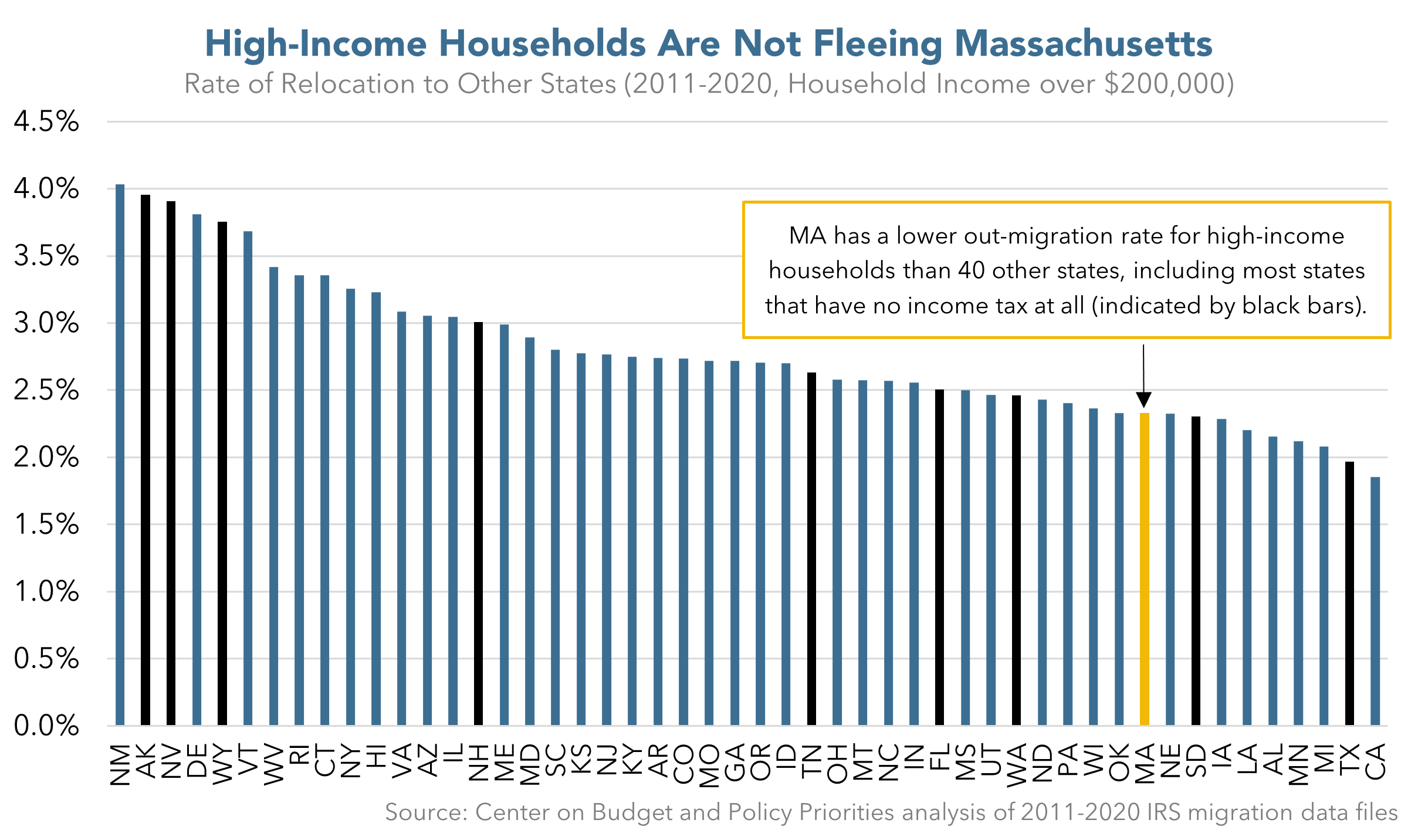

"Internal Revenue Service (IRS) data show that Massachusetts has low rates of out-migration among high-income households compared to other states. As a consequence, delivering large tax cuts to these few households to stem a non-existent exodus is misguided. Moreover, the best research shows that state tax levels have little impact on the decisions of high-income households about where to live.

At the same time, tax cuts aimed at these few households would sacrifice revenue needed for public investments that address the challenges working families in Massachusetts face. These include the high cost of housing, childcare, and post-secondary education, as well as unreliable transportation systems.A forthcoming review of IRS data from 2011-2020 (the most current such data available) by the Center on Budget and Policy Priorities shows that Massachusetts has a lower rate of out-migration among high-income households than all but nine other states.1 Notably, the Massachusetts average annual rate of out-migration among high-income households is lower than rates in seven of the nine states that have no income tax at all.

(Presenting out-migration data as rates – rather than simply by the total numbers of movers – allows a proper comparison among states, regardless of differences in the states’ overall population sizes. It also makes sense to look directly at out-migration separate from in-migration because there can be different issues driving these decisions.)"

Continue reading the article online ->