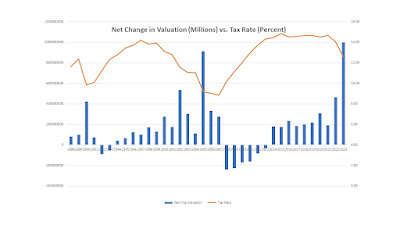

The numbers in this doc allowed me to update (adding FY 2023 #s) to my spreadsheet to produce these charts.

As this chart shows, the tax rate does fluctuate from year to year. We have been as low as 8.86% in 2007, and as high as 14.84% in 2015.

The tax rate is going down from 14.05 to 12.58%. This is due to the increase in overall residential and commercial property valuations increasing. We have all seen what the housing market is doing. This chart shows the relationship between the total assessed valuations and the property tax rates. When the market drops in 1988 and 2008, the rates rise. As the market increases, as in the most recent 2 years, the rate declines.

We do have a single tax rate and that is one question the Council will need to confirm. It is likely they will continue with a single rate. A dual rate doesn't raise any more money than the single, it only takes more from one party than the other. In this case, if we did have a split rate, taking a single dollar from the Residential rate would raise the Commercial/Industrial rate by $4 to raise the same revenue. What do you think might happen as businesses reacted to a $4 tax rate increase?

We do need to grow our overall revenue base and more commercial/industrial growth would be better than more residential growth. We have shifted slightly through the years, but generally in and around an 80-20 split. Follow the bar, or the line. The bar and the line add up to 100%.

|

| commercial/industrial valuation split vs. residential |

So bottom line, while we do need more commercial/industrial growth, whether the tax rate goes up or down (as it does this year), the one other constant in the mix is that the tax bills do increase. This last chart shows that relationship.

|

| whether the tax rate goes up or down the tax bills do increase |

A PDF version of the four charts can be found here