The tax rate increase is minor due to the increase in our overall property valuation and new growth. A larger pie is available to divide the levy by. When valuations go up, the rate flattens. It can also go down as shown in the 2000-2007 years. We are still in the recovery phase from the great recession that started in 2008.

|

Franklin, MA - Net Change in Valuation (Million) vs.

Tax Rate (Percent)

|

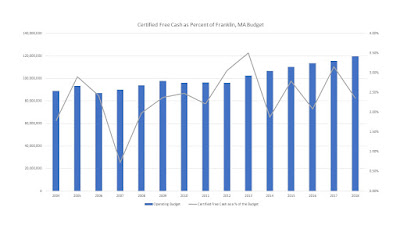

How stable is our budgeting process can be shown in the slight variation of our free cash as a percent of total budget. Free cash is neither free nor cash. It arises from two budget factors: (1) when revenues to the town exceed that forecast and (2) when expenses budgeted are less than forecast. Both of these amounts add up to what is called 'free cash'.

|

| Certified Free Cash as Percent of Franklin, MA Budget |

Both charts were created from Town of Franklin Board of Assessors data combined with MA Dept of Revenue, Division of Local Services data. The Division of Local Services has a variety of data and reporting available

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Dashboard.Cat1munioperatingpos

The Town Council agenda can be found on the Town of Franklin page

http://www.franklinma.gov/town-council/agenda/november-28-town-council-agenda

Specifically the tax rate info can be found here

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf