Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Monday, August 28, 2023

GOOD DEEDS: Probate Court Records and Your Real Estate Title

Monday, August 21, 2023

Register O’Donnell Announces 41,000th Book Printed at Norfolk County Registry of Deeds

Celebrating a significant milestone at the Norfolk County Registry of Deeds, Register William P. O’Donnell today (08/17/23) announced the Registry recently completed printing its 41,000th book of recorded land documents, marking an important occasion for the many who appreciate the convenience of modernization and the reliability of the time-tested method of printing land document books to keep records.

Register O’Donnell noted, “The printing of our 41,000th book, which includes land documents such as deeds, homesteads, mortgages, and mortgage discharges, is a significant event in the life of the Registry and a testament to the volume of work completed each and every business day here at the Registry of Deeds. The printing of Book 41,000 links us to the Registry’s rich history, which dates back to 1793.

"The printing of Book 41,000 links us to the Registry’s rich history, which dates back to 1793"

While the printing of books is ongoing, it is important to note that the Registry continues to embrace and utilize cutting-edge technologies, allowing us to record land documents instantaneously. Documents are scanned and available for viewing within 24 business hours of recording at www.norfolkdeeds.org. This modern approach to document recording makes it possible for the digital land document library, which is on Book 41,356, to stay up-to-date and accurate.

This digitalization process has greatly improved accessibility and efficiency for those seeking land records. Additionally, the Registry of Deeds actively works to ensure the security and integrity of these digital records through regular backups and advanced data protection measures.

“Our computer systems have been backed up on a nightly and weekly basis for decades. This redundancy allows the Registry to maintain a permanent record of all land document recordings in the event of a disaster affecting our building at 649 High Street, Dedham. In addition, the Registry also, per state law, microfilms all recorded land documents and ships the microfilm off-site to a secure location where it can be retrieved in the event of a catastrophe,” stated the Register.

The Register further emphasized the importance of these measures, stating that the backup systems and off-site storage ensure the preservation and accessibility of important land documents even in the face of unforeseen circumstances. This commitment to safeguarding records reflects the Registry's dedication to providing reliable and uninterrupted services to the public.

Residents and those with an interest in Norfolk County property records are encouraged to visit the Registry of Deeds. Users of the Registry have options to view land documents by whichever means they are comfortable with. You, as a member of the public, can research property in hard copy via books, online at one of our many computer workstations available to the public, or from the convenience of your home or work computer.

The Registry of Deeds understands the importance of accessibility and convenience for its users. By offering both physical and online options to view land documents, individuals can choose the method that best suits their needs and preferences. This commitment to flexibility ensures that residents and those with an interest in Norfolk County property records can easily access the information they require, further enhancing the Registry's dedication to providing reliable and uninterrupted services.

Concluding his remarks, Register O’Donnell stated, “The core mission of the Registry of Deeds is to record land documents in a safe, accurate, secure, and accessible manner. Part of this charge is to serve as a depository for over 10 million land documents recorded from the Registry’s beginning in 1793 right up to the present day. While we have embraced the latest technologies to improve efficiencies, the printing of books allows us to maintain a permanent hard copy record of each recorded land document on-site.”

If you would like to stay up-to-date on upcoming Registry of Deeds events, programs, and real estate information, you can sign up for our Registry email updates at www.norfolkdeeds.org, like us on Facebook at www.facebook.com/norfolkdeeds, or follow us on Twitter at www.twitter.com/norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

Monday, August 7, 2023

Increasing Strain on Limited Housing Inventory Pushes July Prices to Surge

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for July show a significant increase in average property sale prices compared to both the previous year and the previous month. This surge can likely be attributed to having limited housing inventory in a competitive market.

“Average property prices are up significantly this month, and while this may be good news for sellers and investors, it makes it increasingly difficult for first-time homebuyers and homeowners looking to move, especially with high interest rates relative to what they were in 2020 and 2021,” stated Register of Deeds William P. O'Donnell.

The average sale price of commercial and residential properties for July 2023 was $1,452,378, a 19% increase compared to July 2022 and an increase of 40% from June 2023. However, the total dollar volume of commercial and residential sales is down, decreasing 7% from last year but up 7% from last month.

“Based on prior years and trusted economic theory, we know that even when demand remains the same but the supply of an item decreases, the price will increase,” said Register O’Donnell. “Unfortunately, when prices rise without a corresponding rise in inventory, it may result in increased competition among buyers. This makes it harder for homebuyers in general but especially for first-time homebuyers who must now deal with the added cost of higher interest rates to afford homes and properties.”

Notwithstanding the increase in average property sales prices the total number of deeds for July 2023, which reflects both commercial and residential real estate sales and transfers, was 1,272, down 18% from July 2022 and decreased 26% from June.

Register O'Donnell noted, “Higher interest rates have a particular impact on first-time homebuyers, especially given that the average price for commercial and residential property is 43% higher than the value in 2021 and 74% higher than the value in 2020. Higher interest rates also affect seasoned homebuyers' eagerness to refinance and willingness to sell, which results in fewer mortgages being recorded.

For the month of July, lending activity overall continued to decline. A total of 1,258 mortgages were recorded, which is 47% less than last year and 14% less than last month.

“Overall real estate activity is on a downward trend, driven by two likely factors: limited inventory and high interest rates, which reduce the number of deeds and the number of mortgages, which make up a large portion of the total document volume at the registry,” said Register O'Donnell.

The Registry of Deeds recorded 8,620 documents in July 2023. This was 21% less than in July 2022 and 18% less than in June 2023.

Norfolk County recordings for July show a significant increase in average property sale prices

“On a positive note, for the first time this year, we are seeing a reduction in both the number of foreclosure deeds and the number of notices to foreclose compared to last year,” said Register O'Donnell.

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In July 2023, there were 5 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in July 2022, there were 9 recorded. Additionally, this month, there were 18 notices to foreclose, the first step in the foreclosure process, less than the 21 recorded in July 2022.

“There is no question that these foreclosure numbers are good news. With that said, we cannot forget that foreclosure activity has a human face associated with it, and there are still a number of our neighbors who have lost their homes, and even more are dangerously close to losing their homes,” said Register O'Donnell. “I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “We have seen some good news in regard to the decrease in foreclosure activity only to be tempered by a limited housing inventory creating an increasingly competitive market. We need to increase new home construction and housing initiatives in order to increase the supply and make homeownership more attainable.”

To learn more about these and other Registry of Deeds events and initiatives, “like” us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

Monday, July 24, 2023

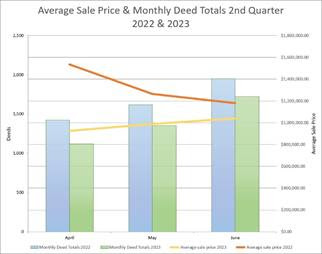

Homeownership Bar Too High, Too Few Homes Brings Decreased Sales in Second Quarter

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings for the second quarter of 2023 indicate a continued decrease in overall real estate activity impacted by interest rates along with a lack of inventory. The increased costs of carrying the purchase of a home, along with limited inventory and high real estate costs, are setting the homeownership bar too high for some individuals.

“It is not a secret, and I believe most people can feel it, that the economy is experiencing a downward trend, driven by two factors: limited inventory and high interest rates, relative to what they were in 2020, which makes finding a home difficult for homebuyers in general but especially for first-time homebuyers who must now deal with the added cost of higher interest rates,” stated Register of Deeds William P. O'Donnell.

In the second quarter of 2023 (April, May, and June), the Norfolk County Registry of Deeds recorded 27,374 documents. This was 23% less than the second quarter of 2022.

“Looking at the statistics, we can see that fewer properties are being sold. The likely factors that are contributing to this are that while new home construction has increased, it is not enough to keep up with the demand, and we need to increase the supply of new homes,” said Register O’Donnell. “The other factor is that existing homes remain off the market, possibly because individuals that want to sell may be struggling to find a suitable home to move into within their budget, and for those individuals who took advantage of lower interest rates in the past, they may be hesitant to exchange that for a higher rate.”

The total number of deeds for the second quarter of 2023, which reflects both commercial and residential real estate sales and transfers, was 4,193, down 16% from the second quarter of 2022.

“Higher interest rates affect seasoned homebuyers in terms of eagerness to refinance and willingness to sell, but first-time homebuyers are particularly impacted, especially considering average prices for commercial and residential property are 16% above 2021 values and 32% above 2020 values,” said Register O’Donnell. “This means that homebuyers in 2023 are paying higher property prices and a higher interest rate, resulting in a monthly mortgage payment that may not be economically feasible, particularly for first-time homebuyers who may not have the financial resources to overcome this obstacle.”

The average sale price for the second quarter of this year was $996,394, a 23% decrease compared to the second quarter of 2022. The total dollar volume of commercial and residential sales is down, decreasing 42% over the same period in 2022.

For the months of April, May, and June, lending activity overall continued to decline. During these months, a total of 4,084 mortgages were recorded, which is 40% less than the same period last year.

“Those who took advantage of the lower interest rates in 2020 and 2021 are also less likely to refinance at current rates, and with property sales going down, this results in a more pronounced decline in the number of mortgages recorded,” said Register O’Donnell. “For individuals who are struggling to keep up with payments now, refinancing at a higher interest rate is not going to help, which is one factor contributing to the increase in notices to foreclose and foreclosure deeds.”

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In the second quarter of 2023, there were 26 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in the second quarter of 2022, there were 16 recorded. Additionally, there were 86 notices to foreclose, the first step in the foreclosure process, significantly more than the 66 recorded in 2022’s second quarter.

“We cannot begin to know all the causes that have contributed to these foreclosures and notices to foreclose, but what we do know is that a number of our neighbors have lost their homes, and even more are dangerously close to losing their homes,” said Register O'Donnell. “We all experience unforeseen events in our lives, and sometimes events beyond our control can have devastating emotional and financial effects, so I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “Overall, the housing market has slowed, especially compared to 2022's busy home sale market, but remains relatively stable. While there may be fluctuations in certain areas and in the country as a whole, the demand to live in and own property in Norfolk County remains high, and the housing market in Norfolk County has shown resilience and continues to provide opportunities for both buyers and sellers.”

To learn more about these and other Registry of Deeds events and initiatives, “like” us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

|

| Homeownership Bar Too High, Too Few Homes Brings Decreased Sales in Second Quarter |

Monday, July 17, 2023

Register O’Donnell Appeared as Guest Speaker at Norwood Council on Aging

Norfolk County Register of Deeds William P. O'Donnell appeared as a guest speaker at the Norwood Council on Aging building June 12, as part of his ongoing efforts to bring the Registry of Deeds directly to the residents of Norfolk County.

"We appreciate that the register was able to come and speak about homestead protection and deed scams, it’s important that seniors and the public stay informed," said Nanci Kelleher, Program Director for the Norwood Senior Center. "I wish more people knew about this information, especially now that there are scams out there taking advantage of people."

Register O’Donnell gave an overview of the Registry of Deeds, which is the principal office for real property records in Norfolk County, cataloging and housing more than 10 million land documents dating back to 1793.

"I welcome any time I can get out into the community and have the opportunity to speak with people about some issues that homeowners might face," said Register of Deeds William P. O'Donnell. "It is especially meaningful, having grown up in Norwood, to come and speak at the Norwood Senior Center and provide valuable information to our seniors who may be vulnerable to scams and frauds."

Register O’Donnell spent time warning those attending the event about an ongoing deed scam that is being perpetrated against all citizens of Norfolk County, young and old. Norfolk County residents continue to receive direct-mail solicitations offering them a certified copy of their property deed for exorbitant fees. The average price for a mailed homeowner’s certified deed by the Registry, usually two pages, is $3.00.

Register O’Donnell Appeared as Guest Speaker at Norwood Council on Aging

"Don’t fall victim to this deed scam. These companies are making outrageous profits. If a consumer knew that the Registry of Deeds would provide them a certified copy of a property deed for a charge of only $1.00 per page, plus an additional $1.00 for postage, they would never agree to pay these companies such an outrageous fee for service," stated Register O'Donnell.

Register O’Donnell discussed the advantages of the Massachusetts Homestead Act. The Homestead Act is an important consumer protection tool for homeowners, as it provides limited protection against the forced sale of an individual’s primary residence to satisfy unsecured debt up to $500,000.

"Homeowners can have peace of mind knowing that with a Declaration of Homestead recorded at the Registry of Deeds, their primary residence cannot be forcibly sold to satisfy most debts. This is especially important when you consider that for most of us, a home is our most valuable asset," said O’Donnell.

The Register also reminded attendees about the importance of filing a mortgage discharge after their mortgage has been paid off. A discharge is a document (typically one or two pages) issued by the lender, usually with a title such as "Discharge of Mortgage" or "Satisfaction of Mortgage".

"When a mortgage has been paid off, a mortgage discharge document needs to be recorded with the Registry of Deeds to clear a homeowner’s property title relative to that loan," said O’Donnell.

The Register elaborated on mortgage discharges for the attendees, who seemed particularly interested in the topic.

"In some cases," noted O’Donnell, "discharges are filed directly by banks or settlement closing attorneys with the Registry as part of a property sale or as a result of a refinancing transaction. In other instances, the mortgage discharge is sent to the property owner, who then becomes responsible for making sure the document is recorded. Whether or not a discharge is recorded by the lending institution or the individual property owner, it is important that the property owner makes sure all necessary documents have been recorded at the Registry of Deeds."

Concluding his remarks, O’Donnell stated, "I first want to thank those who attended the event. They asked great questions, and their attendance was greatly appreciated. I also want to thank Kerri McCarthy, [Executive Director] for inviting me to speak, Nanci Kelleher, [Program Director] for helping coordinate the event, the members of the Norwood Council on Aging board, and all the staff who do an outstanding job advocating for and serving the seniors of Norwood."

If you would like to stay up-to-date on upcoming Registry of Deeds events, programs, and real estate information, you can sign up for our Registry email updates at www.norfolkdeeds.org, like us on Facebook at www.facebook.com/norfolkdeeds, or follow us on Twitter at www.twitter.com/norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

Thursday, July 13, 2023

Register O’Donnell Guest Speaker at the Hyde Park Historical Society - July 20 at 6 PM

Monday, June 26, 2023

Good Deeds: Getting Laws Passed and You

In my tenure as Norfolk Register of Deeds, I have gotten to experience firsthand the making of laws. Laws govern our daily lives and have significant impacts. Not that long ago, the Homestead Protection for your home was $300,000.00. The legislative process here in Massachusetts increased the Homestead Protection you can put on your home to $500,000.00. This change in a law benefited each of you as a consumer who owns a house or condominium as your principal residence.

A Mortgage Discharge Bill was passed into law, giving you, as real estate borrowers, assistance in getting your mortgage discharge document. This is impactful, as a mortgage discharge once recorded at the Registry of Deeds tells the world that your loan has been paid off. The Community Preservation Act, which so many of our local communities have implemented, started as an idea in a bill that later became state law here in Massachusetts.

How do bills become laws?

A bill becomes a law once it has been passed by the State Legislature and signed by the Governor. Once a bill is introduced in either the State House of Representatives or the State Senate, it goes through a series of committee hearings before it is voted on. Members of the committee can ask questions, suggest changes, and vote on whether or not the bill should be sent to the full House or Senate for consideration.

Understanding the legislative process can empower you to engage in advocacy and allow you to see how your elected officials are or are not working on issues that matter to you. Committee hearings are an essential part of the legislative process, as they provide an opportunity for lawmakers to fully understand the potential impact of a bill and make informed decisions.

As Register of Deeds I was very involved in getting a law passed that paved the way for registered land documents to be remotely submitted electronically via the internet for recording at the Registry of Deeds. On January 11, 2017, a filed bill, House Bill 3862, An Act Modernizing the Registries of Deeds, became Chapter 404 of the Acts of 2016. What went into the passing of this law?

A draft of the legislation, accompanied by a fact sheet, was sent to each one of the 200 members of the State Legislature. Calls and emails were made in order to get this bill passed into law. When the bill had its hearing before the Joint Committee on Judiciary, I along with other Registers appeared before the committee to provide testimony.

The effect of this bill was to pave the way for electronic recording of Land Court documents. What is now seen as commonplace today only came about because House Bill 3862 received a favorable vote from the Judiciary Committee. Once this favorable vote occurred, the bill is sent to the House Committee on Ways and Means which reviews every bill for its fiscal impact. From there this piece of legislation, like all bills that become law, went to the House Committee on Bills in the Third Reading for their legal review and approval.

House Bill 3862 once receiving approval from all these committees, went to the full floor of the State House of Representatives, where it received a favorable vote. In the State Senate, a similar process occurred, with the legislation getting favorable reviews and votes from that branch's Ways and Means as well as Third Reading Committees before hitting the Senate Floor for a favorable vote.

After clearing both chambers, the legislation was sent to the Governor's Office, where the executive staff did their own fiscal and legal analysis. The Governor signed this bill into law becoming effective 90 days later. On that day, the Norfolk County Registry of Deeds became the first Registry of Deeds in Massachusetts to record a land court/ registered land document electronically.

For the current legislative session, a notable piece of legislation is an Act to Increase Transparency in the Massachusetts Land Record Systems to Protect the Property Rights of Homeowners and Businesses. Senator Michael D. Brady filed legislation in the Massachusetts State Senate, which was given Senate Docket # 194 and referred to the Joint Judiciary Committee as Senate Bill #908 while in the State House of Representatives, Representative Gerard Cassidy filed legislation that was given House Docket #2461 and referred to the Joint Judiciary Committee as House Bill #1411.

If enacted, this legislation will eliminate the possibility that a homeowner may not know who the holder of their mortgage is because a mortgage assignment was not recorded at the Registry of Deeds. This legislation would make assignments of residential mortgages more transparent for the consumer. You, as a borrower, could just look up this information from your home computer via the internet on the Registry's land records website at www.norfolkdeeds.org or call the Norfolk Registry's Customer Service Center.

Also up for consideration is a bill requiring automatic external defibrillators in Norfolk County public buildings. Representative Denise Garlick filed legislation in the Massachusetts House of Representatives. This bill was given House Docket #1842 and referred to the Joint Committee on Municipalities and Regional Government as House Bill #2051.

I was very proud back in 2010 to install and maintain automatic external defibrillators (AED) on all three floors of the Norfolk County Registry of Deeds building. The Registry of Deeds also pays for the training of staff on the AED, which is a lightweight portable device that delivers an electric shock through the chest to the heart. The American Red Cross states that there are better survival rates and outcomes if an AED is used on a person experiencing sudden cardiac arrest in a timely manner. The American Red Cross has estimated that some 50,000 lives could be saved with improved training and access to an AED. Representative Denise Garlick wants to use Norfolk County as a pilot program. The more locations for the AED, increases all our chances for a better health result. The difference between life and death may be the availability of a functioning AED unit.

You have learned about the law-making process. You have read about bills that have become laws and some bills that are being considered to become law. Maybe some issues or matters you feel strongly about can be put into place by passing a law, as we are a society as well as a government of laws.

|

| Good Deeds: Getting Laws Passed and You |

Monday, June 19, 2023

Register O'Donnell’s “Suits for Success” Program Donates to Boston’s St. Francis House

Norfolk County Register of Deeds William P. O’Donnell donated two car loads of smart casual clothing and business attire totaling more than 150 articles of clothing to St. Francis House in Boston through the "Suits for Success" program, May 16.

The often-taken-for-granted suit or dress clothes hidden away in the back closet and only occasionally seeing the light of day may seem to some like an unfortunate necessity. However, for those looking to regain self-sufficiency, quality clothing can be that extra push they need and help them on the path to success.

"These clothes will be put to good use and appreciated by the thousands who come to St. Francis House each year for a fresh pair of clothes in times of need," said Keri Thomas, St. Francis House Vice President of Programs and Services. "It is so valuable and necessary in getting individuals ready for the next step and help them to become more independent."

St. Francis House’s mission is to rebuild lives by providing refuge and pathways to stability for adults experiencing homelessness and poverty. They aim to transform lives using a holistic approach to understanding and addressing behavioral health, housing, and employment needs.

Register O’Donnell remarked, "We’re happy to assist St. Francis House. I thank all those who donated to our ‘Suits for Success’ program, and I hope other local residents and businesses will consider making a clothing donation. The program is truly needed, and it’s a great resource for the community."

St. Francis House has been aiding the community since 1984. They provide a range of services, including clinical care, behavioral health services, and job counseling. They also offer food, clothing, and affordable and low-threshold housing to those in need.

"Donations like this help ensure the physical and emotional safety of our guests and assist in the process of changing the trajectory of their lives and moving beyond homelessness," said Thomas. "It offers choices to people who have had total control of their lives taken away, and this is the final touch that can help individuals land a job and help them on their path to becoming self-sufficient.

Since the Registry started the "Suits for Success" program in February 2009, it has collected more than 10,000 articles of clothing.

The "Suits for Success" program, developed by Register O’Donnell, partners with groups like Interfaith Social Services of Quincy, Father Bill’s & MainSpring of Quincy, the Veterans Affairs Boston Healthcare System Voluntary Service Program, Circle of Hope in Needham, United Parish’s Thrifty Threads, St. Francis House in Boston, Suits and Smiles in Jamaica Plain, and InnerCity Weightlifting on our ‘Suits for Success’ program to assist those who are in need of clothing as well as household items. The mission of "Suits for Success" is to collect donations of suitable clothing to be distributed to individuals who may need appropriate attire for employment interviews.

"During the past decade, we have learned that programs like ‘Suits for Success’ work," said O’Donnell. "This program has given many people a valuable resource to help them on the path to success and may ultimately help them achieve self-sufficiency. It is rewarding just to help others in our community who are less fortunate.”

If you would like to stay up-to-date on upcoming Registry of Deeds events, programs, and real estate information, you can sign up for our Registry email updates at www.norfolkdeeds.org, like us on Facebook at www.facebook.com/norfolkdeeds, or follow us on Twitter at www.twitter.com/norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry’s website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.

Register O'Donnell’s “Suits for Success” Program Donates to Boston’s St. Francis House

Monday, June 12, 2023

Register O’Donnell Reports on May 2023 Real Estate Activity in Norfolk County

Monday, June 5, 2023

Register O'Donnell Reports on Increasing Number of Foreclosures, Promotes Assistance Programs

A statistical review of the past five months shows an increase in foreclosures, particularly notice to foreclose mortgage filings, the first step in the process. Over this time period, a total of 33 foreclosure deeds and 161 notices to foreclose were recorded. February saw the most notices to foreclose with 43 in one month.

"Higher home prices, mortgage interest rates above 6%, and an increased cost of living are all factors that could be contributing to the increase in the number of foreclosures and notices to foreclose we are seeing recorded at the Registry." Register O'Donnell continued, "With that said, we realize that while Norfolk County is a destination location to both live and work, but there are still some of our neighbors facing economic hardships."

To help those facing issues paying their mortgage, the Registry of Deeds has partnered with upstanding non-profit agencies by promoting their services when it comes to mortgage modification and foreclosure programs.

NeighborWorks Housing Solutions (NHS) offers a multitude of services with the aim of helping homeowners maintain safe, affordable, high-quality housing and grow their financial skills. NHS' services include rental assistance, emergency financial help, shelter and homelessness prevention, first-time homebuyer education and counseling, financial coaching, foreclosure prevention, affordable residential and small business loans, and the construction and management of high-quality rental housing across Southern Massachusetts.

Since 1965, Quincy Community Action (QCAP) has been providing anti-poverty services in the Greater Quincy region. This includes basic needs such as food and nutrition, fuel assistance, affordable housing, quality early education and care, adult education and workforce development, and financial education. QCAP helps more than 100 communities, and more than 28,000 individuals benefit from QCAP services annually.

Homeowners can contact Quincy Community Action Programs at (617) 479-8181 x-376 or NeighborWorks Housing Solutions at (508) 587-0950 x-46. Another option available is to contact the Massachusetts Attorney General's Consumer Advocacy and Response Division (CARD) at (617) 727-8400.

"All of these agencies provide a range of assistance, from helping with the mortgage modification process to providing legal services to offering credit counseling," stated Register O'Donnell. "If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance."

For more information on these and other support options, go to the Registry's website at www.norfolkdeeds.org, click on the Support tab, and then click on the subtab that mentions Foreclosure Assistance.

"Counselors can help homeowners understand their mortgage terms, negotiate with their lender, and develop a plan to avoid foreclosure. There are legitimate resources available to help homeowners in distress, but it is important to be cautious and do your research before trusting any company promising quick solutions," said Register O'Donnell.

Register O'Donnell also warned homeowners against falling prey to for-profit companies that offer loan modification and credit counseling services but charge an exorbitant fee.

"Unfortunately, foreclosure rescues and mortgage modification relief are becoming a growing scam. In some cases, unscrupulous for-profit foreclosure relief and mortgage modification companies are preying on vulnerable homeowners," noted O'Donnell. "They make unrealistic promises and charge a lot of money for doing so. If one of these companies is telling you something that is too good to be true, it probably is. Please check out any for-profit foreclosure relief and mortgage modification company before entering into a contract with them."

To avoid falling prey to for-profit companies that offer loan modification and credit counseling services but charge an exorbitant fee, residents can check the Better Business Bureau or consumer protection websites to see if there are any complaints against the company.

Register O'Donnell concluded, "The Registry is proud of its commitment to helping those facing a mortgage delinquency or foreclosure by directing them to the appropriate agency that can hopefully put them back on the road to financial recovery. I urge people who feel that they need such services to contact the agencies referenced above."

To learn more about these and other Registry of Deeds events and initiatives, "like" us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.

|

| Register O'Donnell Reports on Increasing Number of Foreclosures, Promotes Assistance Programs |