Over the past 40 years, revenue collected from corporate excise and related taxes has dropped by a third as a percentage of total state tax revenue in Massachusetts, according to the latest report from the Massachusetts Budget and Policy Center (MassBudget). At the same time, the report finds, corporations across the nation are claiming an ever-growing share of all the income generated in the U.S.

According to the report, Rising Profits, Falling Tax Shares: Fixing What's Broken, multiple factors have contributed to the long-term decline in the share of state taxes provided by corporate income taxes. The tax rate on most corporate income in Massachusetts was reduced from 9.5 percent to 8 percent between 2009 and 2012. Growth in the number and cost of state special business tax breaks also has played a role, as have increasingly aggressive tax avoidance efforts by corporations.

Key report findings include:

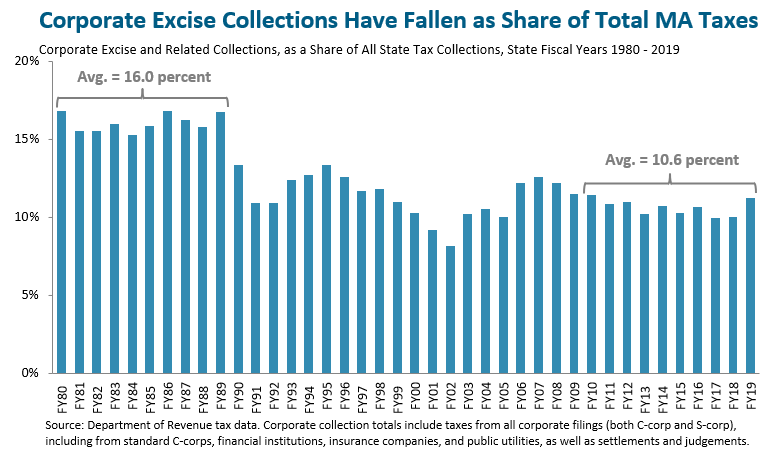

- During the last decade, Massachusetts corporate income and related taxes delivered an average of 10.6 percent of total state tax collections, compared to an average of 16 percent in the 1980s;

- Businesses would have contributed another $1.4 billion in taxes to the Commonwealth in FY 2019 had Massachusetts' corporate excise tax collections remained at the share of total taxes they provided throughout the 1980s (about 16 percent of the total);

- Massachusetts corporations are seeing a reduction in their annual federal tax bills of around $4 billion due to the 2017 Tax Cut and Jobs Act;

- Massachusetts is in the bottom fifth of all states in terms of the share of total state and local taxes paid by businesses

"At a time when profits are soaring, taxes on those profits should not be delivering a smaller slice of our total tax pie. Kids, commuters and communities across the state need profitable corporations doing business here in Massachusetts to step up and do more, not less," said Marie-Frances Rivera, President of MassBudget.