Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Saturday, June 14, 2025

Property Insurance Costs Can be High in Every U.S. Region

Tuesday, April 1, 2025

Register O’Donnell Promotes Mortgage Assignment Legislation

With April being designated National Fair Housing Month, Norfolk County Register of Deeds William P. O’Donnell today reaffirmed his support for Senate Bill 1030, an Act to increase transparency in the Massachusetts land record systems to protect the property rights of homeowners and businesses.

SB1030 was filed by Senator Michael D. Brady of Brockton on January 7, 2025, in the Massachusetts State Senate and was Referred to the Joint Committee on Judiciary.

If enacted, this legislation will eliminate the possibility that a homeowner may not know who the holder of their mortgage is because an assignment was not recorded. Currently, if homeowners are not aware who holds their mortgage, coupled with banks having gone out of business or merged, the homeowners must then contact the State’s Division of Banks and Banking in an attempt to track down who actually held the homeowner’s mortgage. This legislation would make assignments of residential mortgages more transparent for the consumer.

|

| Register O’Donnell Promotes Mortgage Assignment Legislation |

“This legislation would require that when banks transfer or assign their residential mortgages to a different lending institution then that assignment would be required to be recorded with the relevant Massachusetts Registry of Deeds office within 30 days of its execution,” noted Norfolk County Register of Deeds William P. O’Donnell.

The bill also creates a more level playing field between banks especially smaller community banks that record residential mortgage assignments and other banks that do not. It would also curtail the avoidance of paying recording fees by the lending institutions, which now results in the loss of needed revenue. This bill also implements on the Recorded Land side of the Massachusetts Registries of Deeds the procedure that takes place on the Registered Land side of Massachusetts Registries of Deeds.

Register O’Donnell stated, “I want to express my appreciation to Senator Michael D. Brady for filing this legislation. If this legislation becomes law it would help homeowners find out if their mortgage has been assigned to another party in a very timely manner. Also with this information available on-line it would be easier and more transparent for the homeowner to make sure they get this mortgage assignment information.”

The next step in the legislative process for SB1030 is for the Joint Committee on Judiciary to give the bill its initial review and recommendation. House and Senate co-sponsoring may continue until the measure is reported by the initial committee.

Register O’Donnell concluded, “It makes a great deal of sense to require residential mortgage assignments to be filed at the Registry of Deeds. After all, recording and storing land related documents for real estate transactions is something that has been done at the Norfolk County Registry of Deeds since 1793. Presently, the Registry maintains over 13.1 million land related documents.”

To learn more about these and other Registry of Deeds events and initiatives, like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and Instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@norfolkdeeds.

Monday, April 15, 2024

Washington Post: "Are you ready to buy a house? Take our quiz and find out"

"Homeownership is how many Americans accumulate wealth, and it’s an important life goal for millions. But affording a home is a growing challenge — if not out of reach entirely — for many people.In the past three years, mortgage rates have more than doubled and are now at nearly 7 percent on a typical 30-year loan. And they are unlikely to drop significantly this year. Even those who can swing an all-cash purchase, experts say, still have plenty of other expenses to consider, including maintenance and insurance.So, should you buy a home right now? To help you decide, take this quiz."

Monday, July 10, 2023

Register O'Donnell Reports on June 2023 Real Estate Activity in Norfolk County

Norfolk County Register of Deeds William P. O'Donnell reported that Norfolk County recordings for the month of June 2023 indicate a continued decrease in overall real estate activity, with significant drops in average property sale prices and the total dollar volume of commercial and residential sales

as compared to June 2022.

"As compared to last year, we are still seeing a decrease in overall real estate activity, however, this month the decrease in document volume was less pronounced than in previous months," noted Register of Deeds William P. O'Donnell. "Despite the overall decline in activity throughout the county, there are still pockets of the market here in Norfolk County that are seeing growth and stability, particularly in certain neighborhoods and property types. Additionally, while overall real estate activity is down compared to 2022, the market continues to show steady seasonal fluctuations month over month."

The Norfolk County Registry of Deeds recorded 10,552 documents in June 2023, the highest one-month total of the year so far. This was 19% less than in June 2022 but 15% more than in May 2023.

Register O'Donnell Reports on June 2023 Real Estate Activity in Norfolk County

Overall lending activity showed a continued downward trend for the month of June. A total of 1,543 mortgages were recorded this month, 33% less than a year ago at the same time, but up 8% from last month.

"So far this year, June has seen the largest monthly volume of deeds and mortgages. This month also saw some of the smallest decreases from the previous year in terms of the number of deeds, mortgages, and average sale price," noted Register O'Donnell. "This may suggest that while some homeowners are hesitant to make moves with average mortgage interest rates above 6%, others are not dissuaded by current interest rates, but time will tell if this trend continues."

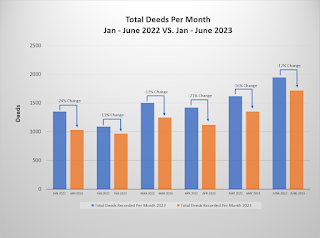

The number of deeds for June 2023, which reflect real estate sales and transfers, both commercial and residential, was 1,721, a decrease of 12% from June 2022 but an increase of 27% from the previous month of May.

"The decrease in the number of deeds is likely due to a lack of inventory of new and existing homes, which means fewer homes are listed, keeping costs above pre-pandemic prices," noted Register O'Donnell. "Higher prices also mean that some buyers may be struggling to find affordable homes within their budget, leading to a decrease in the number of potential buyers and further decreasing the number of home sales."

Sale prices for June appear to have dropped compared to June 2022. The average sale price in June was $1,039,792, a 12% decrease from June 2022, but a 5% increase from May 2023. The total dollar volume of commercial and residential sales is down, decreasing 29% from one year ago but increasing 48% from last month.

"While prices have come down from a year ago, the demand to live and own a home in the communities that make up Norfolk County remains high," said O'Donnell. "This may suggest that the decrease in dollar volume may be due to a shortage of available properties and a decline in the number of individuals with the ability to buy."

Homestead recordings by owners of homes and condominiums decreased again this month at the Norfolk Registry of Deeds. There was a 16% decrease in homestead recordings in June 2023 compared to June 2022.

"The reduction in recorded Declarations of Homestead is not too surprising where the sales of homes continue to level off, but all homeowners, not just new purchasers, should keep in mind that a recorded Declaration of Homestead provides limited protection against the forced sale of an individual's primary residence to satisfy unsecured debt up to $500,000," noted O'Donnell. "We want to see folks protecting the biggest asset most of us have, our homes. I would urge anyone who has not availed themselves of this important consumer protection tool to consider doing so.

The recording fee for a homestead is $36. Visit the Registry website at www.norfolkdeeds.org to get more information on homesteads and obtain a homestead application form.

Register O'Donnell concluded, "We are seeing some significant increases month over month in the home buying season, the period where we typically see the most home sales, and despite recent declines in the market, driven by areas in Norfolk County that are seeing growth and stability, but it remains to be seen if this momentum will continue as we move into the second half of the year."

To learn more about these and other Registry of Deeds events and initiatives, "like" us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.

Monday, June 5, 2023

Register O'Donnell Reports on Increasing Number of Foreclosures, Promotes Assistance Programs

A statistical review of the past five months shows an increase in foreclosures, particularly notice to foreclose mortgage filings, the first step in the process. Over this time period, a total of 33 foreclosure deeds and 161 notices to foreclose were recorded. February saw the most notices to foreclose with 43 in one month.

"Higher home prices, mortgage interest rates above 6%, and an increased cost of living are all factors that could be contributing to the increase in the number of foreclosures and notices to foreclose we are seeing recorded at the Registry." Register O'Donnell continued, "With that said, we realize that while Norfolk County is a destination location to both live and work, but there are still some of our neighbors facing economic hardships."

To help those facing issues paying their mortgage, the Registry of Deeds has partnered with upstanding non-profit agencies by promoting their services when it comes to mortgage modification and foreclosure programs.

NeighborWorks Housing Solutions (NHS) offers a multitude of services with the aim of helping homeowners maintain safe, affordable, high-quality housing and grow their financial skills. NHS' services include rental assistance, emergency financial help, shelter and homelessness prevention, first-time homebuyer education and counseling, financial coaching, foreclosure prevention, affordable residential and small business loans, and the construction and management of high-quality rental housing across Southern Massachusetts.

Since 1965, Quincy Community Action (QCAP) has been providing anti-poverty services in the Greater Quincy region. This includes basic needs such as food and nutrition, fuel assistance, affordable housing, quality early education and care, adult education and workforce development, and financial education. QCAP helps more than 100 communities, and more than 28,000 individuals benefit from QCAP services annually.

Homeowners can contact Quincy Community Action Programs at (617) 479-8181 x-376 or NeighborWorks Housing Solutions at (508) 587-0950 x-46. Another option available is to contact the Massachusetts Attorney General's Consumer Advocacy and Response Division (CARD) at (617) 727-8400.

"All of these agencies provide a range of assistance, from helping with the mortgage modification process to providing legal services to offering credit counseling," stated Register O'Donnell. "If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance."

For more information on these and other support options, go to the Registry's website at www.norfolkdeeds.org, click on the Support tab, and then click on the subtab that mentions Foreclosure Assistance.

"Counselors can help homeowners understand their mortgage terms, negotiate with their lender, and develop a plan to avoid foreclosure. There are legitimate resources available to help homeowners in distress, but it is important to be cautious and do your research before trusting any company promising quick solutions," said Register O'Donnell.

Register O'Donnell also warned homeowners against falling prey to for-profit companies that offer loan modification and credit counseling services but charge an exorbitant fee.

"Unfortunately, foreclosure rescues and mortgage modification relief are becoming a growing scam. In some cases, unscrupulous for-profit foreclosure relief and mortgage modification companies are preying on vulnerable homeowners," noted O'Donnell. "They make unrealistic promises and charge a lot of money for doing so. If one of these companies is telling you something that is too good to be true, it probably is. Please check out any for-profit foreclosure relief and mortgage modification company before entering into a contract with them."

To avoid falling prey to for-profit companies that offer loan modification and credit counseling services but charge an exorbitant fee, residents can check the Better Business Bureau or consumer protection websites to see if there are any complaints against the company.

Register O'Donnell concluded, "The Registry is proud of its commitment to helping those facing a mortgage delinquency or foreclosure by directing them to the appropriate agency that can hopefully put them back on the road to financial recovery. I urge people who feel that they need such services to contact the agencies referenced above."

To learn more about these and other Registry of Deeds events and initiatives, "like" us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.

|

| Register O'Donnell Reports on Increasing Number of Foreclosures, Promotes Assistance Programs |

Tuesday, June 7, 2022

Challenged to bring food home, or to meet your mortgage payment, there is help

Food Pantry's can help

"Nearly a third of Massachusetts adults are struggling to get enough to eat as the economic pressures of the COVID-19 pandemic continue to batter household budgets.At least 1.8 million people — or 32 percent of the state’s adult population — are food-insecure, a new survey from the Greater Boston Food Bank found. The burden lies most heavily on Black and Latinx communities and families with children.It’s “a frightening statistic,” said GBFB CEO Catherine D’Amato. “We’ve worked with much better numbers in years past.”

As day-to-day administrators & marketers of MA's Homeowner Assistance Fund, MHP & know spreading the word is key to helping people who need mortgage help due to #COVID-19. The wrote about #MassHAF.

Please share. https://bit.ly/3tcXT04 #housingassistance

|

| meet your mortgage payment, there is help |

Shared from Twitter -> https://twitter.com/mhphousing/status/1533780993726943234

Monday, June 14, 2021

Register O’Donnell Reminds Homeowners of Need to File Mortgage Discharges with this Increased Real Estate Activity

Given this huge increase in mortgage activity Register of Deeds William P. O’Donnell advises Norfolk County homeowners about the need to file a mortgage discharge after their mortgage has been paid off.

Register O’Donnell stated, “As consumers we all need to borrow money. There are many reasons why consumers borrow money- to purchase a house, to make home improvements or to help pay for ever increasing tuition payments of our children. The borrowing of money involving real estate leads to a mortgage being recorded against the title of that real estate.”

Register O’Donnell stated, “When a mortgage has been paid off, a mortgage discharge document needs to be recorded with the Registry of Deeds to clear a homeowner’s property title relative to that loan. This is particularly important in light of the thousands of homeowners who have been taking advantage of historically low interest rates to refinance their mortgages. It should be noted a discharge is a document (typically one-two pages) issued by the lender, usually with a title such as “Discharge of Mortgage” or “Satisfaction of Mortgage”. During this busy period of refinancing your old mortgages are being paid off. As a consumer you want to make sure a discharge has been recorded at the Registry of Deeds which tells the world that that mortgage has been paid off.”

“In some instances,” noted the Register, “mortgage discharges are filed directly by banks or settlement closing attorneys with the Registry as part of a property sale or as a result of a refinancing transaction. In other cases, the mortgage discharge is sent to the property owner who then becomes responsible for making sure the document is recorded. Whether or not the mortgage discharge is recorded by the lending institution or the individual property owner, it is imperative that the property owner makes sure all necessary documents have been recorded at the Registry of Deeds.”

“If you are looking to check your title and make sure all your mortgages have been properly discharged, Norfolk County homeowners can access the Registry’s online records at www.norfolkdeeds.org. By going to the Online Research section of our website, you can verify that all mortgages associated with the property have been discharged. Please remember not having a mortgage discharged will result in a title issue and thereby impact the process of selling one’s home,” noted O’Donnell.

The Register further noted that there have been cases where no discharge has been recorded against a long paid off mortgage. “Unfortunately, some of the lending institutions that provided funds for these mortgages are no longer in existence. In other cases, financial entities have merged with another lending institution.”

If a property owner needs to retrieve an original discharge of a mortgage and is unclear which lending institution is now responsible for providing the document, an option is to contact the Massachusetts Division of Banks at 1-800-495-2265 x-1 and then x-61501. Another option is to access the Federal Deposit Insurance Corporation website www.fdic.gov. Then find the BankFind tab approximately half way down the home page, put in the lending institution in question, then click on the lending institution link and you will be able to determine who has responsibility for the mortgage.

When recording a mortgage discharge, the original document is required. The Registry of Deeds by law cannot accept photo copies or faxed copies of documents. The filing fee, set by state statute, is $106.00.

In conclusion, Register O’Donnell stated, “After paying off all the mortgages on their property, homeowners want to know they have clear title to their property, especially if they are contemplating selling. Knowing what steps need to be taken to ensure all paid off mortgages have been properly discharged will go a long way in giving the homeowner assurances that they have clear title to their property. I cannot emphasize enough how important it is that homeowners make sure their mortgage discharge has been filed with the Registry of Deeds once their mortgage has been paid off.”

The Norfolk County Registry of Deeds is staffed with a team of customer service representatives who can be reached Monday through Friday, 8:30AM-4:30PM at 781-461-6101. These representatives have been trained in researching documents and are well versed on the subject of mortgage discharges and what, if necessary, needs to be done to clear title to a property.

To learn more about these and other Registry of Deeds events and initiatives like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@norfolkdeeds.org.

Monday, December 21, 2020

Register O’Donnell Discusses Need for Mortgage Transparency

At the beginning of 2019, Register O’Donnell had two bills filed, H.1413 and S.960, which stated that when banks sold their residential mortgages to a different lending institution, that transaction, or assignment, would be required to be recorded with the relevant Massachusetts Registry of Deeds office within 30 days of its execution.

“During the most recent legislative session,” noted O’Donnell, “both H.1413 and S.960 wound their way through the legislative process. After both pieces of legislation were filed with the Massachusetts House and Senate Clerks offices by lead sponsors Rep. William Galvin (D-Canton) and Sen. John Keenan (D-Quincy) respectively and given a docket number, dozens of other state representatives and senators signed up as co-sponsors. The clerks offices then gave each piece of legislation a bill number (H. 1413 and S.960). Then each bill was assigned to the Joint Committee on the Judiciary for further consideration. A public hearing on the legislation was then held where I provided arguments for supporting the legislation. The joint committee on the Judiciary reported the legislation favorably in early 2020. On February 13, 2020, H.1413, accompanied by S. 960, was ordered to a third reading by the Massachusetts House. Unfortunately, no further action has taken place on the legislation. Certainly, the members of the legislature have been dealing with many pressing matters including COVID-19 and the fiscal year 2021 State Budget.”

The Register further stated, “My specific arguments for supporting the mortgage transparency legislation included the fact the legislation would eliminate the possibility that a homeowner may not know who the holder of their mortgage is because an assignment was not recorded. Because some banks have gone out of business in previous years or merged with another lending institution, homeowners are in some instances forced to consult with the Federal Deposit Insurance Corporation website or the Massachusetts Division of Banks to determine who holds their mortgage. The legislation would make assignments of residential mortgages more transparent to the consumer.”

Another argument for the bill’s passage was that it created a more level playing field between smaller community banks and larger lending institutions. The smaller community banks tend to hold their mortgages while many larger nationwide banks are not diligent in recording their mortgage assignments.

The need for this legislation hit home recently when the Boston Globe published an article by Sean P. Murphy on December 8, 2020 which highlighted the difficulties that can result when an assignment is not recorded. O’Donnell stated, “The article spoke about a couple who had found a home in Worcester which needed work. To finance the purchase and remodeling costs, the couple wanted to sell their condo in Easton. However, a title problem developed with the Easton condo due to a mortgage assignment not being properly recorded. Because the assignment was not recorded at the Registry of Deeds, the lending institution who was the current holder of the mortgage lacked the legal authority to discharge the mortgage. A process that should have taken a few days took several weeks as two large lending institutions could not get their act together and solve the title problem by filing the assignment. After several weeks of back and forth the problem was resolved and the assignment was recorded, but only after the intervention of the Boston Globe.”

“The assignment legislation that has been filed would have eliminated this problem as an assignment would have been required to be recorded 30 days after the mortgage was transferred, or sold, to another lending institution,” stated O’Donnell.

In conclusion, Register O’Donnell noted, “With the legislative session winding down, it is unlikely the legislation, H.1413 and S.960 will advance further. However, I am not giving up the fight to help Massachusetts homeowners. I will once again be filing mortgage transparency legislation in the upcoming 2021-2022 legislative session. I am hopeful our arguments will be persuasive and after years of trying, the legislation will wind its way through the legislative process and onto Governor Baker’s desk for his signature.”

To learn more about these and other Registry of Deeds events and initiatives, like us at Facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and/or Instagram.com/NorfolkDeeds.

|

| Register O’Donnell Discusses Need for Mortgage Transparency |

Monday, September 28, 2020

Register O’Donnell Discusses How to Record a Land Document

Norfolk County Register of Deeds William P. O’Donnell today reminded residents that even in the midst of the COVID-19 pandemic, the Registry process to record land documents is designed to make it as easy and seamless as possible. “Whether the document in question is a deed, mortgage, homestead, mortgage discharge or any other type of land document, Registry staff have been trained to record the documents in as expeditious and accurate a manner as possible,” noted O’Donnell.

Register O’Donnell further noted, “As the depository of over 8 million land documents, there are certain basic steps that need to be followed when submitting a land document for recording. First and foremost, the document needs to be associated with one of the twenty-eight communities comprising Norfolk County. In addition, the document must be an original; we will not record photo copies or documents submitted via fax. Please note in many cases, land documents require signatures be notarized before they are recorded.”

“It should also be noted that the Registry does not draft land documents. The Registry of Deeds is in the business of recording land documents only. If an individual is unsure if a drafted land document, particularly a deed, is in proper order, it may be prudent to have a lawyer familiar with real estate law review the document for its accuracy. A simple mistake on a deed for example could lead to a major problem.”

Another important point to note is that there are various fees set by the Commonwealth of Massachusetts associated with the recording of land documents at the Registry. Recording fees vary depending on the specific land document type. The Registry’s website, www.norfolkdeeds.org has a fee schedule that can be consulted for specific recording fee amounts. The Registry accepts checks made out to the Norfolk County Registry of Deeds. The Registry also accepts cash payment.

“Once you have a land document ready for recording and know the fee and type of payment,” stated O’Donnell, “you can then choose how to actually get the document delivered to the Norfolk County Registry of Deeds. Due to the COVID-19 pandemic, the Registry of Deeds building is currently closed to all members of the general public and real estate professionals alike. The options to get an original document and payment to the Registry of Deeds for recording are via regular mail, Federal Express, or placing the document and payment in a drop-off box located just outside the main entrance to our building located at 649 High Street, Dedham, MA.”

’Donnell concluded by stating, “Our trained recording staff is more than happy to record your land documents. Land documents are recorded in an expeditious manner once they arrive here at the Registry. It should also be noted that institutional users such as lending institutions and law firms have the additional option to submit documents electronically via our two e-file vendors, Simplifile and ePN. Finally, if you have any questions about land documents in general, please call our Customer Service Center at 781-461-6101, Monday through Friday between the hours of 8:30AM-4:30PM.”

To learn more about these and other Registry of Deeds events and initiatives like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@norfolkdeeds.org.

|

| Register O’Donnell Discusses How to Record a Land Document |

Monday, July 27, 2020

Register O’Donnell Advises Homeowners of Need to File Mortgage Discharges

The Register stated, “When a mortgage has been paid off, a mortgage discharge document needs to be recorded with the Registry of Deeds to clear a homeowner’s property title relative to that loan. This is particularly important in light of the many homeowners currently taking advantage of historically low interest rates to refinance their mortgages. Please note a discharge is a document (typically one-two pages) issued by the lender, usually with a title such as “Discharge of Mortgage” or “Satisfaction of Mortgage.”

“There are instances,” noted the Register, “where discharges are filed directly by banks or settlement closing attorneys with the Registry as part of a property sale or as a result of a refinancing transaction. In other cases, the mortgage discharge is sent to the property owner who then becomes responsible for making sure the document is recorded. Whether or not a discharge is recorded by the lending institution or the individual property owner, it is important that the property owner makes sure all necessary documents have been recorded at the Registry of Deeds.”

“To check on their title,” noted O’Donnell, “Norfolk County homeowners can access the Registry’s online records at www.norfolkdeeds.org and verify if all mortgages associated with the property have been discharged. Please remember not having a mortgage discharged will result in a title issue and thereby impact the process of selling one’s home.”

The Register further noted that there have been cases where no discharge has been recorded against a long paid off mortgage. “Unfortunately, some of the lending institutions that provided funds for these mortgages are no longer in existence. In other cases, financial entities have merged with another lending institution.”

If a property owner needs to retrieve an original discharge of a mortgage and is unclear which lending institution is now responsible for providing the document, an option is to contact the Massachusetts Division of Banks at 1-800-495-2265 x-1 and then x-61501. Another option is to access the Federal Deposit Insurance Corporation website www.fdic.gov. Then find the BankFind tab approximately half way down the home page, put in the lending institution in question, then click on the lending institution link and you will be able to determine who has responsibility for the mortgage.

When recording a discharge, the original document is required. The Registry of Deeds does not accept photo copies or faxed copies of documents. The filing fee, set by state statute, is $106.00.

In conclusion, Register O’Donnell stated, “After paying off all the mortgages on their property, homeowners want to have peace of mind that they have clear title to their property, especially if they are contemplating selling. Being on top of what is required will go a long way in giving the homeowner assurances that they have clear title to their property. I strongly urge homeowners to make sure their mortgage discharge has been filed with the Registry of Deeds once their mortgage has been paid off.”

The Norfolk County Registry of Deeds is staffed with a team of customer service representatives who can be reached Monday through Friday, 8:30 AM - 4:30 PM at 781-461-6101. These representatives have been trained in researching documents and are well versed on the subject of mortgage discharges and what, if necessary, needs to be done to clear title to a property.

To learn more about these and other Registry of Deeds events and initiatives like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@norfolkdeeds.org.

|

| Register O’Donnell Advises Homeowners of Need to File Mortgage Discharges |

Monday, February 24, 2020

Register O’Donnell Provides Update on Mortgage Transparency Legislation

“The impact of this legislation,” noted the Register, “guarantees that a homeowner would know when a third party has been assigned their residential mortgage (usually sold by one financial institution to another), since the legislation requires the mortgage assignment to be recorded at the appropriate Registry of Deeds office within 30 days of the transaction.”

Additionally, consumers looking to record a mortgage discharge and those facing foreclosure would benefit as the legislation provides a permanent source of reference for the homeowner. They could even view the transaction online via the relevant Registry of Deeds website. Register O’Donnell has been a strong supporter of the legislation and has twice testified on its merits before the legislature’s Joint Committee on the Judiciary.

“This legislation levels the playing field as it requires the larger lending institutions who in the past have not recorded assignments to do so just as the smaller local community banks have been doing all along,” noted O’Donnell.

“I am hopeful the House Committee on Bills in the Third Reading will report the legislation favorably to the floor of the House of Representatives for consideration. This legislation benefits homeowners across Massachusetts, since it will eliminate uncertainty as to which lending institution is the mortgage holder of record,” concluded Register O’Donnell.

To learn more about these and other Registry of Deeds events and initiatives, like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and Instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@norfolkdeeds.org.

|

| Register O’Donnell Provides Update on Mortgage Transparency Legislation |