|

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Showing posts with label tax rate. Show all posts

Showing posts with label tax rate. Show all posts

Tuesday, February 12, 2019

MassBudget: Why Top-Income Households Receive Most Tax Benefits from Charitable Deduction

Wednesday, November 28, 2018

Live reporting: Tax classification hearing

| 5. APPOINTMENTS |

None

|

| 6. HEARINGS | None |

Kevin Doyle, Assessor; Chris Sandini, Comptroller

80.31 % 19.68%

motion to close hearing, seconded, passed 9-0

motion to move tax motions to now, rather than wait until later, seconded, passed 9-0

motion to close hearing, seconded, passed 9-0

motion to move tax motions to now, rather than wait until later, seconded, passed 9-0

| 10b. LEGISLATION FOR ACTION |

Resolution 18-66: Classification Tax Allocation - Residential Factor (Motion to Approve Resolution 18-66 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10c. LEGISLATION FOR ACTION |

Resolution 18-67: Classification Tax Allocation- Open Space Exemption (Motion To Approve Resolution 18-67- Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10d. LEGISLATION FOR ACTION |

Resolution 18-68: Classification Tax Allocation- Small Business Exemption (Motion to Approve Resolution 18-68 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10e. LEGISLATION FOR ACTION |

Resolution 18-69: Classification Tax Allocation- Residential Property Exemption (Motion to Approve Resolution 18-69 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

Tuesday, November 27, 2018

What drives the tax rate? How stable is our budgeting process?

The tax rate will be voted on during Wednesday's Town Council meeting. It is expected to be set at 14.66/thousand, an increase of .01 over the tax rate for FY 2018 (14.65).

The tax rate increase is minor due to the increase in our overall property valuation and new growth. A larger pie is available to divide the levy by. When valuations go up, the rate flattens. It can also go down as shown in the 2000-2007 years. We are still in the recovery phase from the great recession that started in 2008.

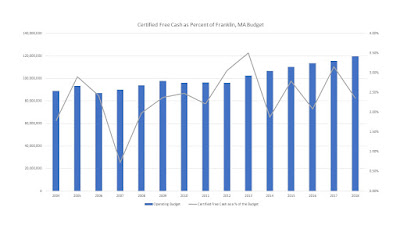

How stable is our budgeting process can be shown in the slight variation of our free cash as a percent of total budget. Free cash is neither free nor cash. It arises from two budget factors: (1) when revenues to the town exceed that forecast and (2) when expenses budgeted are less than forecast. Both of these amounts add up to what is called 'free cash'.

Both charts were created from Town of Franklin Board of Assessors data combined with MA Dept of Revenue, Division of Local Services data. The Division of Local Services has a variety of data and reporting available

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Dashboard.Cat1munioperatingpos

The Town Council agenda can be found on the Town of Franklin page

http://www.franklinma.gov/town-council/agenda/november-28-town-council-agenda

Specifically the tax rate info can be found here

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf

The tax rate increase is minor due to the increase in our overall property valuation and new growth. A larger pie is available to divide the levy by. When valuations go up, the rate flattens. It can also go down as shown in the 2000-2007 years. We are still in the recovery phase from the great recession that started in 2008.

|

Franklin, MA - Net Change in Valuation (Million) vs.

Tax Rate (Percent)

|

How stable is our budgeting process can be shown in the slight variation of our free cash as a percent of total budget. Free cash is neither free nor cash. It arises from two budget factors: (1) when revenues to the town exceed that forecast and (2) when expenses budgeted are less than forecast. Both of these amounts add up to what is called 'free cash'.

|

| Certified Free Cash as Percent of Franklin, MA Budget |

Both charts were created from Town of Franklin Board of Assessors data combined with MA Dept of Revenue, Division of Local Services data. The Division of Local Services has a variety of data and reporting available

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Dashboard.Cat1munioperatingpos

The Town Council agenda can be found on the Town of Franklin page

http://www.franklinma.gov/town-council/agenda/november-28-town-council-agenda

Specifically the tax rate info can be found here

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf

Monday, November 26, 2018

Franklin, MA: Town Council - Meeting - Nov 28, 2018

The published agenda and documents for the Franklin Town Council meeting scheduled for Wednesday, November 28, 2018. This meeting sets the tax rate for the fiscal year 2019, effectively completing the budget cycle that started a year ago and officially funds the Town's operation for July 1, 2018 through June 30, 2019.

(Note: where there are active links in the agenda item, it will take you to the associated document)

(Note: where there are active links in the agenda item, it will take you to the associated document)

You can also find the full set of documents in one PDF

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf| Agenda Item | Summary |

|---|---|

| Town Council Meeting Agenda |

Meeting of November 28, 2018 - 7:00PM

|

| 1. ANNOUNCEMENTS |

a. This meeting is being recorded by Franklin TV and shown on Comcast Channel 11 and Verizon Channel 29. This meeting may be recorded by others.

|

| 2. CITIZENS COMMENTS |

a. Citizens are welcome to express their views for up to five minutes on a matter that is not on the agenda. The Council will not engage in a dialogue or comment on a matter raised during Citizen Comments. The Town Council will give remarks appropriate consideration and may ask the Town Administrator to review the matter.

|

| 3. APPROVAL OF MINUTES |

None

|

| 4. PROCLAMATIONS/RECOGNITIONS |

a. Swearing in of Firefighters

|

| 5. APPOINTMENTS |

None

|

| 6. HEARINGS | |

| 6a. HEARINGS |

Tax Classification Hearing

|

| 6b. HEARINGS |

Zoning Bylaw Amendment 18-821: Zoning Map Changes On Or Near Plain Street, Pond Street, and Palomino Drive

|

| 7. LICENSE TRANSACTIONS |

None

|

| 8. PRESENTATIONS/DISCUSSIONS |

a. Snow Update

|

| 9. SUBCOMMITTEE REPORTS |

a. Capital Budget Subcommittee

b. Budget Subcommittee

c. Economic Development Subcommittee

d. Town Administrator Search Committee

|

| 10. LEGISLATION FOR ACTION | |

| 10a. LEGISLATION FOR ACTION |

Resolution 18-65: Conditional Offer of Town Administartor Position to Current Deputy Town Administartor (Motion to Approve Resolution 18-65- Majority Vote (5))

|

| 10b. LEGISLATION FOR ACTION |

Resolution 18-66: Classification Tax Allocation - Residential Factor (Motion to Approve Resolution 18-66 - Majority Vote (5))

|

| 10c. LEGISLATION FOR ACTION |

Resolution 18-67: Classification Tax Allocation- Open Space Exemption (Motion To Approve Resolution 18-67- Majority Vote (5))

|

| 10d. LEGISLATION FOR ACTION |

Resolution 18-68: Classification Tax Allocation- Small Business Exemption (Motion to Approve Resolution 18-68 - Majority Vote (5))

|

| 10e. LEGISLATION FOR ACTION |

Resolution 18-69: Classification Tax Allocation- Residential Property Exemption (Motion to Approve Resolution 18-69 - Majority Vote (5))

|

| 10f. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-821: Zoning Map Changes On Or Near Plain Street, Pond Street, and Palomino Drive - 1st Reading (Motion to Move Zoning Bylaw Amendment 18-821 to a 2nd Reading-Majority Vote (5))

|

| 10g. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-822: Changes to §185-20. Signs - Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-822 to the Planning Board - Majority Vote (5))

|

| 10h. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-823: Changes To Sign District Regulations - Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-823 to the Planning Board- Majority Vote (5))

|

| 10i. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-824: Changes to Sign District Overlay Map- Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-824 to the Planning Board- Majority Vote (5))

|

| 10j. LEGISLATION FOR ACTION |

Bylaw Amendment 18-825: Chapter 47, Alcoholic Beveralges- 1st Reading (Motion to Move Bylaw Amendment 18-825 to a 2nd Reading - Majority Vote (5))

|

| 10k. LEGISLATION FOR ACTION |

Bylaw Amendment 18-828: Fees Bylaw Changes- 1st Reading (Motion to Move Bylaw Amendment 18-828 to a 2nd Reading- Majority Vote (5))

|

| 11. TOWN ADMINISTRATORS REPORT | |

| 12. FUTURE AGENDA ITEMS | |

| 13. COUNCIL COMMENTS | |

| 14. EXECUTIVE SESSION |

None Scheduled

|

| 15. ADJOURN |

|

| Municipal Building, 355 East Central St, Franklin, MA |

Thursday, November 8, 2018

Franklin Tax Hearing - Nov 28

The Following notice will be published in the Milford Daily Newspaper on Monday,

November 12, 2018.

The Franklin Town Council will hold a Public Hearing in the Council Chambers in the Municipal Office Building, 355 East Central Street, Franklin, MA on Wednesday evening, November 28, 2018 at 7:10 P.M. on the issue of allocating the local property tax levy among the 5 property classes for the Fiscal Year 2019. The hearing will provide an open forum for the discussion of local property tax policy. Interested taxpayers may present oral or written information on their views.

Prior to the setting of the tax rate, the Town Council must adopt a Residential Factor following which the Council selects the percentage of the levy to be borne by Commercial and Industrial and Personal Property.

The hearing location is accessible to persons with physical disabilities. If you have any questions, please call the Town Administrator’s Office at (508) 520-4949.

Submitted by,

Chrissy Whelton

November 12, 2018.

FRANKLIN TAX HEARING

NOTICE OF PUBLIC HEARING

PROPERTY TAX CLASSIFICATION

Prior to the setting of the tax rate, the Town Council must adopt a Residential Factor following which the Council selects the percentage of the levy to be borne by Commercial and Industrial and Personal Property.

The hearing location is accessible to persons with physical disabilities. If you have any questions, please call the Town Administrator’s Office at (508) 520-4949.

Submitted by,

Chrissy Whelton

Sunday, January 14, 2018

MassBudget: Sweeter than SALT

Highest-income households get federal tax cuts more than twice SALT losses

|

|

Subscribe to:

Posts (Atom)