"Give the gift that keeps on giving this holiday season!VFJ Renovations is now taking orders for planters, raised garden beds, and Empower with Gardening signs! Read all about what we do and why we do it at www.vfjrenovations.com. A limited quantity of signs are available now, and all planters and garden beds will be built in the spring.As in the past, all profits will be donated to a non-profit organization."

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Monday, December 13, 2021

#ThinkFranklinFirst: VFJ Renovations is now taking orders for planters, raised garden beds

Monday, December 6, 2021

MetroWest Nonprofit Network: December Lunch and Learns

| Connect. Collaborate. Strengthen. Act. | ||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||

|

Saturday, November 27, 2021

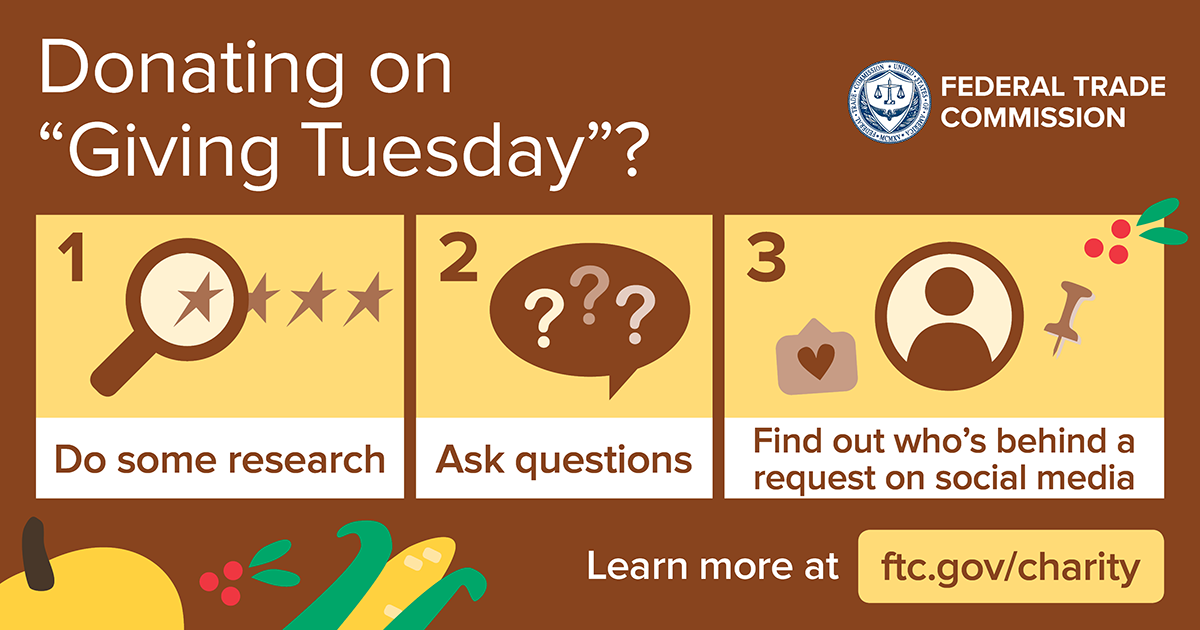

Donate safely this #GivingTuesday

|

Giving Tuesday is a great time to show your gratitude by donating to help others. But you don’t want to give money to a fake charity or scammer (any day of the week).

Before you donate this Giving Tuesday ― and anytime you’re asked to give to charity:

- Research the cause or the organization. Search online for the name of the organization or cause with words like “review,” “scam,” or “complaint.” See if others have had good or bad experiences with the charity. Check out what charity watchdog groups say about that organization.

- Continue reading the article -> https://www.consumer.ftc.gov/blog/2021/11/donate-safely-giving-tuesday?utm_source=govdelivery

|

| Donate safely this #GivingTuesday |

Friday, November 5, 2021

From the IRS: "Year-end giving reminder"

The Internal Revenue Service today (11/03/21) reminded taxpayers that a special tax provision will allow more Americans to easily deduct up to $600 in donations to qualifying charities on their 2021 federal income tax return.

Ordinarily, people who choose to take the standard deduction cannot claim a deduction for their charitable contributions. But a temporary law change now permits them to claim a limited deduction on their 2021 federal income tax returns for cash contributions made to qualifying charitable organizations. Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify.

Under this provision, individual tax filers, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. The maximum deduction is increased to $600 for married individuals filing joint returns.

Included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted in March 2020, a more limited version of this temporary tax benefit originally only applied to tax-year 2020. The Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted last December, generally extended it through the end of 2021.

Cash contributions include those made by check, credit card or debit card as well as amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with their volunteer services to a qualifying charitable organization. Cash contributions don't include the value of volunteer services, securities, household items or other property.

The IRS reminds taxpayers to make sure they're donating to a recognized charity. To receive a deduction, taxpayers must donate to a qualified charity. To check the status of a charity, they can use the IRS Tax Exempt Organization Search tool (https://www.irs.gov/charities-non-profits/tax-exempt-organization-search).

Cash contributions to most charitable organizations qualify. But contributions made either to supporting organizations or to establish or maintain a donor advised fund do not. Contributions carried forward from prior years do not qualify, nor do contributions to most private foundations and most cash contributions to charitable remainder trusts.

In general, a donor-advised fund is a fund or account maintained by a charity in which a donor can, because of being a donor, advise the fund on how to distribute or invest amounts contributed by the donor and held in the fund. A supporting organization is a charity that carries out its exempt purposes by supporting other exempt organizations, usually other public charities.

Keep good records

Special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. Usually, this includes obtaining an acknowledgment letter from the charity before filing a return and retaining a cancelled check or credit card receipt for contributions of cash.

For details on the recordkeeping rules for substantiating gifts to charity, see Publication 526, Charitable Contributions (https://www.irs.gov/forms-pubs/about-publication-526), available on IRS.gov.

Remind families about the Child Tax Credit

Besides the special charitable contribution deduction, the IRS also encourages employers to help get the word out about the advance payments of the Child Tax Credit because they have direct access to many employees and individuals who receive this credit. In particular, remind low-income workers, especially those who don't normally file returns, that the deadline for signing up for these payments is now November 15, 2021. More information on the advance Child Tax Credit is available on IRS.gov.

For more information about other coronavirus-related tax relief, visit IRS.gov/coronavirus.

|

| From the IRS: "Year-end giving reminder" |

Monday, September 20, 2021

Franklin Area Nonprofit Network (FANN) Meeting Agenda - Monday, Sep 20, 2021 – 7:00 PM

FANN Meeting Agenda

Monday, September 20, 2021 – 7:00 PM

1. 700 PM - Call to order, review agenda and any housekeeping Steve Sherlock

2. Introductions

715 PM open

720 PM open

725 PM open

730 PM open

3. 7:35 PM (or 7:10ish) Review and approval of Mission, Vision and Core Values https://www.franklinareanonprofitnetwork.org/2021/08/fann-steering-committee-has-two-updates.html

4. 7:45 PM (or 7:20ish) Round table on outlook for each group; what items are you working on to add to the community calendar of events?

Link to meeting day of week preference -> https://www.franklinmatters.org/2019/06/quick-survey-results-wednesday-evening.html

Action: To submit a community or cultural event, please use this form:

https://forms.gle/oPdi8X3ZbHHyrHzo6

5. 8:00 PM (or 7:35ish) Steering Committee, Actions, Next Month agenda, Wrap Up Bo Kinney/Steve Sherlock

4. 820 PM (0r 7:45ish) Adjourn

--------------------------

Join Zoom Meeting

https://us02web.zoom.us/j/88526616859?pwd=cGJ6QXlMaG5OdjhzVXJsZ3hySmJpZz09

Meeting ID: 885 2661 6859

Passcode: wfpr1029

One tap mobile

+16465588656,,88526616859#,,,,*02277432# US (New York)

+13017158592,,88526616859#,,,,*02277432# US (Washington DC)

---------------------

The Franklin Area Nonprofit Network page is now live and functioning.

https://www.franklinareanonprofitnetwork.org/

Check out the listing of nonprofits https://www.franklinareanonprofitnetwork.org/p/area-non-profits.html

Use the form to make updates, changes, or additions

https://www.franklinareanonprofitnetwork.org/p/directory-addchange.html

|

| Franklin Area Nonprofit Network (FANN) Meeting Agenda - Monday, Sep 20, 2021 – 7:00 PM |

Thursday, September 2, 2021

MAss Nonprofit Network: Trainings & Events Calendar: September 2021

| Upcoming webinars and training events happening for nonprofit professionals in Massachusetts. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|