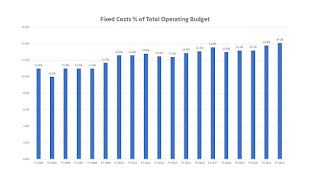

As part of the continuing series to prepare for the Finance Committee budget hearings (which begin next week) and the Town Council budget hearings (in May), check out the link to the details on the history of the fixed costs year over year from FY 2004 to FY 2022.

- Appendix C3 - Historic Data: Fixed Cost

The chart depicts the fixed costs of the budget year by year from FY 2004 to FY 2022.

What are the fixed costs?

- Liability Insurance

- Employee Benefits:

- Pensions

- Health/Life Insurance/non school

- Retired Teacher Health Ins

- Non GIC - School Retirees

- Workers Compensation

- Unemployment Compensation

- OPEB

- Medicare

|

| What are the fixed costs of the Town of Franklin budget? |

Prior posts

Town of Franklin - budget growth and split between municipal and schools - FY 2012 to FY 2022

School budget, executive summary by School Superintendent Sara Ahern

Executive summary by Town Administrator Jamie Hellen

https://www.franklinmatters.org/2021/04/franklin-public-schools-fy-2022-annual.html

Link to Town of Franklin budget proposal for FY 2022

https://www.franklinmatters.org/2021/04/fy-2022-town-of-franklin-budget-proposal.html

https://www.franklinmatters.org/2021/04/fy-2022-town-of-franklin-budget-proposal.html