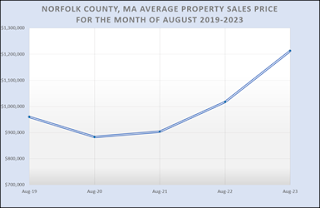

Norfolk County Register of Deeds William P. O’Donnell reported that Norfolk County recordings indicate average property sales prices rose to a record high for the month of August as compared to previous years. This increase can likely be attributed to a limited inventory of new housing up for sale and a lack of existing houses on the market.

“Average property prices in August are up significantly this year compared to the same month in previous years,” stated Register of Deeds William P. O'Donnell. “Seasoned homebuyers and those looking to purchase their first home are faced with the challenge of property values that are 19% higher than 2022 prices, 34% higher than 2021 prices, and 37% higher than 2020 prices, in addition to a mortgage interest rate that for some exceeds 7%.”

|

| Average August Property Prices Reach Record Highs |

The average sale price of commercial and residential properties for August 2023 was $1,212,694, a 19% increase compared to August 2022 but a decrease of 17% from July 2023. The total dollar volume of commercial and residential sales is down, decreasing 6% from last year and 12% from last month.

“Looking at the numbers from August 2022, 2021, and 2020 shows that average property prices fell seasonally by 12% to 17% in August compared to July,” noted Register O'Donnell. “This means that while prices remain high, the seasonal fluctuations in the housing market month over month have remained constantly steady when you compare them to the ebbs and flows of previous years.”

Notwithstanding the increase in average property sales prices, the total number of deeds recorded for August 2023, which reflects both commercial and residential real estate sales and transfers, was 1,478, down 12% from August 2022 but up 16% from July.

“Overall real estate activity is on a downward trend compared to the previous year, driven by two likely factors: limited inventory and high interest rates, resulting in a reduction of the number of deeds and mortgages, which make up a large portion of the total document volume at the Registry.” Register O'Donnell continued. “A slight increase in the number of deeds from last July may suggest that some sellers are taking advantage of higher property values, increasing the number of existing homes on the market.”

The Registry of Deeds recorded 9,527 documents in August 2023. This was 18% less than in August 2022 but an 11% increase compared to July 2023.

Register O'Donnell noted, “Higher mortgage interest rates have an impact on the number of mortgages and deeds recorded at the Registry. Higher interest rates affect seasoned homebuyers' eagerness to refinance, which means fewer mortgages. It also affects a homeowner’s willingness to sell, which results in fewer homes on the market that can be bought. Higher interest rates also impact buyers.”

For the month of August, lending activity overall continued to decline from last year. A total of 1,328 mortgages were recorded, which is 33% less than last year but 6% more than last month.

“In addition to fewer people refinancing, the decline in lending activity can also be attributed to fewer first-time home loans,” said Register O'Donnell “High property prices and increased mortgage interest rates make it more challenging for first-time homebuyers to afford a mortgage and to keep up with payments.”

The Norfolk County Registry of Deeds continues to closely monitor the foreclosure market. In August 2023, there were 4 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, whereas in August 2022, there were 7 recorded. Additionally, this month, there were 25 notices to foreclose, the first step in the foreclosure process, less than the 33 recorded in August 2022.

“We hope to see this trend continue into the fall season, especially as the weather gets cooler. With that said, we cannot forget that foreclosure activity has a human face associated with it, and there are still a number of our neighbors who have lost their homes, and even more are dangerously close to losing their homes,” said Register O'Donnell. “I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

Register O’Donnell concluded, “We have seen some increases in the number of property sales and in the total number of documents compared to last month, but with record property prices for this month and a limited housing inventory, we are seeing significant decreases in overall real estate activity compared to 2022.”

To learn more about these and other Registry of Deeds events and initiatives, “like” us on Facebook at facebook.com/norfolkdeeds. Follow us on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.