|

| R.I. launches launches first-time homeownership program touting ‘affordable’ mortgage options |

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Saturday, December 6, 2025

R.I. launches launches first-time homeownership program touting ‘affordable’ mortgage options

Saturday, June 14, 2025

Property Insurance Costs Can be High in Every U.S. Region

Wednesday, May 15, 2024

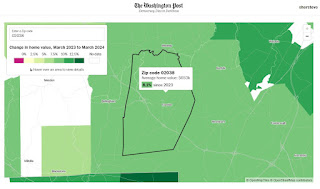

Washington Post: "Are home prices still rising? See how prices have changed in your area"

"Many first time home buyers are struggling to break into the U.S. housing market as prices continue to rise.

Since 2019, home prices have surged 54 percent. In the last year, prices increased 5.8 percent — a more steady rise after the volatile years of the early pandemic, according to a Washington Post analysis of home value data from the mortgage technology division of Intercontinental Exchange (ICE). But high interest rates, low inventory and years of price jumps continue to challenge Americans buying homes.

Prices vary widely depending on where you live. Enter your Zip code below to see how the market value of the average home in your area has changed."

|

| Are home prices still rising? See how prices have changed in your area" |

Monday, April 15, 2024

Washington Post: "Are you ready to buy a house? Take our quiz and find out"

"Homeownership is how many Americans accumulate wealth, and it’s an important life goal for millions. But affording a home is a growing challenge — if not out of reach entirely — for many people.In the past three years, mortgage rates have more than doubled and are now at nearly 7 percent on a typical 30-year loan. And they are unlikely to drop significantly this year. Even those who can swing an all-cash purchase, experts say, still have plenty of other expenses to consider, including maintenance and insurance.So, should you buy a home right now? To help you decide, take this quiz."

Monday, October 16, 2023

Economic Development Subcommittee - Agenda for Oct 18 meeting at 5:30 PM

a. Staff memo

|

| Economic Development Subcommittee - Agenda for Oct 18 meeting at 5:30 PM |

Sunday, October 1, 2023

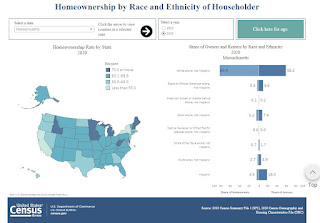

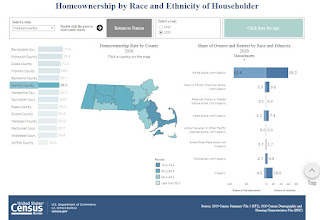

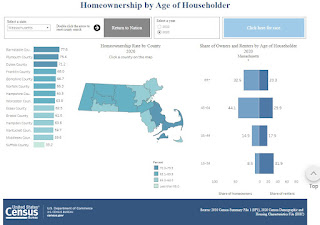

Census data for MA by county and age for homeownership vs rental

"The U.S. Census Bureau released an interactive map illustrating 2020 Census data about homeownership by the age, race and ethnicity of the householder. The map provides data at the national, state and county levels and data from the 2010 Census for comparison.

The Census Bureau also released the brief Housing Characteristics: 2020, which provides an overview of homeownership, renters, vacant housing and other 2020 Census housing statistics previously released through the 2020 Census Demographic and Housing Characteristics File (DHC)."

Continue reading the press release -> https://www.census.gov/newsroom/press-releases/2023/2020-census-map-homeownership.html

|

| homeownership vs rental for MA at State level |

|

| homeownership vs rental for MA at County level |

|

| homeownership vs rental for MA at County level by Age |

Wednesday, February 15, 2023

Boston Globe Editorial: "Seizing home equity over unpaid taxes is unfair to homeowners"

State Representative Jeff Roy has co-sponsored legislation to avoid this and is mentioned in the article.

"After Deborah Foss fell behind on property taxes on her two-unit house in New Bedford, the city sold her debt to an outside company, which pursued the $30,000 the retired grandmother owed.But rather than simply recouping the debt, according to her lawyers, Foss fell victim to an overly punitive state law that cost her the entire house, valued at $241,600 — far more than was needed to settle her debt — and left her temporarily homeless last winter.Massachusetts is one of a dozen states that allows a practice critics refer to as “home equity theft.” If a home is foreclosed on due to unpaid property taxes, the municipality — or a company that buys the tax debt — can sell the home and keep the profit, even if the sale price is more than the taxpayer owes.The system often disproportionately and unfairly punishes elderly homeowners. Of course, people need to pay taxes. Municipalities should be allowed to recoup the costs they incur in collecting those taxes if a homeowner is delinquent, including by seizing a home."

|

| BOSTON GLOBE; BAURKA/CANDY1812/ADOBE |