Norfolk County Register of Deeds William P. O'Donnell reported that Norfolk County recordings for the month of February 2023 indicate a continued decrease in overall real estate activity, with significant drops in mortgage activity and the average property sale price as compared to the February 2022 numbers.

In February, there were 6,702 documents recorded at the Norfolk County Registry of Deeds, a 35% decrease from February 2022 and a decrease of 10% from January 2023.

"As the real estate market ventures further into 2023, it is still feeling the effects of high inflation, steep interest rates, and recession fears," said Register of Deeds William P. O'Donnell.

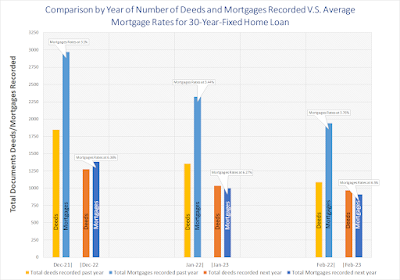

Overall lending activity showed a continued downward trend for the month of February. A total of 909 mortgages were recorded this month, 53% less than a year ago at the same time and down 9% from last month.

"In February, the average mortgage rate jumped back to 6.5%, which may be contributing to a decrease in lending activity," noted Register O'Donnell.

The number of deeds for February 2023, which reflect real estate sales and transfers, both commercial and residential, was 968, a decrease of 11% from February 2022 and a decrease of 6% from the previous month of January 2023.

"A continued decline in the number of deeds and mortgages recorded at the registry may indicate that homeowners who took advantage of lower interest rates in 2020 are hesitant to make moves with mortgage interest rates at or above 6.5%," said O'Donnell. "The scarcity of available real estate inventory is the most likely factor in keeping property prices above pre-pandemic levels, as well as the desire to live in area communities."

Sale prices for February appear to have dropped significantly compared to February 2022. The average sale price in February was $947,974, a 22% decrease from February 2022 and an 11% increase from January 2023. The total dollar volume of commercial and residential sales is down, decreasing 33% from one year ago and increasing 2% from last month.

O'Donnell noted, "While mortgage rates remain high, potential homebuyers may find comfort in the fact that prices have come down significantly from a year ago, bringing home values about 4% above values seen in 2019."

"According to the data, we are recording significantly fewer mortgages, which could be the result of several factors that the country is currently experiencing, including the increasing cost of living and spike in interest rates," noted O'Donnell. "These aspects of the economy can have an effect on the local real estate market."

The Norfolk County Registry of Deeds has been closely monitoring the foreclosure market. In February 2023, there were 3 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in February 2022, there were 8 recorded. However, in February 2023, there were 43 notices to foreclose, the first step in the foreclosure process, significantly more than the 27 recorded in February 2022.

"February 2023 saw notices to foreclose more than double the number in February 2022. The increasing number of these notices is troubling. It suggests that more of our neighbors may have financial difficulties adapting to a shifting economy," said O'Donnell. "We will continue to monitor these figures."

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General's Consumer Advocacy and Response Division (CARD) at 617-727-8400.

"If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance," said Register O'Donnell.

Register O'Donnell concluded, "With homebuyers concerned about affordability challenges and the impact of higher interest rates, property sales remain low. Sales prices, on the other hand, appear to be leveling off, which may provide some relief to prospective homebuyers."

To learn more about these and other Registry of Deeds events and initiatives, "like" us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.

|

| Register O'Donnell Reports on February 2023 Real Estate Activity in Norfolk County |