Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Showing posts with label tax rate. Show all posts

Showing posts with label tax rate. Show all posts

Wednesday, December 4, 2019

Live reporting: Tax Classification Hearing

6. HEARINGS

Franklin Tax Classification Hearing

https://www.franklinma.gov/sites/franklinma/files/mai/files/12-4-19_memo_tax_rate_hearing.pdf

Chris Sandini, Kevin Doyle, Chris Feeley

factor of 1 = uniform rate across the property classes

no land classified as open space per State Land use

calculated increase of approx $178 for avg residence with reduction in rate of 15 cents from prior year

new growth of $127M for this tax year

almost 2.5% growth (which helps establish the tax base)

Chandler - clarification questions on exemptions and forms

to be found on the Board of Assessors page

https://www.franklinma.gov/board-assessors

Jones - impressed with the 5B valuation of the Town

For the single tax rate

Bissanti - I don't remember addressing a dual tax rate

C Feeley - about 14 years ago there was a Councilor who did propose a dual tax rate; it was not passed

Pellegri - do we know if we have everyone who would be eligible?

Doyle - we did a mailing some years ago, that didn't urn up much; we work closely with the Senior Center and Veterans Agent to ensure we cover all we hear of; we work with Karen Alves to prepare a summary flyer

Hellen - we'll coordinate an update and social media blast to make sure folks are aware of it

Dellorco - once applied do they need to re-apply?

Feeley - re-apply yes, but once they have, we notify them of what they need to do

Mercer - I support the single tax rate, one of our strengths in attracting business

hearing closed

moving to first of the four resolutions

10a. LEGISLATION FOR ACTION

Resolution 19-80: Tax Classification Residential Factor (Motion to Approve Resolution 19-80 - Majority Vote (5))

motion to approve, seconded, passed 8-0

10b. LEGISLATION FOR ACTION

Resolution 19-81: Tax Classification - Open Space Exemption (Motion to Approve Resolution 19-81 - Majority Vote (5))

motion to approve, seconded, passed 8-0

10c. LEGISLATION FOR ACTION

Resolution 19-82: Tax Classification Small Business Exemption (Motion to Approve Resolution 19-82 - Majority Vote (5))

motion to approve, seconded, passed 8-0

10d. LEGISLATION FOR ACTION

Resolution 19-83: Tax Classification Residential Property Exemption (Motion to Approve Resolution 19-83 - Majority Vote (5))

motion to approve, seconded, passed 8-0

( 2 min recess )

short break to allow for signature of the docs as approved

Friday, November 1, 2019

MassBudget: Statement on Proposed Gas Tax Increase

|

|

Wednesday, October 2, 2019

Board of Assessors: Agenda - Oct 3, 2019

Franklin Board Of Assessors

meeting at

Franklin Municipal Building, Room 106,

355 East Central Street, Franklin, Massachusetts

Thursday, October 3, 2019 at 9:00 AM

A. Approval Of Minutes:

Regular & Executive Session Minutes of September 19, 2019

B. Administration, Old Business and New Business

1. Report on FY 2020 tax file preparation, FY 2021 Chapterlands filings

C. Motor Vehicle Excise

1. MV Abatement Denials

2. September 2019 MV List of Abatements for Comptroller

D. Personal Property

1. Utility Valuation vs. Net Book Value

E. Boat Excise

F. Real Estate

1. Abatements and Appeals

2. Exemptions

G. Executive Session

1.The Board may vote to go into Executive Session under Purpose 7 to discuss and vote on matters that are confidential in accordance with law, such as, but not limited to abatements and exemptions (MGL Ch. 59, Sec. 60), or property income & expense disclosures (MGL Ch. 59, Sec 52B). Will the Board return to Open Session?

This was shared from the Town of Franklin page

https://www.franklinma.gov/sites/franklinma/files/agendas/agenda_10-03-2019.pdf

|

| Board of Assessors: Agenda - Oct 3, 2019 |

Thursday, August 8, 2019

Franklin Election 2019: What does the Board of Assessors do?

While the Town Council votes to set the tax rate annually, the calculations on what the tax rate should be are based upon the valuations of all the commercial, industrial, residential, and personal property that Franklin has record of. These calculations are performed by the Assessors under the oversight of the elected Board of Assessors.

The state has changed the requirement for a property revaluation from every three years to every five years.

There are three members of the Board. Two positions are up for election this year. All three positions are four year terms of office and staggered to avoid a complete replacement and loss of institutional knowledge.

From the Town of Franklin Board of Assessors page

http://www.franklinma.gov/board-assessors

The Board of Assessors section in Franklin Annual Report for 2018 can be found

https://www.franklinmatters.org/2019/02/franklin-annual-report-2018-board-of.html

Find more information on the Franklin Election Nov 5, 2019 in the "election collection"

https://www.franklinmatters.org/2019/07/franklin-election-collection-2019.html

The state has changed the requirement for a property revaluation from every three years to every five years.

There are three members of the Board. Two positions are up for election this year. All three positions are four year terms of office and staggered to avoid a complete replacement and loss of institutional knowledge.

From the Town of Franklin Board of Assessors page

http://www.franklinma.gov/board-assessors

Mission

Establish and maintain valuations for all real and personal property within the community for purposes of generating tax revenues.

Services and Programs

Valuation, classification and assessment of all real and personal property for tax purposes. Conduct research of real estate market (including sales and ratio studies); prepare sales and other reports for state review and certification of values. Prepares and certifies abutters lists. Processes abatements, liens, and apportionment. Maintains assessors' maps, plans, property transfer records, and valuation data. Processes all real and personal property abatements and exemptions. Processes and abates motor vehicle excise. Prepares data for state approval of tax rate.

Inquiries regarding the valuation of residential property, industrial and commercial valuations, or questions about personal property valuations should be directed to Kevin W. Doyle, Peter Mooney or David Ruberti.

Questions regarding abatement and exemption applications, abutters lists, motor vehicle excise, ownership of real and personal property and general assessment data should be directed to the clerical support staff.

The Board of Assessors section in Franklin Annual Report for 2018 can be found

https://www.franklinmatters.org/2019/02/franklin-annual-report-2018-board-of.html

Find more information on the Franklin Election Nov 5, 2019 in the "election collection"

https://www.franklinmatters.org/2019/07/franklin-election-collection-2019.html

|

| Franklin Election 2019: What does the Board of Assessors do? |

Tuesday, February 12, 2019

MassBudget: Why Top-Income Households Receive Most Tax Benefits from Charitable Deduction

|

|

Wednesday, November 28, 2018

Live reporting: Tax classification hearing

| 5. APPOINTMENTS |

None

|

| 6. HEARINGS | None |

Kevin Doyle, Assessor; Chris Sandini, Comptroller

80.31 % 19.68%

motion to close hearing, seconded, passed 9-0

motion to move tax motions to now, rather than wait until later, seconded, passed 9-0

motion to close hearing, seconded, passed 9-0

motion to move tax motions to now, rather than wait until later, seconded, passed 9-0

| 10b. LEGISLATION FOR ACTION |

Resolution 18-66: Classification Tax Allocation - Residential Factor (Motion to Approve Resolution 18-66 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10c. LEGISLATION FOR ACTION |

Resolution 18-67: Classification Tax Allocation- Open Space Exemption (Motion To Approve Resolution 18-67- Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10d. LEGISLATION FOR ACTION |

Resolution 18-68: Classification Tax Allocation- Small Business Exemption (Motion to Approve Resolution 18-68 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

| 10e. LEGISLATION FOR ACTION |

Resolution 18-69: Classification Tax Allocation- Residential Property Exemption (Motion to Approve Resolution 18-69 - Majority Vote (5))

motion to approve, seconded, passed 9-0

|

Tuesday, November 27, 2018

What drives the tax rate? How stable is our budgeting process?

The tax rate will be voted on during Wednesday's Town Council meeting. It is expected to be set at 14.66/thousand, an increase of .01 over the tax rate for FY 2018 (14.65).

The tax rate increase is minor due to the increase in our overall property valuation and new growth. A larger pie is available to divide the levy by. When valuations go up, the rate flattens. It can also go down as shown in the 2000-2007 years. We are still in the recovery phase from the great recession that started in 2008.

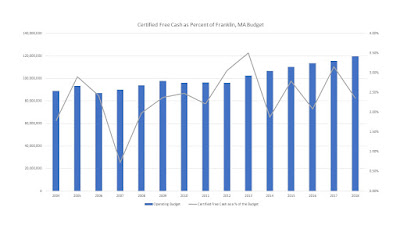

How stable is our budgeting process can be shown in the slight variation of our free cash as a percent of total budget. Free cash is neither free nor cash. It arises from two budget factors: (1) when revenues to the town exceed that forecast and (2) when expenses budgeted are less than forecast. Both of these amounts add up to what is called 'free cash'.

Both charts were created from Town of Franklin Board of Assessors data combined with MA Dept of Revenue, Division of Local Services data. The Division of Local Services has a variety of data and reporting available

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Dashboard.Cat1munioperatingpos

The Town Council agenda can be found on the Town of Franklin page

http://www.franklinma.gov/town-council/agenda/november-28-town-council-agenda

Specifically the tax rate info can be found here

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf

The tax rate increase is minor due to the increase in our overall property valuation and new growth. A larger pie is available to divide the levy by. When valuations go up, the rate flattens. It can also go down as shown in the 2000-2007 years. We are still in the recovery phase from the great recession that started in 2008.

|

Franklin, MA - Net Change in Valuation (Million) vs.

Tax Rate (Percent)

|

How stable is our budgeting process can be shown in the slight variation of our free cash as a percent of total budget. Free cash is neither free nor cash. It arises from two budget factors: (1) when revenues to the town exceed that forecast and (2) when expenses budgeted are less than forecast. Both of these amounts add up to what is called 'free cash'.

|

| Certified Free Cash as Percent of Franklin, MA Budget |

Both charts were created from Town of Franklin Board of Assessors data combined with MA Dept of Revenue, Division of Local Services data. The Division of Local Services has a variety of data and reporting available

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Dashboard.Cat1munioperatingpos

The Town Council agenda can be found on the Town of Franklin page

http://www.franklinma.gov/town-council/agenda/november-28-town-council-agenda

Specifically the tax rate info can be found here

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf

Monday, November 26, 2018

Franklin, MA: Town Council - Meeting - Nov 28, 2018

The published agenda and documents for the Franklin Town Council meeting scheduled for Wednesday, November 28, 2018. This meeting sets the tax rate for the fiscal year 2019, effectively completing the budget cycle that started a year ago and officially funds the Town's operation for July 1, 2018 through June 30, 2019.

(Note: where there are active links in the agenda item, it will take you to the associated document)

(Note: where there are active links in the agenda item, it will take you to the associated document)

You can also find the full set of documents in one PDF

http://www.franklinma.gov/sites/franklinma/files/agendas/town_council_meeting_agenda_for_november_28_2018.pdf| Agenda Item | Summary |

|---|---|

| Town Council Meeting Agenda |

Meeting of November 28, 2018 - 7:00PM

|

| 1. ANNOUNCEMENTS |

a. This meeting is being recorded by Franklin TV and shown on Comcast Channel 11 and Verizon Channel 29. This meeting may be recorded by others.

|

| 2. CITIZENS COMMENTS |

a. Citizens are welcome to express their views for up to five minutes on a matter that is not on the agenda. The Council will not engage in a dialogue or comment on a matter raised during Citizen Comments. The Town Council will give remarks appropriate consideration and may ask the Town Administrator to review the matter.

|

| 3. APPROVAL OF MINUTES |

None

|

| 4. PROCLAMATIONS/RECOGNITIONS |

a. Swearing in of Firefighters

|

| 5. APPOINTMENTS |

None

|

| 6. HEARINGS | |

| 6a. HEARINGS |

Tax Classification Hearing

|

| 6b. HEARINGS |

Zoning Bylaw Amendment 18-821: Zoning Map Changes On Or Near Plain Street, Pond Street, and Palomino Drive

|

| 7. LICENSE TRANSACTIONS |

None

|

| 8. PRESENTATIONS/DISCUSSIONS |

a. Snow Update

|

| 9. SUBCOMMITTEE REPORTS |

a. Capital Budget Subcommittee

b. Budget Subcommittee

c. Economic Development Subcommittee

d. Town Administrator Search Committee

|

| 10. LEGISLATION FOR ACTION | |

| 10a. LEGISLATION FOR ACTION |

Resolution 18-65: Conditional Offer of Town Administartor Position to Current Deputy Town Administartor (Motion to Approve Resolution 18-65- Majority Vote (5))

|

| 10b. LEGISLATION FOR ACTION |

Resolution 18-66: Classification Tax Allocation - Residential Factor (Motion to Approve Resolution 18-66 - Majority Vote (5))

|

| 10c. LEGISLATION FOR ACTION |

Resolution 18-67: Classification Tax Allocation- Open Space Exemption (Motion To Approve Resolution 18-67- Majority Vote (5))

|

| 10d. LEGISLATION FOR ACTION |

Resolution 18-68: Classification Tax Allocation- Small Business Exemption (Motion to Approve Resolution 18-68 - Majority Vote (5))

|

| 10e. LEGISLATION FOR ACTION |

Resolution 18-69: Classification Tax Allocation- Residential Property Exemption (Motion to Approve Resolution 18-69 - Majority Vote (5))

|

| 10f. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-821: Zoning Map Changes On Or Near Plain Street, Pond Street, and Palomino Drive - 1st Reading (Motion to Move Zoning Bylaw Amendment 18-821 to a 2nd Reading-Majority Vote (5))

|

| 10g. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-822: Changes to §185-20. Signs - Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-822 to the Planning Board - Majority Vote (5))

|

| 10h. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-823: Changes To Sign District Regulations - Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-823 to the Planning Board- Majority Vote (5))

|

| 10i. LEGISLATION FOR ACTION |

Zoning Bylaw Amendment 18-824: Changes to Sign District Overlay Map- Referral to the Planning Board (Motion to Refer Zoning Bylaw Amendment 18-824 to the Planning Board- Majority Vote (5))

|

| 10j. LEGISLATION FOR ACTION |

Bylaw Amendment 18-825: Chapter 47, Alcoholic Beveralges- 1st Reading (Motion to Move Bylaw Amendment 18-825 to a 2nd Reading - Majority Vote (5))

|

| 10k. LEGISLATION FOR ACTION |

Bylaw Amendment 18-828: Fees Bylaw Changes- 1st Reading (Motion to Move Bylaw Amendment 18-828 to a 2nd Reading- Majority Vote (5))

|

| 11. TOWN ADMINISTRATORS REPORT | |

| 12. FUTURE AGENDA ITEMS | |

| 13. COUNCIL COMMENTS | |

| 14. EXECUTIVE SESSION |

None Scheduled

|

| 15. ADJOURN |

|

| Municipal Building, 355 East Central St, Franklin, MA |

Subscribe to:

Posts (Atom)