"The median sale price of single-family homes in Franklin, MA hit a record high of $727,000 in 2024. In the last 4 years, the median sale price of Franklin single-family homes has surged 44%, a value gain that was completely unforeseen by real estate experts at the start of the COVID pandemic in 2020.The gain is all the more impressive given the sharp rise in mortgage interest rates that began in 2022. The current 30-year fixed-rate mortgage stands at an average of nearly 7%, more than double the 3% rate average last seen in January of 2022."

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Tuesday, January 21, 2025

Franklin home prices surge during 2024

Monday, April 3, 2023

Self Assessment - In person session - Tuesday April 4 - Natick Community/Senior Center

- We will discuss assessments and why companies require them.

- Learn how to "Work from the inside out."

- We will review "why people hire people."

- You'll have the chance to take some free assessments.

- Meet people in person - Network!

|

| Self Assessment - In person session - Tuesday April 4 - Natick Community/Senior Center |

Tuesday, November 29, 2022

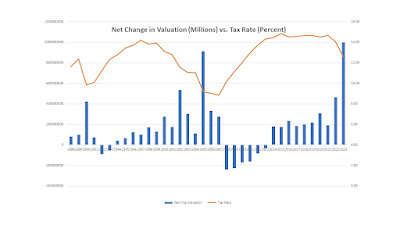

Good news, the tax rate is going down; however, that doesn't mean our taxes are decreasing

|

| commercial/industrial valuation split vs. residential |

So bottom line, while we do need more commercial/industrial growth, whether the tax rate goes up or down (as it does this year), the one other constant in the mix is that the tax bills do increase. This last chart shows that relationship.

|

| whether the tax rate goes up or down the tax bills do increase |

Thursday, October 27, 2022

Finance Committee learns more about the assessment process for valuations on residential and commercial property (video)

|

| Finance Committee learns more about the assessment process for valuations on residential and commercial property (video) |

Saturday, July 30, 2022

Franklin Food Pantry Releases Client Needs Assessment

Report Provides Overview of Food Insecurity in Franklin Community

The Franklin Food Pantry is proud to release its Client Needs Assessment, a comprehensive overview of food insecurity in the Franklin community with recommendations to address the crisis. In 2021 and early 2022, the Franklin Food Pantry reviewed expert literature on food insecurity, conducted research among its current neighbors, interviewed community partners and assessed third-party data sources. The report’s findings will drive programming and operational initiatives to reach more households experiencing food insecurity and related challenges.

The Franklin Food Pantry will focus on the following areas to better support its neighbors:

- Community awareness

- Nutrition

- Community garden

- Partnerships, programs and wrap around services

- Youth programs

- Transportation

- Housing

“The biggest take-away of the Community Needs Assessment is that many more people in Franklin are food insecure than we see accessing our services. We have always assumed there are those in the community whom we haven’t reached, but it was difficult to confirm this assumption with only internal data,” said Tina Powderly, executive director for the Franklin Food Pantry.

“The report shows that in Franklin, while there are 3,284 people who receive MassHealth, only 1,508 are enrolled in SNAP (Supplemental Nutrition Assistance Program). That translates to 549 to 755 households who could benefit from The Pantry but who do not currently shop with us. We want to reach those individuals and encourage them to visit us. As we support people in becoming more food secure, we must focus on moving out of their immediate anxiety so clients can think long term. We can do that with programming to help progress along a continuum toward stability.”

The report includes answers from a weekly question that staff asked current Pantry clients. The information gathered from the clients’ answers will influence future Pantry programming. To date, the Pantry has increased community garden beds, implemented client service office hours, provided free Covid-19 test kits, offered a hybrid distribution method, and launched a new mobile pantry site. The Pantry continues to evaluate future programming based on feedback from its neighbors.

|

| Franklin Food Pantry Releases Client Needs Assessment |

“This assessment shines a bright light on our neighbors’ struggles and what resources are available to help them,” continued Powderly. “Food insecurity is not just an individual problem. It is a community, state and national problem, and we all must work together to help lessen food insecurity. We are very grateful to our local partners for their participation in this critical research and for their collaboration and hard work addressing the issues outlined in the Community Needs Assessment.”

To read the entire report please visit our website. If you or someone you know needs additional help, please direct them to The Pantry.

The Pantry is open on Tuesdays from 9:00 AM – 1:00 PM and 5:30 –6:30 PM for drive-up distribution (no appointment needed), and Thursday and Friday from 9:00 AM – 1:00 PM for appointment-only shopping.

About the Franklin Food Pantry

The Franklin Food Pantry offers supplemental food assistance and household necessities to almost 1,100 individuals per year. The Franklin Food Pantry is not funded by the Town of Franklin. As a private, nonprofit organization, we depend on donations from individuals, corporations, foundations and other strategic partners. We are grateful for our many partnerships, including that with the Greater Boston Food Bank, that allow us to achieve greater buying power and lower our costs.

Donations and grants fund our food purchases, keep our lights on, and put gas in our food truck. Other programs include home delivery, Weekend Backpack Program for Franklin school children in need, mobile pantry, emergency food bags and holiday meal packages. The Pantry is located at 43 W. Central St. in Franklin on Route 140 across from the Franklin Fire Station.

Visit www.franklinfoodpantry.org for more information.

Tuesday, May 31, 2022

Franklin Police to Participate in Accreditation Assessment

Chief Lynch is pleased to announce that a team of assessors from the Massachusetts Police Accreditation Commission is scheduled to arrive on June 22, 2022, to begin examining various aspects of the Franklin Police Department’s policies and procedures, operations and facilities.

Verification by the Assessment Team that the Department meets the Commission’s standards is part of a voluntary process to gain state Accreditation -- a self-initiated evaluation process by which police departments strive to meet and maintain standards that have been established for the profession, by the profession.

The Massachusetts Police Accreditation Program consists of 257 mandatory standards as well as 125 optional standards. In order to achieve accreditation status, the Department must meet all applicable mandatory standards as well as 60% of the optional standards.

Achieving Accreditation is a highly prized recognition of law enforcement professional excellence. Anyone interested in learning more about this program is invited to contact Chief Lynch or the Department’s Accreditation Manager, Deputy Chief James West.

|

| Franklin Police to Participate in Accreditation Assessment |

Wednesday, May 11, 2022

School Committee Space Needs Subcommittee - 05/10/22 (audio)

FM #792 = This is the Franklin Matters radio show, number 792 in the series.

This session of the radio show shares the School Committee - Space Needs Subcommittee meeting held in the 3rd floor training room on Tuesday, May 10, 2022.

The meeting reviewed data requested about aspects of the study in the prior meeting. The next meeting is scheduled for June 6 to preview the update to be provided to the full School Committee at the regularly scheduled meeting of June 14, 2022.

SubCmte Chair - Al Charles; committee members - Denise Spencer, Elise Stokes; Central office support - Supt Sara Ahern, Business Manager Miriam Goodman, Student Services Director Paula Marano.

The recording runs about 55 minutes, so let’s listen to the Space Needs discussion on May 10, 2022. Audio file -> https://franklin-ma-matters.captivate.fm/episode/fm-792-schcmte-space-needs-subcmte-mtg-05-10-22

--------------

Meeting agenda => https://www.franklinmatters.org/2022/05/space-needs-facilities-assessment.html

My notes for the meeting => https://drive.google.com/file/d/1rP5gMrQv4kgPi2EdbaevJcypfk5Jh20V/view?usp=sharing

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

If you don't like something here, please let me know

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

|

| School Committee Space Needs Subcommittee - 05/10/22 (audio) |

Wednesday, March 23, 2022

Space Needs / Facilities Analysis Sub Committee - Mar 29 - 6:30 PM (virtual only)

"The listing of matters are those reasonably anticipated by the Chair which may be discussed at the meeting. Not all items listed may in fact be discussed and other items not listed may also be brought up for discussion to the extent permitted by law."

|

| Space Needs / Facilities Analysis Sub Committee |

Friday, July 9, 2021

The Guardian: "Why declining birth rates are good news for life on Earth"

Given that there is a discussion about Franklin's population and rate of growth, putting our stats in context with national and world trends should help.

"Fertility rates are falling across the globe – even in places, such as sub-Saharan Africa, where they remain high. This is good for women, families, societies and the environment. So why do we keep hearing that the world needs babies, with angst in the media about maternity wards closing in Italy and ghost cities in China?

The short-range answer is that, even though this slowdown was predicted as part of the now 250-year-old demographic transition – whose signature is the tumbling of both fertility and mortality rates – occasional happenings, such as the publication of US census data or China’s decision to relax its two-child policy, force it back into our consciousness, arousing fears about family lines rubbed out and diminishing superpowers being uninvited from the top table.

The longer range answer is that our notion of a healthy, vibrant society is still rooted in the past. The inevitable byproduct of the demographic transition is that populations age, in a chronological sense, but life expectancy, and particularly healthy life expectancy, have increased dramatically over the last half-century, and the societal definition of “old” has not kept up (though artistic experiments such as casting 82-year-old Sir Ian McKellen as Hamlet might help to challenge age-related stereotypes)."

https://www.franklinps.net/district/meeting-packets/files/demographic-presentation

Monday, January 11, 2021

Session #1 - 50+ Jobseeker - elf-assessment, career pathways, and Ageism

Tuesday, January 12th 10:00 am – 12 pm

Friday, January 15th 1:00 pm – 3 pm

Monday, January 18th 6:30 pm – 8:30 pm

Virtual Doors open 15 minutes before the start time

Facilitators: Melody Beach and Ed Lawrence

If you are already registered with the 50+ program, you have already received an email inviting you to join the sessions. (Same link works for all three sessions)

Not yet in the program? Pre-Registration is required:

https://50plusjobseekers.org/outreach/registration/

For additional information, please contact: Susan Drevitch Kelly, Founder/Program Director at susan@sdkelly.com or 781-378-0520.

|

| Session #1 - 50+ Jobseeker - elf-assessment, career pathways, and Ageism |

Sunday, December 9, 2018

Franklin, MA: Town Council - Agenda - Dec 12, 2018

(Note: where there are active links in the agenda item, it will take you to the associated document)

| Agenda Item | Summary |

|---|---|

| Town Council Meeting Agenda |

Meeting of December 12, 2018 - 7:00 PM

|

| 1. ANNOUNCEMENTS |

a. This meeting is being recorded by Franklin TV and shown on Comcast Channel 11 and Verizon Channel 29. This meeting may be recorded by others.

|

| 2. CITIZENS COMMENTS |

a. Citizens are welcome to express their views for up to five minutes on a matter that is not on the agenda. The Council will not engage in a dialogue or comment on a matter raised during Citizen Comments. The Town Council will give remarks appropriate consideration and may ask the Town Administrator to review the matter.

|

| 3. APPROVAL OF MINUTES |

a. November 14, 2018

|

| 4. PROCLAMATIONS/RECOGNITIONS |

None

|

| 5. APPOINTMENTS | |

| 5a. APPOINTMENTS |

Board of Health - Ciera Maffei

|

| 5b. APPOINTMENTS |

Zoning Board of Appeals - Philip Brunelli

|

| 5c. APPOINTMENTS |

Zoning Board of Appeals - Christopher Stickney

|

| 6. HEARINGS |

None

|

| 7. LICENSE TRANSACTIONS |

Shaws Supermarkets- Change of Manager

|

| 8. PRESENTATIONS/DISCUSSIONS | |

| 8a. PRESENTATIONS/DISCUSSIONS |

Benjamin Franklin Classical Charter School

|

| 8b. PRESENTATIONS/DISCUSSIONS |

Risk Assessment

|

| 9. SUBCOMMITTEE REPORTS |

a. Capital Budget Subcommittee

b. Budget Subcommittee

c. Economic Development Subcommittee

|

| 10. LEGISLATION FOR ACTION | |

| 10a. LEGISLATION FOR ACTION |

Resolution 18-70: Appropriation Cable Funds in Support of PEG Service and Programming per M.G.L Ch.44, §53F3/4 (Motion to Approve Resolution 18-70 - Majority Vote (5))

|

| 10b. LEGISLATION FOR ACTION |

Resolution 18-71: Town Council Meeting Schedule for 2019 (Motion to Approve Resolution 18-71 - Majority Vote (5))

|

| 10c. LEGISLATION FOR ACTION |

Bylaw Amendment 18-826: Chapter 170, Vehicles and Traffic- 2nd Reading (Motion to adopt Bylaw Amendment 18-827 Majority Roll Call Vote (5))

|

| 10d. LEGISLATION FOR ACTION |

Bylaw Amendment 18-827: Amendment to the Water System Map - 2nd Reading (Motion to adopt Bylaw Amendment 18-827 Majority Roll Call Vote (5))

|

| 11. TOWN ADMINISTRATORS REPORT | |

| 12. FUTURE AGENDA ITEMS | |

| 13. COUNCIL COMMENTS | |

| 14. EXECUTIVE SESSION |

Purpose #2: to conduct strategy session in preparation for negotiations and/or to conduct contract negotiations with non-union personnel, namely: new Town Administrator Jamie Hellen, on compensation and other terms and conditions of his employment agreement.

|

| 15. RECONVENE |

Reconvene in Open Session if necessary, re: vote to offer employment agreement, specifying compensation and other employment terms and conditions to the new Town Administrator Jamie Hellen.

|

| 16. ADJOURN |