The Massachusetts Senate approved on Thursday a $55.9 billion budget for Fiscal Year 2024 (FY24). Following a robust, spirited, and engaging debate process, the Senate approved 478 amendments, adding $82.2 million in spending to the budget. As the Commonwealth continues to emerge from the COVID-19 pandemic, the Senate’s budget prioritizes upholding fiscal discipline and responsibility, and supports the long-term economic health of the state. The Senate budget delivers historic levels of investment in education, housing, regional transportation, health care, workforce development, climate preparedness, and much more, while centering equity and opportunity as part of a broader, more comprehensive strategy to make Massachusetts more affordable, inclusive, and competitive.

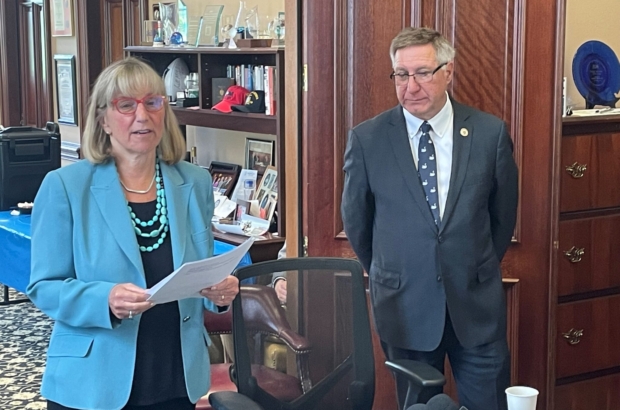

“I am so proud that this chamber voted resoundingly for a transformative budget built on the simple principle that our success as a Commonwealth is tied to the success of every single person who calls Massachusetts home,” stated Senate President Karen E. Spilka (D-Ashland). “Massachusetts will be competitive so long as people from all over the world can come here to fulfill their dreams – whether by going back to school, advancing their career, starting a business, or finding affordable housing and child care to raise a family. At a time when our world-class educational institutions are more needed now than ever, this budget adds a new chapter in Massachusetts’ storied tradition of making education accessible to all through our Student Opportunity Plan. I want to thank Chair Rodrigues, Vice Chair Friedman, Assistant Vice Chair Comerford, the Committee and all my Senate colleagues for their thoughtful and collaborative work on this budget.”

“In my five years as Chair of Ways and Means, I’ve never experienced a smoother or more democratic process than the Fiscal Year 2024 budget the Senate just approved here today,” said Senator Michael J. Rodrigues (D-Westport), Chair of the Senate Committee on Ways and Means. “The chamber focused on an overarching goal to meet (and in many cases exceed) the pressing needs of our communities, and the Commonwealth at large. This budget is a forward-thinking and responsive proposal that greatly facilitates our long-term economic health and expands access to opportunities to reinvigorate and reinvest in our workforce economy, lessen the wealth-income divide, and empower our communities as we build an inclusive post-pandemic future that equitably benefits all. Focusing on shared priorities and upholding fiscal responsibility, the Senate specifically targeted investments collectively in education, transportation, local aid, health care, housing assistance, workforce development, greatly strengthened the social service safety net. The Commonwealth’s economic foundation is now positioned to deftly deflect ongoing challenges and weather future uncertainty. Thank you to my colleagues in the Senate, especially my colleagues on the Committee, whose advocacy, collaboration, and dedication helped to inform and shape this comprehensive budget plan. A special heartfelt thank you to the Ways and Means staff, whose diligent work over the last several months was largely responsible for producing this budget, their tireless efforts did not go unnoticed! Lastly, a huge and sincere thank you to Senate President Spilka for her resolute and compassionate leadership as we work together to rebuild our economy and bolster our state’s long-term economic health.”

“I am proud of the Senate’s proposed budget for Fiscal Year 2024, which builds off prior fiscal year investments to deliver a comprehensive, impactful set of services and programs for the residents of the Commonwealth,” said Senator Cindy F. Friedman (D-Arlington), Vice Chair of the Senate Committee on Ways and Means. “I am particularly proud of the provisions that safeguard preventive health care services like cancer screenings and access to medications for chronic conditions, in the wake of a partisan federal court ruling that threatens access to these important, life-saving health care services. In Massachusetts, we will continue to protect access to commonsense health care for all our residents.”

“Historic investment in food security and the Commonwealth's food system. Record investment in regional transit authorities. Transformative levels of higher education funding,” said Senator Joanne Comerford (D-Northampton), Assistant Vice Chair of the Senate Committee on Ways and Means and Senate Chair of the Joint Committee on Higher Education. “I am proud of the many ways that this budget rises to meet the need of the Commonwealth’s people while strategically stoking opportunity and growth, maximizing equity, tackling pressing challenges, and seizing the promise of our time. Thank you to Senate President Karen Spilka and Chair Michael Rodrigues for their leadership in crafting this compassionate and responsible budget proposal.”

The Committee’s budget recommends a total of $55.8 billion in spending, a $3.4 billion increase over the Fiscal Year 2023 (FY23) Budget. This spending recommendation is based on a tax revenue estimate of $40.41 billion for FY24, representing 1.6 per cent growth with an additional $1 billion from the new Fair Share surtax, as agreed upon during the Consensus Revenue process in January.

Remaining vigilant about the current fiscal environment, the Committee’s FY24 budget adheres to sound fiscal discipline and builds up available reserves for the state’s Stabilization Fund. The fund has grown to a record high of $7.16 billion and is projected to close FY24 at $9.07 billion. ensuring that the Commonwealth continues to have the means to uphold fiscal responsibility during a time of ongoing economic volatility.

The Senate’s FY24 budget also sets aside $575 million to pay for a progressive tax relief package that will center equity and chip away at the headwinds that threaten Massachusetts competitiveness. This tax package will be discussed and debated following the conclusion of the FY24 budget process.

Fair Share Investments

Consistent with the consensus revenue agreement reached with the Administration and House in January, the Senate’s FY24 budget includes $1 billion in revenues generated from the Fair Share ballot initiative voters approved in November 2022, which established a new surtax of 4 per cent on annual income above $1 million and invests these new public dollars to improve the state’s education and transportation sectors.

To safeguard this new source of revenue, the Senate’s FY24 budget also establishes an Education and Transportation Fund to account for these Fair Share funds in an open and transparent manner. This will ensure the public is visibly informed about how much revenue is collected from the new surtax and how much of this revenue is being dedicated to improving public education and transportation systems in accordance with the ballot initiative.

Notable Fair Share Education investments include:

- $125 million for Higher Education Capital Funding, focused on reducing backlog of deferred maintenance projects

- $100 million for Financial Aid Expansion to expand financial aid programs for in-state students attending state universities through MASSGrant Plus, bringing the total proposal for this program to $275 million, more than doubling the amount of scholarship funding provided by the state just two fiscal years prior

- $100 million for Massachusetts School Building Authority Capital Supports for cities, towns and school districts experiencing extraordinary school project costs impacted by post-COVID inflationary pressures

- $30 million for Student Support Services to ensure students in the Commonwealth have success on the post-secondary level through wraparound supports, bringing the total program investment to $44 million

- $25 million to reduce the waiting list for the income-eligible child care assistance program, which will create approximately 2,200 new slots for children

- $25 million for capital investments in early education and care programs to build capacity and ensure the ability of programs to safely accommodate additional slots

- $20 million for Mass Reconnect, as a first step toward free community college in the Commonwealth for those aged 25 and older

- $20 million for a Free Community College Program for nursing students as a pilot to support a high-need workforce area and build toward universal free community college in the fall of 2024

- $15 million for Free Community College Implementation Supports to collect necessary data, develop best practices, and build capacity for free community college in the fall of 2024

- $15 million for the Commonwealth Preschool Partnership Initiative, which empowers school districts to expand prekindergarten and preschool opportunities through public-private partnerships; this funding is on top of an additional $15 million in non-Fair Share funding for this initiative

- $15 million to expand upon the Senate-championed program that supports early education and care staff members with paying for their own personal child care

- $10 million for Early College and Innovation Pathways

Notable Transportation investments include:

- $190 million for MBTA Capital Investments for critical capital resources for both the subway and commuter rail systems

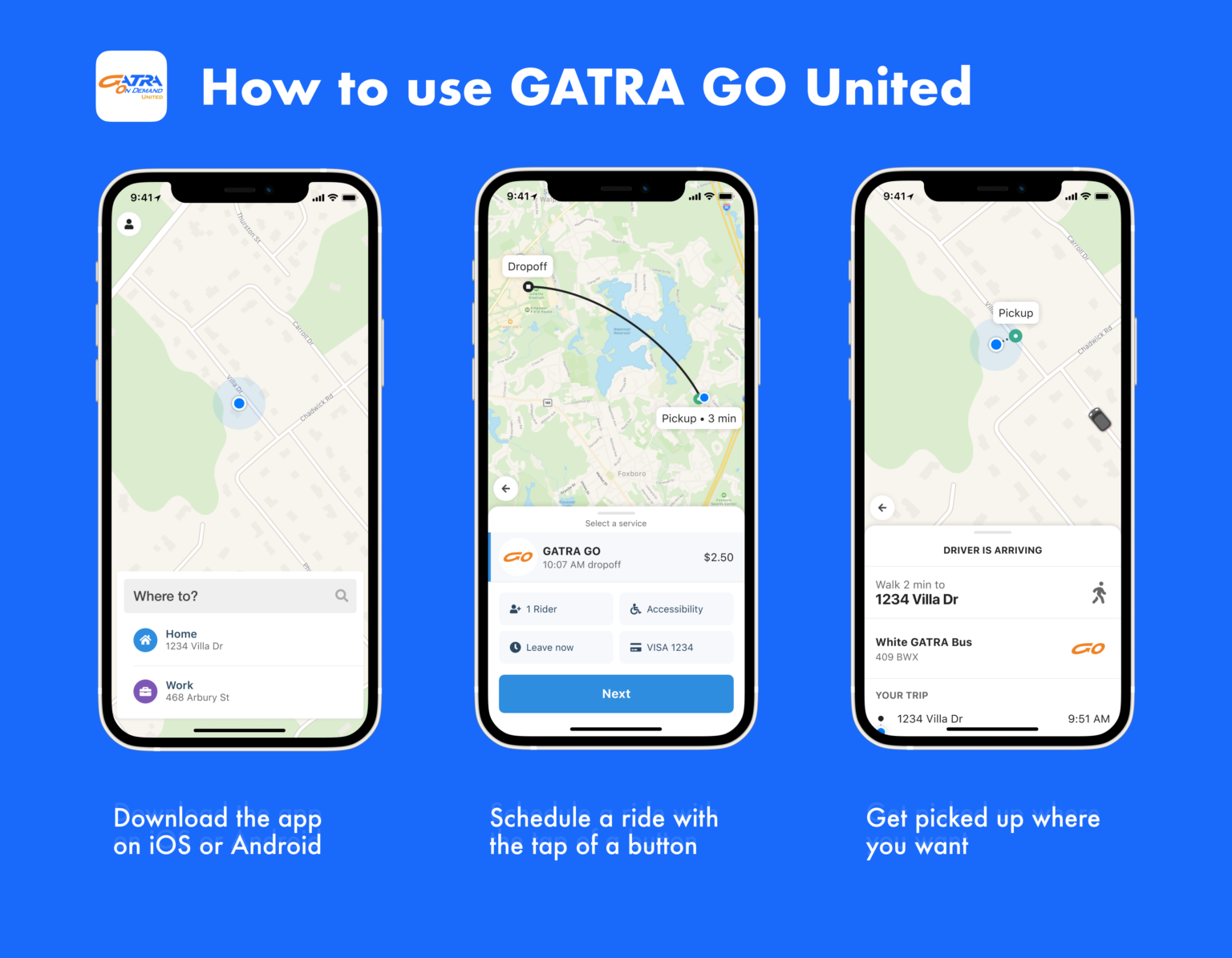

- $100 million for Regional Transit Funding and Grants, which will exclusively be used to support the work of the Regional Transit Authorities that serve the Commonwealth, more than doubling the total funding for RTAs to $194 million, including:

- $56 million to be distributed to RTAs for operating assistance, with special attention paid to those RTAs with historically low state operating assistance

- $25 million for an innovation grant program for transportation providers across the Commonwealth for initiatives such as electrification, infrastructure, capital investments, new and innovative service delivery models, expanded service hours or weekend service, rural connectivity, and connectivity improvements across regional transit authority service areas

- $15 million for fare-free pilot program grants to provide six months of fare-free RTA service across the Commonwealth

- $4 million through the Community Transit Grant Program to support expanded mobility options for older adults, people with disabilities and low-income individuals

- $100 million in supplemental aid for roads and bridges, half of which will be expended consistent with the Chapter 90 program, while the other half will be spent with a focus on the total mileage of participating municipalities

- $50 million for a reserve to provide matching funds for transportation projects that are eligible for federal funds, which will help the state better compete for increased federal transportation funding made available by the Biden Administration

- $50 million for Highway Bridge Preservation, to ensure that consistent funds are provided to make sure that critical infrastructure does not fall into disrepair

- $5 million for MBTA Means-Tested Fares, which will cover initial exploration of the feasibility of implementing a means-tested fare program at the MBTA

- $5 million for Water Transportation, which will cover one-time expenses for a pilot program covering operational assistance for ferry services

Education

The Senate Ways and Means FY24 budget proposal takes the first step toward implementing the Senate’s Student Opportunity Plan by making high-quality education more accessible and by making record investments to support students across the full breadth of the Commonwealth’s education system, from Massachusetts’ youngest learners to adults re-entering higher education.

Recognizing that investments in our early education and care system support the underlying economic competitiveness of the Commonwealth, the Senate’s budget makes a historic $1.5 billion investment in early education and care. This is the largest-ever proposed annual appropriation for early education and care in Massachusetts history. For context, this area of the budget has increased by more than 77 percent (more than $660 million) over the budget from three fiscal years prior. The FY24 budget will maintain operational support for providers, support the early education and care workforce, and prioritize accessibility and affordability throughout our early education and care system.

Notably, this will be the first fiscal year in which the annual state budget includes a full year of funding for C3 grants, signaling a historic commitment to maintain this crucial lifeline for our early education and care sector. Funded at $475 million, this program, which is open to all early education and care providers, provides monthly payments to programs throughout Massachusetts. These grants, which are received by 88% of early education and care programs in the Commonwealth, have empowered programs to raise salaries, to hire additional staff, to maintain their enrollment levels, and to avoid tuition increases. Without the continuation of these grants, 751 providers (which serve over 15,000 children) have indicated that they would have to close their doors.

Other notable funding includes:

- $45 million for the center-based childcare rate reserve for reimbursement rates for subsidized care, including:

- $20 million in line-item appropriations, and

- $25 million in expected leftover funds from Fiscal Year 2023

- $30 million for the Commonwealth Preschool Partnership Initiative, which empowers school districts to expand prekindergarten and preschool opportunities through public-private partnerships. This is double the amount that was appropriated for this initiative in FY23.

- $25 million in new funding to reduce the waiting list for income-eligible child care assistance program, which will create approximately 2,200 new slots for children

- $25 million in new funding for capital investments in early education and care programs to build capacity and ensure the ability of programs to safely accommodate additional slots

- $17.5 million for grants to Head Start programs, which provide crucial early education and child care services to low-income families

- $15 million, an increase of $5 million over FY23, to assist early education and care staff members with paying for their own personal child care

- $10 million for professional development and higher education opportunities for early educators, to assist with recruitment and retention challenges in the workforce

- $5 million, an increase of $1.5 million over FY23, for mental health consultation services in early education and care programs

- In addition to these appropriations, the Fiscal Year 2024 budget includes a policy section that will allow subsidized early education and care programs to provide child care discounts to their own staff members.

For K-12 education, the Senate commits once again to fully funding and implementing the Student Opportunity Act (SOA) by FY 2027, investing $6.59 billion in Chapter 70 funding, an increase of $604 million over FY 2023, as well as doubling minimum Chapter 70 aid from $30 to $60 per pupil. This investment ensures that the state remains on schedule to fully implement the Student Opportunity Act by FY2027 and ensures that all school districts are equipped with the resources to deliver high quality educational opportunities to their students.

In addition to these record investments in early education and public K-12 education, the Committee’s budget expands pathways to affordable public higher education for all by building capacity for free community college for all students in Fall 2024. Laying the groundwork for this momentous change to make higher education more accessible, the Senate budget includes $275 million for the scholarship reserve, $55 million to accelerate and build up capacity to support free community college across all campuses by fall of 2024, and $40 million for free community college programs for students aged 25 or older and for students pursuing degrees in nursing starting in the fall of 2023, thereby addressing a critical need felt across the state.

The Committee’s budget also welcomes students regardless of their race, national origin, citizenship, or immigration status, making clear that all high school students who attend for three years and graduate from a Massachusetts high school are eligible to receive in-state tuition at our public institutions of higher education.

Other education investments include:

- $503.8 million for the special education circuit breaker

- $230.3 million for charter school reimbursements

- $97.1 million to reimburse school districts for regional school transportation costs, representing a 90% reimbursement rate

- $15 million for Rural School Aid supports

- $15 million for Early College programs and $12.6 million for the state’s Dual Enrollment initiative, both of which provide high school students with increased opportunities for post-graduate success

- $5 million to support implementation of the Massachusetts Inclusive Concurrent Higher Education law, including:

- $3 million for grants offered through the Massachusetts Inclusive Concurrent Enrollment initiative to help high school students with intellectual disabilities ages 18–22 access higher education opportunities, and

- $2 million for the Massachusetts Inclusive Concurrent Enrollment Trust Fund

- $2.5 million for the Civics Education Trust Fund, after an increase of $1 million through the amendment process, to promote civics education and civic engagement throughout the Commonwealth.

- $2 million for the Genocide Education Trust Fund, continuing our commitment to educate middle and high school students on the history of genocide.

- $1 million, adopted through the amendment process, for the Department of Higher Education to support Hunger-Free Campuses for both two- and four-year public institutions of higher education and minority serving institutions

Health, Mental Health & Family Care

The Senate budget funds MassHealth at a total of $19.93 billion, providing more than 2.3 million people with continued access to affordable, accessible, and comprehensive health care services. Other health investments include:

- $2.9 billion for a range of services and focused supports for people with intellectual and developmental disabilities

- $597.7 million for Department of Mental Health adult support services, including assisted outpatient programming and comprehensive care coordination among health care providers.

- $582 million for nursing facility Medicaid rates, including:

- $112 million in additional base rate payments to maintain competitive wages in the Commonwealth’s nursing facility workforce

- $213.3 million for a complete range of substance use disorder treatment and intervention services to support these individuals and their families

- $119.8 million for children’s mental health services, after an increase of $500K through the amendment process for the establishment of Behavioral Health Pilot Program for K-12 Schools

- $71.2 million for domestic violence prevention services

- $42.9 million for Early Intervention services, ensuring supports remain accessible and available to infants and young toddlers with developmental delays and disabilities

- $33.8 million for Family Resource Centers to grow and improve the mental health resources and programming available to families

- $26.3 million for grants to local Councils on Aging to increase assistance per elder to $14 from $12 in FY 2023

- $25 million for emergency department diversion initiatives for children, adolescents, and adults

- $21.5 million for family and adolescent health, including:

- $9.2 million for comprehensive family planning services, and

- $6.7 million to enhance federal Title X family planning funding

- $20 million to recapitalize the Behavioral Health, Access, Outreach and Support Trust Fund to support targeted behavioral health initiatives

- $19.2 million to support student behavioral health services at the University of Massachusetts, state universities, community colleges, K-12 schools and early education centers

- $15 million for grants to support local and regional boards of health, continuing our efforts to build upon the successful State Action for Public Health Excellence (SAPHE) Program

- $12.8 million for Elder Nutrition Meals on Wheels, after an increase of $1 million through the amendment process

- $6 million for Social Emotional Learning Grants to help K-12 schools bolster social emotional learning supports for students, including $1 million to provide mental health screenings for K-12 students

- $5 million for Children Advocacy Centers to improve the critical supports available to children that have been neglected or sexually abused

- $4.6 million for the Office of the Child Advocate

- $3.8 million for the Massachusetts Center on Child Wellbeing & Trauma

- $2 million for grants for improvements in reproductive health access, infrastructure, and safety

- $1 million, adopted through the amendment process, for the Public University Health Center Sexual and Reproductive Health Preparation Fund for the purpose of reimbursements to public universities for abortion medications

- $1 million, adopted through the amendment process, for the development, expansion and operation of freestanding birth centers and support for community-based maternal health services

The Senate’s FY24 budget codifies into law the federal Affordable Care Act’s (ACA) provisions that protect access to preventive services. By enshrining the ACA protections into state law, insurance carriers across the Commonwealth will be required to provide coverage for preventive services without imposing cost-sharing such as co-pays and deductibles. With this vital step, the Senate is protecting access to preventive health care services for millions of our residents, including screenings for cancer, diabetes, HIV, and depression, as well as preventive medications such as statins, immunizations, and PrEP (pre-exposure prophylaxis for HIV), and further protecting the rights and freedoms of residents to make their own health care choices without federal interference.

Through the amendment process, the Senate also took a crucial step toward expanding access to reproductive health by allowing pharmacists to dispense hormonal contraceptives.

Expanding & Protecting Opportunities

The Senate remains committed to continuing an equitable recovery, expanding opportunity, and supporting the state’s long-term economic health. To that end, the Committee’s budget includes a record investment in the annual child’s clothing allowance, providing $450 per child for eligible families to buy clothes for the upcoming school year. The budget also includes a 10 per cent increase to Transitional Aid to Families with Dependent Children (TAFDC) and Emergency Aid to the Elderly, Disabled and Children (EAEDC) benefit levels compared to June 2023 to help families move out of deep poverty.

Economic opportunity investments include:

- $444.7 million for Transitional Assistance to Families with Dependent Children (TAFDC) and $201.4 million for Emergency Aid to Elderly, Disabled and Children (EAEDC) to provide the necessary support as caseloads increase and to continue the Deep Poverty increases

- $60 million for adult basic education services to improve access to skills necessary to join the workforce

- $36 million for the Massachusetts Emergency Food Assistance Program, after an increase of $1 million through the amendment process

- $20 million for the Workforce Competitiveness Trust Fund to connect unemployed and under-employed workers with higher paying jobs

- $21 million in Healthy Incentives Programs to maintain access to healthy food options for households in need

- $15 million for a Community Empowerment and Reinvestment Grant Program to provide economic support to communities disproportionately impacted by the criminal justice system

- $15.4 million for Career Technical Institutes to increase our skilled worker population and provide residents access to career technical training opportunities

- $5.8 million for the Innovation Pathways program to continue to connect students to trainings and post-secondary opportunities in the industry sector with a focus on STEM fields

- $5 million for community foundations to provide emergency economic relief to historically underserved populations

- $5 million for the Secure Jobs Connect Program, providing job placement resources and assistance for homeless individuals

- $2.5 million for the Massachusetts Cybersecurity Innovation Fund, including $1.5 million to further partnerships with community colleges and state universities to provide cybersecurity workforce training to students and cybersecurity services to municipalities, non-profits, and small businesses

- $600,000 through the amendment process for the Massachusetts Downtown Initiative, which will provide municipalities with technical assistance to promote compact, walkable downtowns that have a vibrant mix of commercial and residential uses, cultural and recreational amenities, and access to public transportation.

Housing

As the Senate puts in motion plans to make the Commonwealth more inclusive, home affordability remains on the top of residents’ minds. To that end, the Senate’s FY24 budget makes a historic $1.05 billion investment in housing, dedicating resources programs that support housing stability, residential assistance, and homelessness assistance.

The budget prioritizes relief for families and individuals who continue to face challenges brought on by the pandemic and financial insecurity, including $324 million for Emergency Assistance Family Shelters and $195 million for Residential Assistance for Families in Transition (RAFT), which will provide rental assistance that a household can receive at $7,000. Other housing investments include:

$200 million for the Massachusetts Rental Voucher Program (MRVP), including $20.4 million in funds carried forward from FY 2023, creating more than 750 new vouchers and allowing the program to move to a payment standard with a benefit of 110% of the federal small-area fair market rental price, significantly broadening housing options for those served by the program

- $110.8 million for assistance for homeless individuals

- $107 million for assistance to local housing authorities

- $39.6 million for the HomeBASE diversion and rapid re-housing programs, bolstering assistance under this program to two years with a per household maximum benefit of $20,000

- $26 million for the Alternative Housing Voucher Program (AHVP), including $9.1 million in funds carried forward from FY 2023. This funding increase will create 250 new vouchers and will pair with $2.5 million for grants to improve or create accessible housing units. Both programs will also benefit from the inclusion of project-based vouchers in AHVP, which will stimulate the building of new deeply affordable and accessible homes

- $7.6 million for sponsor-based supportive permanent housing

- $6.4 million for the Home and Healthy for Good re-housing and supportive services program, including:

- $250,000 for homeless LGBTQ youth

- $500,000 through the amendment process for a matched savings, coaching, and support program for first-generation, first-time homebuyers across the Commonwealth

In addition to these record supports, the budget makes permanent a COVID-era renter protection that slows down the court process in eviction proceedings when the tenant has a pending rental assistance application.

Community Support

The Committee’s budget – in addition to funding traditional accounts like Chapter 70 education aid – further demonstrates the Senate’s commitment to state-local partnerships, dedicating meaningful resources that touch all regions and meet the needs of communities across the Commonwealth. This includes $1.27 billion in funding for Unrestricted General Government Aid (UGGA), an increase of $39.4 million over FY 2023, to support additional resources for cities and towns. In addition to traditional sources of local aid, the Committee’s budget increases payments in lieu of taxes (PILOT) for state-owned land to $51.5 million, an increase of $6.5 million over FY 2023. PILOT funding is a vital source of supplemental local aid for cities and towns working to protect and improve access to essential services and programs during recovery from the pandemic. Other local investments include:

- $194 million for Regional Transit Authorities (RTAs) to support regional public transportation systems, including $100 million from Fair Share funds to support our RTAs that help to connect all regions of our Commonwealth.

- $47.3 million for libraries, including $16.7 million for regional library local aid, after an increase of $750,000 through the amendment process, $17.6 million for municipal libraries and $6.2 million for technology and automated resource networks.

- $25 million for the Massachusetts Cultural Council to support local arts, culture and creative economy initiatives.

A conference committee will now be appointed to reconcile differences between the versions of the budget passed by the Senate and House of Representatives.

|

| MA Senate Overwhelmingly Approves Fiscal Year 2024 Budget |