|

Providing accurate and timely information about what matters in Franklin, MA since 2007. * Working in collaboration with Franklin TV and Radio (wfpr.fm) since October 2019 *

Friday, July 29, 2022

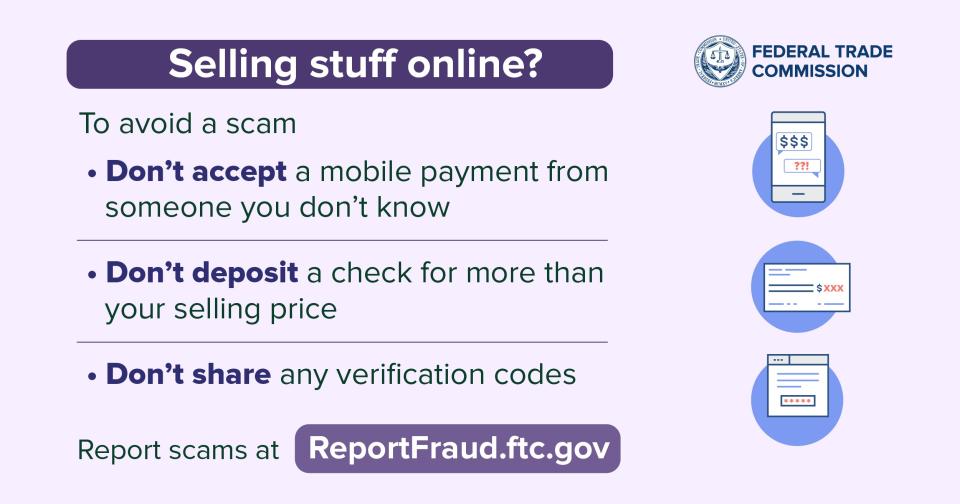

Selling stuff online? Here’s how to avoid a scam

Thursday, July 28, 2022

Tune into Military Consumer all year long

|

| https://www.militaryconsumer.gov/ |

Friday, July 15, 2022

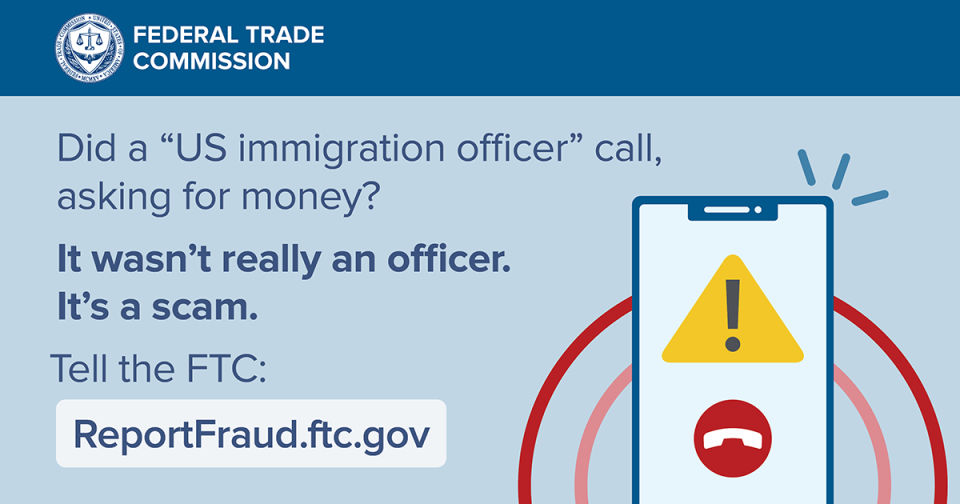

Scammers impersonate US immigration officers

If you got a call from ICE, you're not alone. (And, for the record, it wasn't them.) Scammers are pretending to be from US Immigration and Customs Enforcement (ICE) and US Citizenship and Immigration Services (USCIS).

|

| Scammers impersonate US immigration officers |

Thursday, June 23, 2022

Spot extortion scams on LGBTQ+ dating apps

|

| Spot extortion scams on LGBTQ+ dating apps |

|

Tuesday, June 7, 2022

IRS continues with Dirty Dozen this week

The Internal Revenue Service today kicked off the week with the 5th item on its 2022 annual Dirty Dozen scams warning list, with a sad reminder that criminals still use the COVID-19 pandemic to steal people's money and identity with bogus emails, social media posts and unexpected phone calls, among other things.

These scams can take a variety of forms, including using unemployment information and fake job offers to steal money and information from people. All of these efforts can lead to sensitive personal information being stolen, with scammers using this to try filing a fraudulent tax return as well as harming victims in other ways.

"Scammers continue using the pandemic as a device to scare or confuse potential victims into handing over their hard-earned money or personal information," said IRS Commissioner Chuck Rettig. "I urge everyone to be leery of suspicious calls, texts and emails promising benefits that don't exist."

The IRS has compiled the annual Dirty Dozen list for more than 20 years as a way of alerting taxpayers and the tax professional community about scams and schemes. The list is not a legal document or a literal listing of agency enforcement priorities. It is designed to raise awareness among a variety of audiences that may not always be aware of developments involving tax administration.

"Caution and awareness are our best lines of defense against these criminals," Rettig added. "Everyone should verify information on a trusted government website, such as IRS.gov."

A common scam the IRS continues to see during this period involves using crises that affect all or most people in the nation, such as the COVID-19 pandemic. Some of the scams for which people should continue to be on the lookout include:

Economic Impact Payment and tax refund scams: Identity thieves who try to use Economic Impact Payments (EIPs), also known as stimulus payments, are a continuing threat to individuals. Similar to tax refund scams, taxpayers should watch out for these tell-tale signs of a scam:

Any text messages, random incoming phone calls or emails inquiring about bank account information, requesting recipients to click a link or verify data should be considered suspicious and deleted without opening. This includes not just stimulus payments, but tax refunds and other common issues.

Remember, the IRS won't initiate contact by phone, email, text or social media asking for Social Security numbers or other personal or financial information related to Economic Impact Payments. Also be alert to mailbox theft. Routinely check your mail and report suspected mail losses to postal inspectors.

Reminder: The IRS has issued all Economic Impact Payments. Most eligible people already received their stimulus payments. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. Taxpayers should remember that the IRS website, IRS.gov, is the agency's official website for information on payments, refunds and other tax information.

Unemployment fraud leading to inaccurate taxpayer 1099-Gs: Because of the pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

Taxpayers should also be on the lookout for a Form 1099-G reporting unemployment compensation they didn't receive. For people in this situation, the IRS urges them to contact their appropriate state agency for a corrected form. If a corrected form cannot be obtained so that a taxpayer can file a timely tax return, taxpayers should complete their return claiming only the unemployment compensation and other income they actually received. See Identity Theft and Unemployment Benefits for tax details and DOL.gov/fraud for state-by-state reporting information.

Fake employment offers posted on social media: There have been many reports of fake job postings on social media. The pandemic created many newly unemployed people eager to seek new employment. These fake posts entice their victims to provide their personal financial information. This creates added tax risk for people because this information in turn can be used to file a fraudulent tax return for a fraudulent refund or used in some other criminal endeavor.

Fake charities that steal your money: Bogus charities are always a problem. They tend to be a bigger threat when there is a national crisis like the pandemic.

Taxpayers who give money or goods to a charity may be able to claim a deduction on their federal tax return. Taxpayers must donate to a qualified charity to get a deduction. To check the status of a charity, use the IRS Tax Exempt Organization Search tool.

Here are some tips to remember about fake charity scams:

- Individuals should never let any caller pressure them. A legitimate charity will be happy to get a donation at any time, so there's no rush. Donors are encouraged to take time to do the research.

- Potential donors should ask the fundraiser for the charity's exact name, web address and mailing address, so it can be confirmed later. Some dishonest telemarketers use names that sound like large well-known charities to confuse people.

- Be careful how a donation is paid. Donors should not work with charities that ask them to pay by giving numbers from a gift card or by wiring money. That's how scammers ask people to pay. It's safest to pay by credit card or check — and only after having done some research on the charity.

For more information about avoiding fake charities, visit the Federal Trade Commission website

Shared from the IRS -> https://www.irs.gov/newsroom/irs-continues-with-dirty-dozen-this-week-urging-taxpayers-to-continue-watching-out-for-pandemic-related-scams-including-theft-of-benefits-and-bogus-social-media-posts

|

| IRS continues with Dirty Dozen this week |

Wednesday, June 1, 2022

Hurricane season opens June 1 - Are you ready to deal with weather emergencies and avoid scams?

"Today marks the first day of the Atlantic hurricane season, which will run until November 30. Long-term averages for the number of named storms, hurricanes, and major hurricanes are 14, 7, and 3, respectively."

Shared from https://www.nhc.noaa.gov/gtwo.php?basin=atlc

|

| the first day of the Atlantic hurricane season |

"Threats from hurricanes don’t come just from wind and rain, storm surges, flooding and rip currents, or tornadoes and landslides. Hurricane-related threats also come in the form of scammers who use those weather emergencies to cheat people. Some of the most common weather-related frauds and scams include people who promise to help you with clean-up or repairs, but disappear with your money; those who pretend to be FEMA or other government agencies; people who promise you a job – if only you pay to get it; and those who promise you a place to rent – if only you wire them the money to get the place sight unseen.

The FTC’s site, Dealing with Weather Emergencies, has practical ideas to help you get ready for, deal with, and recover from a weather emergency. It also has advice on how to recognize, avoid, and report frauds and scams."

|

| Are you ready to deal with weather emergencies and avoid scams? |

Thursday, May 19, 2022

Applying for jobs? Be on the lookout for scams

|

|

| https://consumer.ftc.gov/consumer-alerts/2022/05/applying-jobs-be-lookout-scams |

Tuesday, April 12, 2022

Did you get a text from your own number? That’s a scam

|

|

| Did you get a text from your own number? That’s a scam |

Saturday, March 19, 2022

Use These Scam Tools to Spot Fraud

- Check out our Fraud Prevention and Reporting page to learn about Social Security fraud – and how we fight scammers -> https://www.ssa.gov/fraud/

- Read our Scam Alert factsheet to learn what tactics scammers use and how to protect yourself -> https://www.ssa.gov/fraud/assets/materials/EN-05-10597.pdf

Saturday, March 12, 2022

Fraud and older adults – what’s your story?

Your stories help us better understand how fraud affects every community. During National Consumer Protection Week, we’re offering information and advice for some of these communities.

Today we’re focusing on scams that have an impact on older adults.Read more -> https://www.consumer.ftc.gov/blog/2022/03/fraud-and-older-adults-whats-your-story?utm_source=govdelivery

|

| Fraud and older adults – what’s your story? |

Friday, March 11, 2022

Slam the Scam: How to Spot Government Imposters

"Do you know how to spot a government imposter scam?

That’s the question we’re asking as part of our annual Slam the Scam Day on Thursday, March 10, 2022. Scammers continue to evolve and find new ways to steal your money and personal information. On Slam the Scam Day and throughout the year, we raise awareness about Social Security-related scams and other government imposter scams. We want you to know how you and your loved ones can avoid becoming victims!

There are common elements to many of these scams. Scammers often exploit fears, threatening you with arrest or legal action. Scammers also pose as Social Security or other government employees and claim there’s a problem with your Social Security number (SSN) or your benefits. They may even claim your SSN is linked to a crime."

https://blog.ssa.gov/slam-the-scam-how-to-spot-government-imposters/?utm_medium=email&utm_source=govdelivery

Thursday, March 10, 2022

FTC Consumer Alerts: Servicemembers - Reporting for duty

|

Saturday, March 5, 2022

FTC Kicks Off National Consumer Protection Week this Sunday, March 6

The Federal Trade Commission (FTC) will launch the annual National Consumer Protection Week (NCPW) this Sunday, March 6.

Joined by other federal, state, and local agencies, consumer and national advocacy organizations, the FTC will spend March 6-12 sharing information with Americans on how they can avoid scams, identity theft, and other consumer protection issues.

To support these efforts, the FTC and its partners have organized a series of programming ranging from webinars to Twitter chats and livestreams. Topics of interest include college students and cryptocurrency scams, financial caregiving, and how to recover from fraud.

For more about events coming up this week -> https://www.ftc.gov/news-events/press-releases/2022/03/ftc-kicks-national-consumer-protection-week-sunday-march-6?utm_source=govdelivery

|

| FTC Kicks Off National Consumer Protection Week this Sunday, March 6 |

Saturday, January 29, 2022

Conned on social media? It’s not just you

|

|

| If you see or experience scam on social media, report it to ReportFraud.ftc.gov |

Monday, January 3, 2022

Register O'Donnell Warns Homeowners About Deed Scam

Register O’Donnell stated, “For the past several years, a California company has been preying on unsuspecting homeowners by sending a direct mail solicitation asking them to send a check for $95.00 in order to receive a copy of their deed. If a consumer knew that they could print a non-certified copy of their deed for free from our website www.norfolkdeeds.org

“These solicitations,” noted O’Donnell, “are labeled Recorded Deed Notice and request that the homeowner forward a check in the amount of $95.00 for a copy of their deed. The Registry has been contacted by multiple individuals who have received this solicitation. Please do not fall for this scam.”

Register O’Donnell concluded, “While the deed direct mail solicitation may be legal, it is unconscionable as it takes needless advantage of individuals. Clearly, this is a scam being perpetrated against hard working Norfolk County residents, many of whom are first-time homeowners or elderly. Consumers are interpreting these notices as a bill, since they are affixed with a due date. I once again urge in the strongest terms that Norfolk County citizens not let themselves fall victim to these types of misleading deed scam advertisements.”

If you receive such a deed solicitation notice, please contact the Registry’s Customer Service Center immediately at (781) 461-6101 or by email at registerodonnell@

To learn more about these and other Registry of Deeds events and initiatives, like us at facebook.com/NorfolkDeeds or follow us on twitter.com/NorfolkDeeds and Instagram.com/NorfolkDeeds.

The Norfolk County Registry of Deeds is located at 649 High Street in Dedham. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities and others with a need for secure, accurate, accessible land record information. All land record research information can be found on the Registry’s website www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center via telephone at (781) 461-6101, or email us at registerodonnell@

Thursday, December 23, 2021

United against scams - "The first principle of Kwanzaa is Umoja (unity)"

|

|

| United against scams - "The first principle of Kwanzaa is Umoja (unity)" |

Friday, December 17, 2021

’Tis the season for student loan scam calls

|

Sunday, December 5, 2021

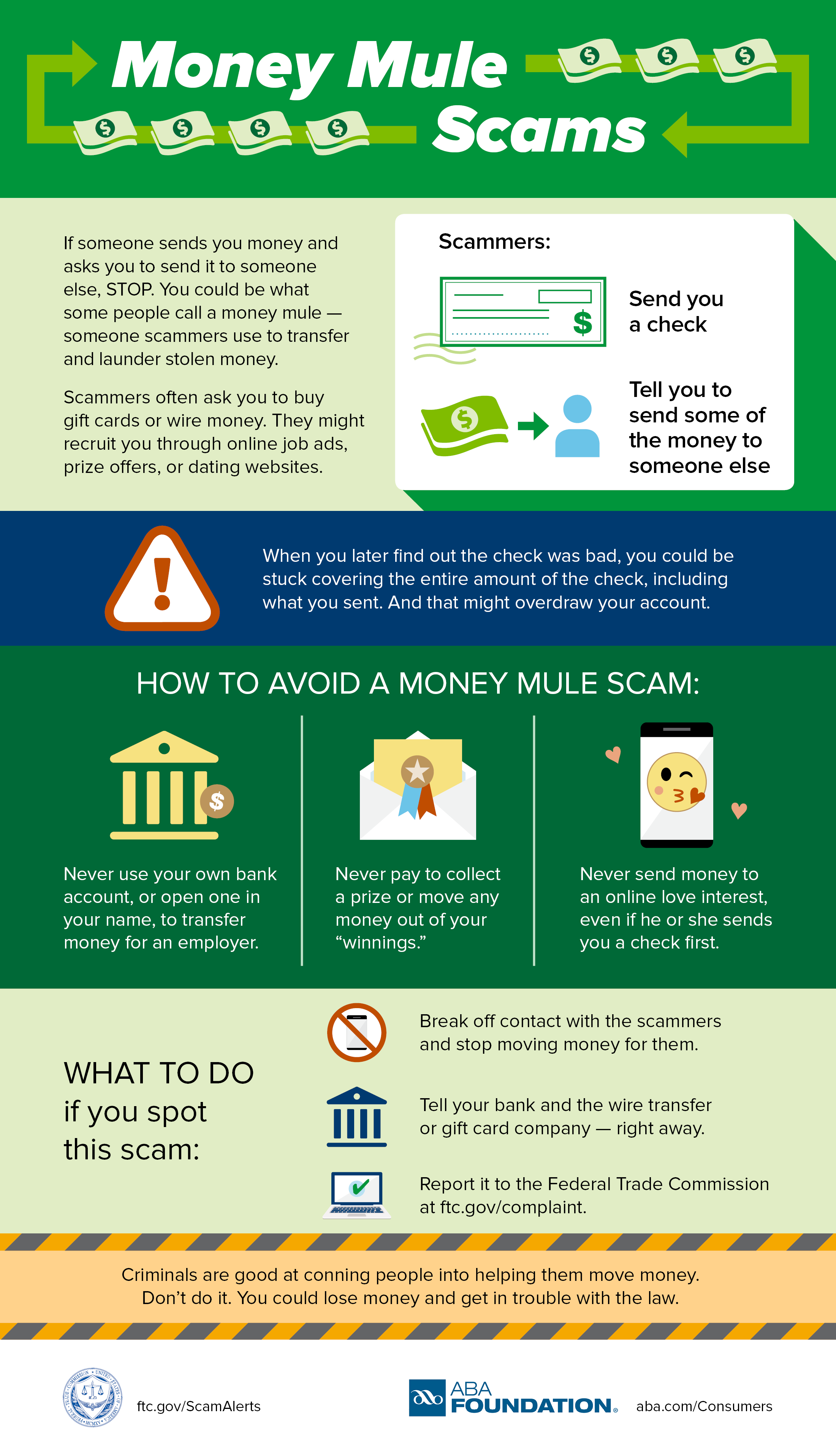

Avoiding a money mule scam

|

Thursday, December 2, 2021

Protect Yourself from Social Security-related Scams

|