|

| Boston Globe: "Mass. municipalities & school districts hit hard by rising health insurance costs" |

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Tuesday, January 6, 2026

Boston Globe: "Mass. municipalities & school districts hit hard by rising health insurance costs"

Sunday, November 16, 2025

Agenda for Town Council meeting Weds, Nov 19 at 6 PM

a. This meeting is being recorded by Franklin TV and shown on Comcast channel 9 and Verizon Channel 29. This meeting may be recorded by others.b. Chair to identify members participating remotely.c. Upcoming Town Sponsored Community Events.

a. Citizens are welcome to express their views for up to three minutes on a matter that is not on the agenda. In compliance with G.L. Chapter 30A, Section 20 et seq, the Open Meeting Law, the Council cannot engage in a dialogue or comment on a matter raised during Citizen Comments. The Council may ask the Town Administrator to review the matter. Nothing herein shall prevent the Town Administrator from correcting a misstatement of fact.

a. Cultural Council - Elizabeth O’Day https://ma-franklin.civicplus.com/DocumentCenter/View/7637/5a---APPOINTMENT---ODayb. Finance Committee - Jennifer D’Angelo https://ma-franklin.civicplus.com/DocumentCenter/View/7638/5b---1---APPOINTMENTS---DAngeloc. Historical Commission - Brandon Carrico https://ma-franklin.civicplus.com/DocumentCenter/View/7639/5c---1---APPOINTMENTS---Carrico

a. Resolution 25-71: Adoption of MGL Chapter 32B, Section 21-23 For the Purpose of Town’s Participating in the Group Insurance Commission(Motion to Approve Resolution 25-71 - Majority Vote) https://ma-franklin.civicplus.com/DocumentCenter/View/7640/9a-GIC

b. Resolution 25-72: General Fund Appropriation Reductions FY26(Motion to Approve Resolution 25-72 - Majority Vote) https://ma-franklin.civicplus.com/DocumentCenter/View/7646/9b-Budget-Adjustment

c. Resolution 25-73: Franklin Town Council’s Withdrawal of Support of Proposed Chapter 40B Affordable Housing Project Located at 444 East Central Street (Motion to Approve Resolution 25-73 - Majority Vote) https://ma-franklin.civicplus.com/DocumentCenter/View/7647/9c-1---MEMO-25-73---Repeal-of-444-E-Central-St

d. Resolution 25-74: 2026 Schedule of Town Council Meetings(Motion to Approve Resolution 25-74 - Majority Vote) https://ma-franklin.civicplus.com/DocumentCenter/View/7648/9d-TC-Meeting-Schedule

e. Resolution 25-75: Gift Acceptance - Fire Department ($1,000), Veterans Services Department ($1,175) (Motion to Approve Resolution 25-75 - Majority Vote) https://ma-franklin.civicplus.com/DocumentCenter/View/7649/9e-Gift-Acceptance

a. Exemption #3: Collective Bargaining (Police Patrol) - To discuss strategy with respect to collective bargaining if an open meeting may have a detrimental effect on the bargaining position of the public body and the Chair so declares.

- Two-Thirds Vote: requires 6 votes

- Majority Vote: requires majority of members present and voting

Saturday, June 14, 2025

Property Insurance Costs Can be High in Every U.S. Region

Thursday, June 12, 2025

We talk with Chris & Winslow to get an introduction to Fyzical Therapy & Balance Centers (audio)

FM #1465 = This is the Franklin Matters radio show, number 1465 in the series.

This session of the radio show shares my conversation with Chris Correnti and Winslow Woodacre. We had our conversation in the newly renovated Fyzical Balance Therapy building on Main St in downtown Franklin on Monday, June 9, 2025.

Our conversation provides an introduction to Chris, Winslow, and the new physical and balance therapy services they can provide to the community.

Discussion items:

How they got located here in Franklin

Services provided

Free balance analysis

Intake process to confirm insurance coverage

The conversation runs about 30 minutes so let’s listen

Audio link -> https://franklin-ma-matters.captivate.fm/episode/fm-1465-intro-to-fyzical-06-09-25/--------------

Fyzical Therapy & Balance Center's webpage https://www.fyzical.com/franklin-main-street-ma

|

| Talking with Chris & Winslow to get an introduction to Fyzical Therapy & Balance Centers (audio) |

Staff page (Winslow’s info) -> https://www.fyzical.com/franklin-main-street-ma/About/Staff

Contact form, or stop by during open hours -> https://www.fyzical.com/franklin-main-street-ma/Contact

--------------

We are now producing this in collaboration with Franklin.TV and Franklin Public Radio (wfpr.fm) or 102.9 on the Franklin area radio dial.

This podcast is my public service effort for Franklin but we can't do it alone. We can always use your help.

How can you help?

If you can use the information that you find here, please tell your friends and neighbors

-

If you don't like something here, please let me know

And if you have interest in reporting on meetings or events, please reach. We’ll share and show you what and how we do what we do

Through this feedback loop we can continue to make improvements. I thank you for listening.

For additional information, please visit Franklinmatters.org/ or www.franklin.news/

If you have questions or comments you can reach me directly at shersteve @ gmail dot com

The music for the intro and exit was provided by Michael Clark and the group "East of Shirley". The piece is titled "Ernesto, manana" c. Michael Clark & Tintype Tunes, 2008 and used with their permission.

I hope you enjoy!

------------------

You can also subscribe and listen to Franklin Matters audio on iTunes or your favorite podcast app; search in "podcasts" for "Franklin Matters"

Tuesday, March 4, 2025

My Ombudsman Hosts In-Person Office Hours at Chris’ Corner – Recovery Resource Center in Milford on Mar 11 & Mar 20, 2025

📍 Location: Chris’ Corner – Recovery Resource Center, 12 Main Street, Milford, MA📅 Dates: March 11, 2025 and March 20, 2025⏰ Time: 10:00 AM – 2:00 PM

At My Ombudsman, we help MassHealth members understand their healthcare rights and ensure they receive the care they need. We offer free, confidential support, including assistance in multiple languages, and work closely with providers to resolve concerns.

Wednesday, December 11, 2024

The low-down on health insurance ads during open season

|

Monday, October 23, 2023

Insurance coverage changing, rates increasing in climate change

"It’s hard to believe now, given the subsequent rigamarole. But when Julia Shanks first learned that her insurance company wouldn’t renew her policy because it wanted to reduce its risk with “coastal properties,” the North Shore resident wasn’t particularly concerned.Coastal? My house? she thought. “That’s ridiculous.”Sure, she lives in a coastal town. But she’s a half a mile from the beach. Up a hill. Not in a flood zone. Once, when she asked a roofer to see if a roof deck would allow her to glimpse the water, he was blunt.“You can’t see the ocean from anywhere in this house.”But as Shanks, who asked that her town not be named, and other Massachusetts property owners are learning, insurers are becoming increasingly risk averse. Experts say that features that were once considered acceptable are now sometimes triggering price increases or even nonrenewals from insurers. A property that is less than two miles from the water may be rejected, for example, or an older home — built many decades ago — that may have outdated systems or hard-to-replace materials. Or, heaven forbid, its owner has committed the sin of all sins and filed claims in the past five years."

|

| WATCH: Florida & California homeowners are having trouble getting coverage. Will the trend spread to Massachusetts? Reporter Beth Teitell has an ominous forecast |

Saturday, September 23, 2023

Children’s Health Insurance Program: Spot the scam

|

| Children’s Health Insurance Program: Spot the scam |

Saturday, February 18, 2023

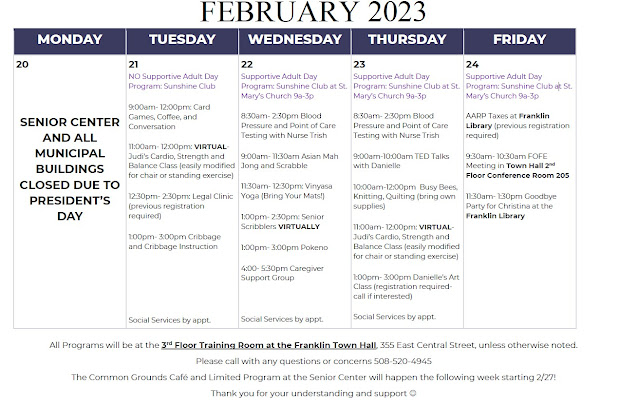

Franklin Senior Center: Remains closed through Feb 24, check schedule for activities thru Feb 24; Café opens Feb 27

SENIOR CENTER CLOSED 2/21-2/24

The Franklin Senior Center is unfortunately going to be closed another week (February 20th-24th) for construction, but in the meantime we have planned a variety of programs for you at the Town Hall and Library! In better news, we will be opening the Common Grounds Café and the attached multipurpose room on the following Monday, February 27th!

The programming schedule for next week is posted on our website as well as our social media- so please take a look and join us next week.

We are also sad to announce, our deputy director Christina LaRose will be leaving us for a wonderful opportunity for the town of Foxboro, so we will be having a goodbye party for her at the Franklin Library next Friday 2/24 at 11:30am.

Hope you all are doing well, and please reach out to us at 508-520-4945 if you have any questions or concerns! We miss you all and have a wonderful presidential weekend!

Thank you for your understanding and support

Danielle Hopkins, Franklin Senior Center Director

Shared from -> https://www.franklinma.gov/franklin-senior-center/news/senior-center-closed-221-224

Download the schedule for Feb 20 - 24 ->One correction to the schedule: the Senior Scribblers will meet at the Franklin TV studio as they normally would for the last Wednesday of the month to record their radio episode for March.

|

| Franklin Senior Center: Remains closed through Feb 24 |

|

| Franklin Senior Center: check schedule for activities thru Feb 24 |

Monday, October 3, 2022

Franklin Public Schools: Chromebook registration and Optional Insurance School year 2022-2023

Coverage Option - The cost for coverage is $45 per year, per device with lower rates for those who qualify for free/reduced meals. Coverage includes Accidental Damage from cracked screens and liquid spills, liquid submersion, fire, flood damage, vandalism, natural disasters, and power surge due to lightning.

NOT COVERED: Intentional damage, case carvings, broken chargers, will not be covered. Additionally, if a device is lost or stolen (as determined by our insurance provider), families may be responsible for the total cost of the device. Please note that full loss due to theft is only covered when accompanied by a police report.

Note: While the insurance is OPTIONAL, those choosing NOT to insure devices will be responsible for the full replacement cost of $250.00 should an accident or loss occur. Full replacement cost will be the only option available and partial costs to repair a damaged chromebook will not be considered regardless of the damage as we do not repair these devices in-house. This form must be completed for each device your child/children may have.

Monday, April 11, 2022

Fire Dept achieves ISO Class 1 rating

Fire Chief James McLaughlin and Joseph Pasco, Northeast Manager of ISO (Insurance Services Office, Inc.), presented the upgraded rating of an ISO Class 1 to the Town Council on April 6th, 2022. The Franklin Fire Department will move to the ISO Class 1 rating effective July 1st, 2022. The ISO Class 1 rating from the Public Protection Classification is the highest rating attainable.

Franklin will be the 9th Fire Department in Massachusetts, only the 15th Fire Department in New England, and 459th in the Nation to obtain this rating. This is out of over 45,000 fire departments rated nationally. The Public Protection Classification goes from 1 to 10. Class 1 represents superior property fire protection and Class 10 indicates that the area’s fire-suppression program doesn’t meet minimum criteria.

This rating is based on strict criteria developed and assessed by the ISO Fire Suppression Rating Schedule (FSRS). ISO provides data and analytics for the property/casualty insurance industry. Most U.S. insurers use the Public Protection Classification information as part of their decision making on offering coverage and the fees charged for the coverage of personal or commercial property insurance. It is estimated that the improvement of each rating on the scale of 1-10 helps save property owners 7-15% on insurance.

Please note that the insurance policy holder must contact their insurance company to inquire about any savings. Not every insurance company may use this rating.

- Emergency Communications

- The Fire Department

- Water Supply

- Community Efforts to Reduce the Risk of Fire

It is important to note that the Town of Franklin Water Department is instrumental in this rating as 40% is based on the Town Water Supply. Additionally, communications, including the support of our regional dispatch center, The Metacomet Emergency Communications Center, play an important role in this rating.

Below is information from the ISO Mitigation Public Protection Classification website: https://www.isomitigation.com/ppc/

|

| Fire Dept achieves ISO Class 1 rating |

Tuesday, June 8, 2021

"Consumer Federation of America cited concerns about unfair pricing, misuse of data, and loss of privacy"

"It is sometimes called “usage-based insurance” and sometimes “insurance telematics.” It’s when you agree to allow your auto insurer to ride along with you — quite literally.If you agree, a constant stream of data flows from your vehicle to your insurer, via a telecommunication device, including how fast you are going, the time of day you are driving, and when and how hard you are hitting the brakes.What’s the purpose? Insurers say they want to reward good drivers with lower premiums: for example, those who drive within the speed limit, mainly during daylight hours, and without frequently jamming on the brakes. (For drivers whose reckless driving habits correlate to higher risk for crashes, higher premiums may result, although few bad drivers are expected to opt in for telematics.)"

Thursday, April 22, 2021

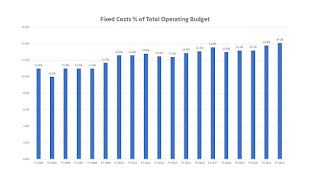

What are the fixed costs of the Town of Franklin budget?

As part of the continuing series to prepare for the Finance Committee budget hearings (which begin next week) and the Town Council budget hearings (in May), check out the link to the details on the history of the fixed costs year over year from FY 2004 to FY 2022.

- Appendix C3 - Historic Data: Fixed Cost

The chart depicts the fixed costs of the budget year by year from FY 2004 to FY 2022.

What are the fixed costs?

- Liability Insurance

- Employee Benefits:

- Pensions

- Health/Life Insurance/non school

- Retired Teacher Health Ins

- Non GIC - School Retirees

- Workers Compensation

- Unemployment Compensation

- OPEB

- Medicare

|

| What are the fixed costs of the Town of Franklin budget? |

Prior posts

Executive summary by Town Administrator Jamie Hellen

https://www.franklinmatters.org/2021/04/franklin-public-schools-fy-2022-annual.html

https://www.franklinmatters.org/2021/04/fy-2022-town-of-franklin-budget-proposal.html

Wednesday, September 16, 2020

Commonwealth Magazine: "Health insurance premiums to rise 8% next year"

From CommonWealth Magazine we share an article of interest for Franklin:

"HEALTH INSURANCE PREMIUMS for Massachusetts residents will rise by an average of 7.9 percent at the beginning of next year, despite insurers having profited from declining health care costs during the COVID-19 pandemic.

Kevin Beagan, deputy commissioner for the health market at the state Division of Insurance, said the higher premiums reflect several factors, including uncertainty about what health care will look like next year. “Every company highlighted the uncertainty associated with 2021,” Beagan said during a presentation before the Health Policy Commission on Tuesday.

The biggest increase will be for the lower-cost offerings of Tufts Health Plan on the Massachusetts Health Connector. Beagan said the Division of Insurance is “definitely not happy with” Tufts’ 12.2 percent planned increase. But the division chose not to challenge the increase and conduct a hearing process because that would have prevented the plans from being available in time for October’s open enrollment period on the Health Connector.

Among the other largest health plans in the state, a Boston Medical Center plan that is also available to low-income patients on the Health Connector will see an average 2.5 percent premium increase. Blue Cross Blue Shield’s HMO Blue plan, a commercial plan that covers 80,000 members, will see a 5.4 percent premium increase. Always Health Partners and United Healthcare both are planning increases of at least 9 percent, while members with different Tufts health plans will see increases of at least 7 percent. Harvard Pilgrim’s HMO plan members will see a 5.5 percent increase on average."

Thursday, February 20, 2020

In the News: ISO rating improved for Franklin; Bellingham cinema exploring alcohol license

"Some homeowners will see their insurance rates decrease this spring when the Franklin Fire Department’s new ISO rating takes effect next month.

Previously holding a Class 3 rating since 2018, Chief James McLaughlin recently announced that the department has improved its ISO rating - also referred to as a “fire score,” or Public Protection Classification (PPC) - to Class 2. Determined by the Insurance Services Office Inc. (ISO), the rating indicates how prepared a department is in the case of fire and how quickly it would be able to put it out, he said.

Ratings are issued on a scale of 1 to 10, with 1 being the best. Jersey City, New Jersey-based ISO provides statistical and claims-related information to serve insurers, regulators and other risk managers in the property-casualty insurance market.

Though the audit process to review a department’s ranking takes place every five years, McLaughlin called the ISO to question why the department’s rating was a 3 when he joined the department last July. A few months later, he was informed that its rating was improved upon further review, he said."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20200219/franklin-fire-dept-secures-improved-safety-rating

|

| "Franklin’s water supply was a factor in improving the Fire Department’s rating" |

"The serving of alcohol and a $6 million renovation could be coming to Bellingham’s Regal Cinema.

The news comes from recently released Bellingham selectmen minutes from the board’s Jan. 21 meeting. Regal Bellingham General Manager Josh Ferriera and attorney Andrew Upton discussed “the possibility of obtaining an All Alcohol Restaurant license,” according to the minutes.

Management at Regal Bellingham, in the Charles River Center shopping plaza near Interstate 495, directed comment to the company’s media inquiries line. Messages left at that number and at Upton’s Boston office and email address were not returned by the Daily News’ deadline.

“Regal in Bellingham is in the process of a $6M update to the cinema and would like to offer the option of purchasing an alcoholic beverage,” the minutes read."

Continue reading the article online (subscription may be required)

https://www.milforddailynews.com/news/20200219/bellinghams-regal-theater-considers-6m-update-serving-alcohol

Saturday, February 3, 2018

Franklin Receives MIIA’s “Community Excellence” Award

"Congratulations to the Town of Franklin for demonstrating an enthusiastic enterprise-wide commitment to risk management and safety," said Stephen Batchelder, director of Claims Operations for MIIA.

The town's Public Works and Facility Maintenance departments have proactively engaged in, and focused on, OSHA-related training and implementation of risk management best practices. Their collaborative efforts include comprehensive quarterly safety meetings in which they review and investigate all incidents, routine site and building inspections, and continue use of MIIA Rewards training.

"This award is team effort and a testament to the hard work our town departments," said Jamie Hellen, deputy Town Administrator for the Town of Franklin. "Our staff at the DPW, Facilities, Custodians, Police, Fire, Library and Schools do a great job providing training opportunities for our employees to reduce work place injuries and accidents and provide a safe working environment for the community. It is also important to note their efforts have helped save the taxpayers almost $60,000 on our insurance premium for next year. These are the little things our staff do on a day-to-day basis that makes our organization function effectively. The town appreciates MIIA's support and recognition of the hard work our town departments put in."

Factors considered to earn the community excellence award are solid implementation of risk management fundamentals such as on-going and effective safety committees, focused training, and a commitment to strong infrastructure and maintenance protocols throughout the entire community. In addition, awarded communities actively seek out new and creative ways to drive safety and mitigate risk.

About MIIA

The Massachusetts Interlocal Insurance Association (MIIA) is the non-profit insurance arm of the Massachusetts Municipal Association. As a member-based organization, MIIA's only focus is to provide excellent service and quality risk management solutions to Massachusetts' municipalities and related public entities. Municipal insurance its only business, MIIA insures nearly 400 cities, towns, and other public entities in Massachusetts. For more information, visit www.emiia.org and www.mma.org.

Friday, January 26, 2018

In the News: election day registration proposed; GIC decision being reviewed

"Beginning next year, Massachusetts voters would be able to register to vote on the same day they cast their ballots, under a new proposal from Secretary of State William Galvin.

Galvin announced Thursday that he is proposing legislation that would allow Massachusetts residents who are otherwise eligible to vote to go to their local polling place on Election Day, complete a registration form, and vote immediately afterward. Current law requires voters to be registered at least 20 days before an election in which they plan to vote.

“Election Day registration has been shown to be one of the simplest and more effective ways of increasing voter participation, with administrative costs much lower than many other proposals to do the same thing, because it combines the act of registration and voting,” Galvin said."

Continue reading the article online (subscription may be required)

http://www.milforddailynews.com/news/20180125/galvin-proposes-same-day-voter-registration-in-mass

"The Group Insurance Commission, relenting to days of withering criticism over its decision to limit health plan offerings to nearly 450,000 state employees and retirees, plans to reconsider that plan when it meets next week.

The GIC has a meeting scheduled for next Thursday when it was supposed to consider benefit design within the three providers -- UniCare, Neighborhood Health and Health New England -- that were selected to sell plans through the agency after a procurement process.

The agency now says it will put a motion for reconsideration of the 8-5 vote held Jan. 18 on its agenda for the Feb. 1 meeting.

At the meeting last Thursday, the GIC voted to eliminate three of the six insurance carriers that offer coverage to the nearly 450,000 state employees and retirees. The change eliminates Harvard Pilgrim Health Care, Fallon Community Health and Tufts Health Plan as carriers, and would save the state an estimated $20.8 million next year."

Continue reading the article online (subscription may be required)

http://www.milforddailynews.com/news/20180125/group-insurance-commission-relents-on-state-employee-health-plan-changes