Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Tuesday, August 30, 2022

Town of Franklin (MA): Five Year Fiscal Forecast - FY 2025 (part 4 of 5)

Monday, August 29, 2022

Town of Franklin (MA): Five Year Fiscal Forecast - FY 2024 (part 3 of 5)

Sunday, August 28, 2022

Town of Franklin (MA): Five Year Fiscal Forecast - FY 2023 (part 2 of 5)

Saturday, August 27, 2022

Town of Franklin (MA): Five Year Fiscal Forecast (FY 2023-2027) Now Available

The Office of the Town Administrator has released the Five Year Fiscal Forecast for FY23-27. This memorandum provides a synopsis of the financial outlook for each year as well as a "snapshot" of the town today.

-------------------------------------

August 15, 2022

To: Town of Franklin

From: Jamie Hellen, Town Administrator

Re: Town Administrator Five-Year Fiscal Forecast FY23-FY27

Welcome to the first “Five-Year Fiscal Forecast” from my office in almost three years. Due to the immense time pressures put on the office during the pandemic in 2020 and 2021, as well as the consistent economic shifts, it was difficult to depict an accurate picture of future town fiscal affairs. As mentioned in this year's budget narrative, I’m committed to getting back on a regular routine with this traditional update now that the country is moving past the regulatory structure of the COVID-19 pandemic. With the global and national economy in the center of everyone’s minds and the start of the new fiscal year (FY23) upon us, summer is a perfect time to hit a quick reset on town fiscal matters and get the view from 30,000 feet. I am hopeful to publish a more comprehensive version later this fall/winter as the Town approaches its annual tax rate hearing in December. By then, staff will have revenue trends through the first quarter of the fiscal year, finalized state aid numbers, and expected new growth figures. The forecast is also a requirement of bond rating agencies.

Quality of life and organization stability in Franklin

Before I dive into the forecast details, I believe it is worth taking a step back for a moment to pause and reflect. Over the past few years, our community, like the rest of the world, has gone through a tremendous disruption. Everyone has dealt with unforeseen adversity, challenge, and loss. Yet despite these professionally and personally challenging times for everyone, the overall quality of life in Franklin, as well as Massachusetts as a whole, could be considered some of the best in the United States.

The Town has exceptional, diverse schools and education opportunities, unprecedented achievement in public education, one of the most prepared local public safety operations in the state, a dedicated and well-trained public works department and countless exceptional

amenities for families and citizens of all ages and backgrounds. The Town is an attractive area for major corporate businesses and has a strong local economy with many diverse economic sectors. The Town continues to make historic investments in open space and recreation to add to the great quality of life in town.

The Town has developed a proven financial management strategy. We have had strong financial audits for many consecutive years. For the first time in the Town’s history, a AAA Bond rating was awarded due to prudent financial management, a diverse economy and well executed financial policies. For details, please visit the S&P Global Rating from May 2022 for the facts surrounding the AAA Bond rating. It is one of the most important documents to read for any member of the community.

From a bird’s eye view, everyone should feel an incredible sense of achievement for being a model community that is supportive, innovative and full of continued promise. We owe an immense amount of gratitude to our municipal and school employees for their incredible dedication over the last three years, by not only weathering a global pandemic, but improving the organization and continuing to succeed at an elite level. The social fabric of the community and citizens remains very good with a positive outlook given the countless events, festivals, community organizations and opportunities for all. As we move into a fiscal year without any COVID-19 restrictions or regulations for the first time in three years, I believe Franklin is more resilient and prepared for the future than we were three years ago. The organization remains very stable.

FY22 Closeout

Fiscal Year 2022 (FY22) closed out on June 30th. July is one of the busiest times for the Finance staff closing out the past fiscal year, entering the new one, working on state required reporting and closing out budgets. I am pleased to report that all departments did a phenomenal job managing their budgets in FY22. As a result, very few year end transfers were required and another sterling financial audit was presented in May for FY21.

The revenue source with the greatest fluctuation to economic conditions, “Local Receipts”, ended up coming in at pre-pandemic levels, which is very good news. This dynamic was predicted and reflected in the FY23 budget revenue assumptions.

This trend is bolstered by a slowly returning local economy. Hotel revenues are now about 60% back to pre-pandemic numbers. The new cannabis excise (sales) tax provided an additional $104,000 in new revenue for less than a half a year of collections. Motor vehicle excise taxes were higher than budgeted due to the valuation of cars increasing. Ambulance receipts have increased due to higher demand for EMS services. As the Town enters FY23, revenues remain steady in this category, but FY24 may need some expenditure adjustments in order to deliver the services that we see trending in demand.

That said, Local Receipts are revenues mostly generated based on consumer behavior (hotels, meals, cannabis, licenses) and public demand (such as ambulance runs or building permits). Thus, they can stabilize or decrease with the changes in consumer patterns and the broader economy. They can also increase, which the Town must consider that staffing or equipment may be needed to adjust to meet those demands. The fees in this category need to mirror the capacity at the staff level to deliver the services.

Indications from the Federal Reserve and leading local economists acknowledge that to quell inflation, policy will be focused on reducing demand for goods, services and products to help ease cost increases. I tend to believe any policy action at the federal or state levels will take a while to settle into the local consumer patterns that drive revenues in local receipts.

Nonetheless, this is an area of revenue that the Town will need to monitor in FY23 heading into FY24 to ensure we have the capacities to meet the demand for services. We'll also need to monitor any major declines in revenues from attempts to quell inflation.

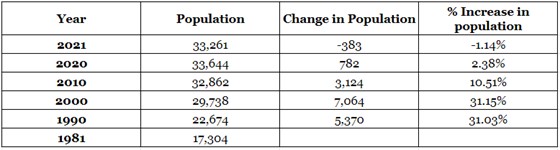

A couple of final statistics to close out FY22: only ten (10) single family homes were built in Franklin during Fiscal Year 2022. By comparison, in 1994, at the Town’s peak, the Town built 172 single family homes. Population in 2021 decreased for the 1st time in over four decades.

|

| Population in 2021 decreased for the 1st time in over four decades |

Monday, August 8, 2022

Annual Report Of The Town Administrator - FY 2021

Sunday, May 15, 2022

Town Officials Office Hours - May 19 - 8:30 AM

The Franklin (MA) Town Council will be holding monthly office hours at the Franklin Senior Center. One or more Councilors, along with the Town Administration, will be present for this standing time for seniors, their families and residents to ask questions and discuss issues of concern. State Representative Jeff Roy participates so questions and issues of a local or state district matter are open for discussion.

|

| yes, trying to think cool thoughts |

Tuesday, May 10, 2022

Town of Franklin - FY 2023 Budget Narrative - the high level view of what's in this year's proposed budget

In compliance with Article Six, Sections 6-3-1 through 6-5-2 of the Franklin Town Charter, we are submitting the proposed FY23 Budget Message & Budget to the Town Council and Finance Committee.

We are presenting a balanced budget proposal for Fiscal Year 2023 (FY23). The Executive Summary explains the budget process, highlights, assumptions, and some general statistics about the budget. Further below are detailed department budget narratives that speak about the mission and strategic initiatives within each department. Detailed budget line item numbers are in Appendix A. The staff will continue to update the budget model as new information becomes available. We have a Town Budget page and people should consult the website for the latest information.

As the Town, state and country exit the two year pandemic and enter FY23 on July 1, 2022, the Town of Franklin is more prepared and better than ever before. Town department operations have excelled throughout these past two years adapting to the pandemic, but continued to accomplish all of their goals and have positioned the town for continued excellence in 2022-2023 and beyond. The facts present an organization performing at a very high level with tremendous accomplishments for the constituents we serve.

Enough cannot be said for the dedication, commitment, passion, innovation, humility and teamwork the staff of this organization showcase on a daily basis. The overall achievements in this organization have been tremendous. We should all be thankful and appreciate what this team has achieved and the role the municipal and school staff play in the community. The future for the organization remains as bright as ever and the quality of life in Franklin is as exceptional as it has ever been.

The organization is poised to support the budget requests from all departments in FY23, including the Franklin Public Schools. While the DPW financial request was the only one not met, the organization was able to begin to implement a financial remedy for this when the stormwater utility set to take effect on July 1, 2023.

Here are the assumptions being incorporated into the FY23 budget:

Revenues Highlights

● The proposed FY23 budget does not include any revenues from the Budget Stabilization “Rainy Day'' Fund. The fund currently has a balance of $2,038,652. These reserves set the town up to be prepared in the event of an emergency, but equally as important, these reserves show bond rating agencies and financial institutions good financial policy and execution. Strong financial annual audits, an effective OPEB policy, voter approved Community Preservation Act, a stormwater utility and increasing emergency reserves puts the town in a greater position to be competitive with interest rates and maintain a stable bond rating.

● The Property Tax Levy and “New Growth” revenue forecast will increase a cumulative $3,202,527 in new property tax revenue from FY22. Traditionally, the Town has used a ten-year average model for the new growth figure. For FY23 this would be $1,224,716. However, the town did not meet its revenue projections in new growth in FY22 and remain conservative and cautious of this dynamic in FY23. Thus, staff have adjusted the revenue figure lower than the ten year average and assume $1,000,000 in new growth revenue by the time the town sets the tax rate in December. This is largely due to uncertain economic factors in the commercial development, housing construction and residential home improvements. Over the past year, the staff have seen a small downturn in planning board and conservation commission applications for larger developments. Also, many new state regulations are set to take effect on housing in the next year. New Growth assumptions will be revisited in November prior to the tax rate hearing as we have done in previous years.

● State Aid is assumed at the Governor’s FY23 budget levels. As it currently stands, a $91,255 increase in local aid from FY22 is the net result. The House of Representatives and the State Senate have historically increased local aid and ended up with a higher figure than the Governor. That said, as staff, stakeholders, and elected officials have discussed for many years, state aid is highly unlikely to be a financial savior this coming fiscal year or in the near future.

● The Town’s Local Receipts look to rebound closer to pre-pandemic numbers. Staff assume an additional $930,000 in local receipts. The Town is still predicting we’ll be shy of the FY21 record breaking year. However, the Recreation Department, Building Department, Board of Health and other permitting departments should see an enthusiastic public, ready to be active again with COVID restrictions removed. The Town should see a steady stream of revenues for town service permits, hotel, meals and motor vehicle excise taxes. To see FY 2023 assumptions, see below.

Finally, per a new town policy,

the cannabis excise tax (or “local option sales tax” of 3% of all sales) will be included in this figure. Two retail medical and non-medical stores

have opened in Franklin over the course of the past year. The Town

has limited data on sales at this point. FY23 should show the community a good

baseline year for revenue anticipated through this source. This local option

tax diversifies the towns local receipts

profile and we anticipate approximately $250,000 a year in revenues to add to the operating budget.

● The recommendation for the two active Host Community Agreements (HCA’s) will be:

○ $300,000 will go to the Department of Public Works to provide revenue for the Grove Street/Washington Street traffic flight and intersection redesign. Combined with last year’s appropriations and a $2.2 million MassWorks grant, this project will now have almost $3 million to rebuild the road with traffic lights, pedestrian friendly crossings, a bike lane and a rebuilt roadway; and

○ $125,000 to the Franklin Police Department for an officer (and benefits, gear, uniform, salary, etc.) who will focus on management of the new dynamics of legal cannabis in town and serve many roles toward ensuring there is proper public service dedicated to substance abuse in town.

HCA Note: A revenue line item has now been created to budget for these agreements. Staff fully expect continued changes to this line item in assumptions, revenues streams and impacts. It will remain fluid due to state regulatory changes. Funds are earmarked in state law for impacts of a marijuana facility and are not general fund revenues to be used anywhere in the town budget.

One major factor in FY23 is the rollout of a new state law relative to Host Community Agreements and, in general, the cannabis industry. Corrective legislation on a myriad of issues with the industry are poised to in effect within the next 1-2 years, including a requirement that cities and towns re-negotiate all agreements with their licensed businesses in their communities. FY23 and FY24 will see substantial changes in this revenue source. Regardless, the mitigation projects from the impacts are good community investments to help solve issues that have arisen from the presence of the industry in Franklin.

Expenditures Highlights

● The Franklin Public School District will see an increase of $2,400,000 over FY22. This represents 100% of the request from the School Committee and Superintendent’s Recommended Budget.

● Municipal employee pension costs will absorb almost $500,000 in new revenue for the municipal departments (and some non-teacher employees). These numbers do not include the school department portion of health insurance, which is included in the Superintendent’s budget.

● Overall, debt is still low relative to past years as a percentage of the overall town budget. The proposed budget decreases $296,405 in non-excluded debt and interest as two significant projects, a $2 million School Repairs Bond and a $824,000 Public Buildings Remodeling Bond come off the books. This offsets the debt service increases from Town borrowing $1.55 million for technology infrastructure and $808,000 for two fire trucks in FY22.

● The Department of Public Works will see an overall increase of $350,842. The increase is for restoration of smaller services that have been reduced over the past two years at the DPW due to the impending requirements for stormwater. The FY23 budget restores the two ground and highway positions that were eliminated from the FY22 budget.

In addition, the community has established a stormwater utility and fee, which should significantly help the funding challenges the DPW has been experiencing in recent years.

See the narrative on the proposed

changes in the DPW narrative below.

● On January 1, 2021, the Mendon-Millville regional dispatch center merged into the Metacomet Emergency Communications Center (MECC), which gives the special district access to state development grants. This move will save the Town approximately half of its annual assessment in operating budget capacity in FY23. We have budgeted a half year assessment at $610,664, which is anticipated to be ½ of the actual assessment. The state 911 Department is paying for the other half.

In FY24, the District will be eligible for the final grant award as part of this merger. The Town will be obligated to pay 25% of the FY24 assessment.

The Town has established a MECC Stabilization account, which has deposited savings from the MECC into this account to ensure that the Town has the resources when the full MECC assessment comes back on the Town’s books in FY25. Staff anticipate a large increase in one year and will need to phase that share of the budget back in with one-time revenues from the Stabilization account.

Additionally, as part of the merger agreement with Mendon and Millville, excess and deficiency (unspent savings, similar to free cash) funds from the four original communities will be seeing a savings rebate of the first two years of the MECC that will come back to the Town. This rebate is $230,857. Those monies will also be deposited into the Stabilization account, which will then have a balance of approximately $1.134 million.

● New municipal positions in operating budget:

○ Two additional staff for the DPW, which were eliminated from the FY22 budget;

○ Two additional part-time kitchen staff for the Senior Center cafe;

○ Full-time Benefits Coordinator under the supervision of the Town Human Resources Department, but will service all Municipal and School benefits programs and employees; and

○ Full-time Conservation Agent/Natural Resource Protection Manager (formerly part-time at 19 hours) will now be full-time given the volume of community planning work being asked of the town on its parks, open space planning, Franklin Greenway, Delcarte management, Earth Day coordination and many more projects. The former part-time position barely met the Town’s needs. Additionally, part-time professional work is a difficult recruitment task these days.

● Community Preservation Act (CPA). In FY23, the Town will see its first state match for CPA and the first slate of projects. The CPA is completely outside of the general budget of the Town (like water, sewer, trash and stormwater utilities). For those interested, please see the CPA Plan HERE.

● The FY23 budget proposal does not include dollars from various federal stimulus allocations (such as CARES Act, American Rescue Plan Act) or federal stimulus grants. All of those revenues are in “special revenue accounts” by state statute. For a complete update on federal stimulus, please visit the Town website here.

Future Trends

Municipal and School departments have been doing a great job managing their budgets, investing in value added services and adapting to citizen feedback and a changing world. Moving forward in to FY23 and the following two fiscal years, we see a handful of issues to monitor:

● Net School Spending. The Superintendent of Schools and School Business Administrator foresee a likely “fiscal challenge” coming in FY25 relative to net school spending requirements in state law. See the recent School Department Budget flier as an issue of significant takeaways.

● MECC. The full assessment for the MECC Regional Dispatch Center comes back on in FY25. While there are reserves set aside for the transition back to a full assessment, this is expected to last only 1-2 fiscal years depending on cost drivers to the regional district. By the time FY25 arrives, the Town assessment will be anticipated at approximately $1.5 million.

● Stormwater Utility. July 1, 2023, or FY24, the stormwater utility implementation will be a tremendous amount of work and will require a 1-3 year transition out of the operating budget and into the utility. The start of this process in FY24 will be exhausting and time consuming for Finance, HR and DPW.

●

Inflation will be a factor as wages, petroleum and

costs are increasing across the board for materials, goods and services, which will increase

town budgets especially for departments such as Facilities and Public Works.

● Debt & Interest. The next three fiscal years will see a demand for increased share of debt and interest with projects that are in the pipeline or are anticipated to start within the next year. Projects that will require borrowing, debt and interest are Police Station, Remington-Jefferson Rehabilitation, the Beaver Street Interceptor, Davis-Thayer School and potential open space investments. While some outside the operating budget sources will pay for these projects, it is a reminder costs will continue to rise due to projects that are badly needed or will have significant community interest.

● Recruitment and Retention. Maintaining Franklin as an attractive place to work as employment markets shift as we adapt to the pandemic. A Compensation and Classification Study to analyze market competitiveness in the current environment for nonunion Municipal Departments and the Technology Department. The Town has an exceptional work culture. The Town has invested heavily in facilities, gear, apparatus and equipment that make Franklin an attractive place to work by getting our staff the gear they need to do their jobs.

Revenue trends. As in any year, monitoring revenue trends is important. However, FY23 will give the Town a greater sense of where the economy is post-COVID-19 pandemic, with rising inflation, petroleum costs, interest rates, consumer shopping trends and global finance markets. These dynamics are critical to the Town’s new growth and local receipts revenue sources.

|

| Town of Franklin - FY 2023 Budget Narrative - the high level view of what's in this year's proposed budget |