January 12, 2021

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Wednesday, January 13, 2021

Franklin Public Schools: Jan 12, 2021 Re-opening Update on Pool Testing

Both FHS swim teams top King Philip on Tuesday

Girls Swimming = Franklin, 93 @ King Philip, 75 – Final

🎉Big win for JV!! 🎉Final score 7-4 vs Canton. Goals by Dennett (2), Greco (2), Ford, Puleo, and Iannuzzi. Great work girls!

Follow the Girls Varsity Ice Hockey game at KP live: https://t.co/bT8W1VNPMQ @FHSGirlsPuck

— FranklinAthletics (@FHSSports) January 13, 2021

|

| Both FHS swim teams top King Philip on Tuesday |

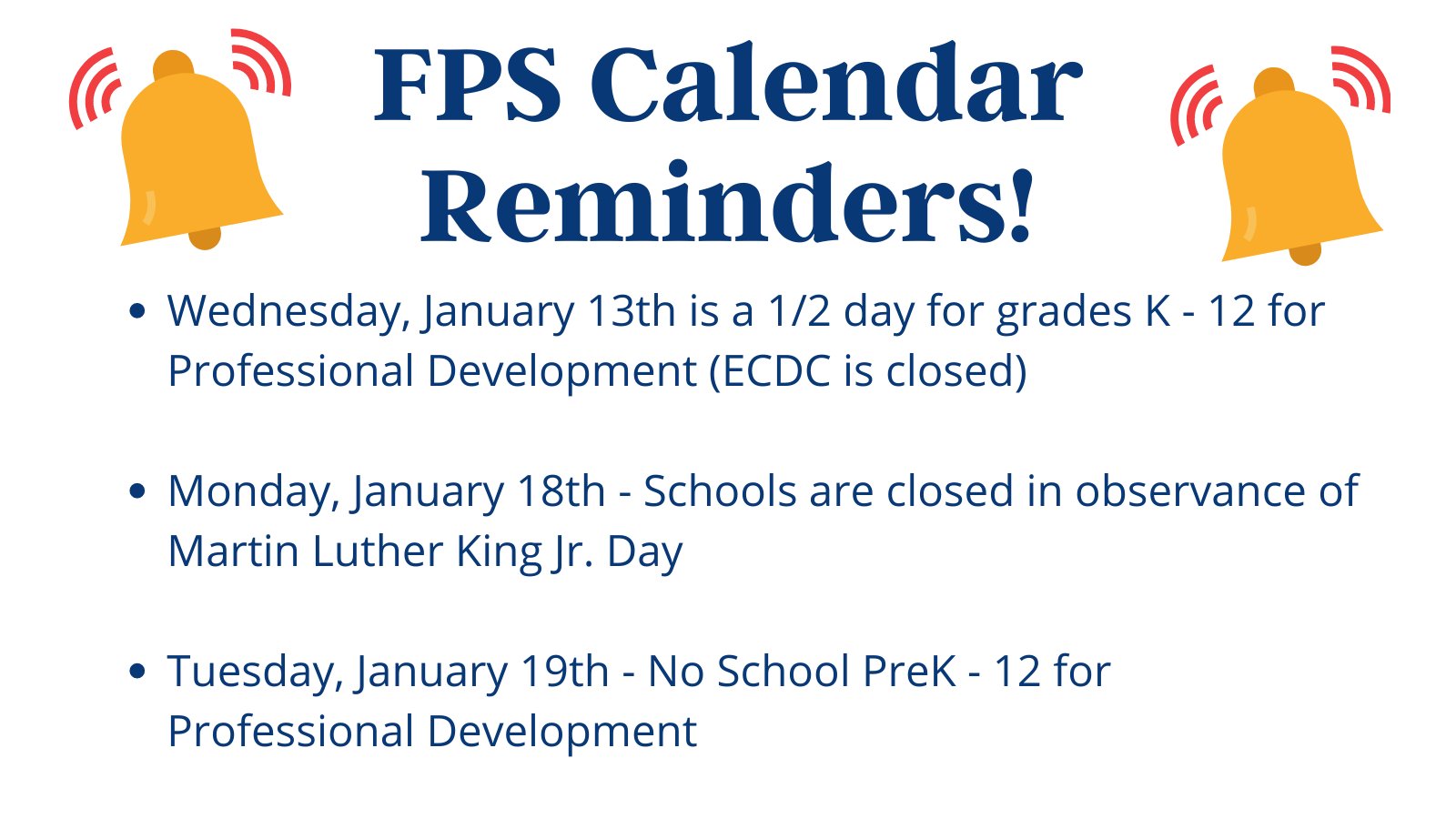

Franklin Public Schools, MA: School schedule reminders

Please make note of the upcoming schedule for FPS.

You can always find the 20-21 school calendar on our website at https://t.co/pFrWeBYdv8

|

| Franklin Public Schools, MA: School schedule reminders |

"systems couldn’t tell when words in a sentence were jumbled up"

From the MIT Technology Review, we find that while Artificial Intelligence (AI) continues to make strides, it also contains a significant flaw.

"Many AIs that appear to understand language and that score better than humans on a common set of comprehension tasks don’t notice when the words in a sentence are jumbled up, which shows that they don’t really understand language at all. The problem lies in the way natural-language processing (NLP) systems are trained; it also points to a way to make them better.

Researchers at Auburn University in Alabama and Adobe Research discovered the flaw when they tried to get an NLP system to generate explanations for its behavior, such as why it claimed different sentences meant the same thing. When they tested their approach, they realized that shuffling words in a sentence made no difference to the explanations. “This is a general problem to all NLP models,” says Anh Nguyen at Auburn University, who led the work."

|

| From the MIT Technology Review, we find that Artificial Intelligence (AI) contains a significant flaw |

CommonWealth Magazine: Gov Baker signs six bills, more await decision; including the climate change bill

"Baker signs campus sexual assault bill, approves deal affecting craft brewers"

"GOV. CHARLIE BAKER on Tuesday signed six bills with statewide implications, including a bill to provide more rights and resources to students involved in cases of sexual misconduct on campus and a long-sought after deal between craft brewers and their distributors.

The flurry of action came on myriad bills that landed on the governor’s desk in the final days of the legislative session, which included a marathon all-night session January 5."

"GOV. CHARLIE BAKER will be the final arbiter of a dispute between restaurants and food delivery apps over how much the apps can charge for providing delivery services.

The economic development bill currently on Baker’s desk would impose a statewide cap on the size of fees that delivery services like GrubHub and Uber Eats can charge to restaurants during the COVID-19 emergency. Restaurants have been pushing for the cap, arguing that high delivery commissions will drive them out of business. But delivery services say if they can’t charge high commissions, they will instead have to charge consumers more or do fewer deliveries, which will then hurt the restaurants."

"Could Gov. Charlie Baker veto the climate change bill?

It seems hard to believe, but several supporters of the sweeping legislation say they are hearing troubling reports coming out of the Baker administration as the clock winds down to the Thursday night deadline.

Some advocates and lawmakers, who asked not to be identified, said they are hearing the governor could possibly veto the bill. “I’m worried,” said one of the people."

IRS: All taxpayers now eligible for Identity Protection PINs

The Internal Revenue Service today expanded the Identity Protection PIN Opt-In Program to all taxpayers who can verify their identities.

The Identity Protection PIN (IP PIN) is a six-digit code known only to the taxpayer and to the IRS. It helps prevent identity thieves from filing fraudulent tax returns using a taxpayers' personally identifiable information.

"This is a way to, in essence, lock your tax account, and the IP PIN serves as the key to opening that account," said IRS Commissioner Chuck Rettig. "Electronic returns that do not contain the correct IP PIN will be rejected, and paper returns will go through additional scrutiny for fraud."

The IRS launched the IP PIN program nearly a decade ago to protect confirmed identity theft victims from ongoing tax-related fraud. In recent years, the IRS expanded the program to specific states where taxpayers could voluntarily opt into the IP PIN program. Now, the voluntary program is going nationwide.

About the IP PIN Opt-In Program

Here are a few key things to know about the IP PIN Opt-In program:

- This is a voluntary program.

- You must pass a rigorous identity verification process.

- Spouses and dependents are eligible for an IP PIN if they can verify their identities.

- An IP PIN is valid for a calendar year.

- You must obtain a new IP PIN each filing season.

- The online IP PIN tool is offline between November and mid-January each year.

- Correct IP PINs must be entered on electronic and paper tax returns to avoid rejections and delays.

- Never share your IP PIN with anyone but your trusted tax provider. The IRS will never call, text or email requesting your IP PIN. Beware of scams to steal your IP PIN.

- There currently is no opt-out option but the IRS is working on one for 2022.

How to get an IP PIN

Taxpayers who want an IP PIN for 2021 should go to IRS.gov/IPPIN and use the Get an IP PIN tool. This online process will require taxpayers to verify their identities using the Secure Access authentication process if they do not already have an IRS account. See IRS.gov/SecureAccess for what information you need to be successful. There is no need to file a Form 14039, an Identity Theft Affidavit, to opt into the program

Once taxpayers have authenticated their identities, their 2021 IP PIN immediately will be revealed to them. Once in the program, this PIN must be used when prompted by electronic tax returns or entered by hand near the signature line on paper tax returns.

All taxpayers are encouraged to first use the online IP PIN tool to obtain their IP PIN. Taxpayers who cannot verify their identities online do have options.

Taxpayers whose adjusted gross income is $72,000 or less may complete Form 15227, Application for an Identity Protection Personal Identification Number (https://www.irs.gov/pub/irs-pdf/f15227.pdf), and mail or fax to the IRS. An IRS customer service representative will contact the taxpayer and verify their identities by phone. Taxpayers should have their prior year tax return at hand for the verification process.

Taxpayers who verify their identities through this process will have an IP PIN mailed to them the following tax year. This is for security reasons. Once in the program, the IP PIN will be mailed to these taxpayers each year.

Taxpayers who cannot verify their identities online or by phone and who are ineligible for file Form 15227 can contact the IRS and make an appointment at a Taxpayer Assistance Center (https://www.irs.gov/help/contact-your-local-irs-office) to verify their identities in person. Taxpayers should bring two forms of identification, including one government-issued picture identification.

Taxpayers who verify their identities through the in-person process will have an IP PIN mailed to them within three weeks. Once in the program, the IP PIN will be mailed to these taxpayers each year.

No change for confirmed identity theft victims

Taxpayers who are confirmed identity theft victims or who have filed an identity theft affidavit because of suspected stolen identity refund fraud will automatically receive an IP PIN via mail once their cases are resolved. Current tax-related identity theft victims who have been receiving IP PINs via mail will experience no change.

See IRS.gov/IPPIN for additional details.

The IRS also encourages tax professionals and employers to share information with taxpayers about the availability of the IP PIN. Tax professionals and employers can print or email Publication 5367 or share IRS social media/e-poster products.

Medicare: What you should know about the COVID-19 vaccines

| Continue protecting yourself and others from COVID-19. |

|