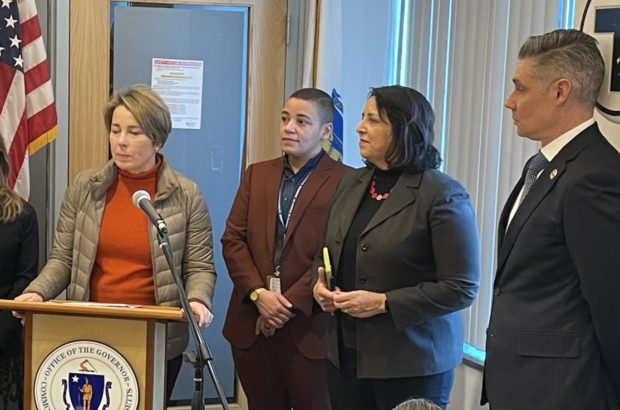

Governor Maura T. Healey and Lieutenant Governor Kimberley Driscoll today unveiled a $742 million tax relief package that provides significant savings for families, renters, seniors, farmers, commuters and more. The proposal, announced at the Demakes Family YMCA in Lynn, also includes key reforms to the tax code that will bring Massachusetts in line with other states, making it a more attractive place to live, work and do business.

“Everywhere we go, the Lieutenant Governor and I hear from people who are struggling to get by as the cost of living continues to skyrocket past them – the family watching their grocery bill grow each week, the young mom who wants to return to her dream job but can’t afford child care, the recent college graduate who can’t afford both his rent and student loan payments, the seniors who want to keep the home where they raised their family,” said Governor Healey. “We’re filing this tax relief package for each of them. This proposal centers affordability, competitiveness and equity each step of the way, delivering relief to those who need it most and making reforms that will attract and retain more businesses and residents to our great state.”

“Massachusetts is a national leader in so many ways – in education, business, science and technology, democracy and civil rights. But we’re not leading when it comes to affordability,” said Lieutenant Governor Driscoll. “If people can’t afford to live and work here, we’re not going to be able to maintain our economic edge. Our tax relief package will put more money back in the pockets of those who need it most while also making key reforms in areas where we are an outlier among other states.”

“The Healey-Driscoll Administration has made a values-driven decision to utilize the resources at our disposal to deliver economic relief to those who are struggling to make ends meet in the face of rising costs,” said Administration and Finance Secretary Matthew J. Gorzkowicz. “The Healey-Driscoll Tax Relief Package is both progressive and fiscally responsible, directly addressing many of the most urgent needs of our residents and setting the state up for economic growth.”

This package of tax reforms for Fiscal Year 2024 (FY24) will be filed on Wednesday as companion legislation to the administration’s FY24 budget (H.1). The proposal is built around relief that will go directly to families, seniors and those dealing with the high costs of housing.

That includes Healey’s Child and Family Tax Credit, a new benefit that will provide families with a $600 credit per dependent, including children under 13, people with disabilities, and senior dependents aged 65 and older. It combines two different benefits, the Household Dependent Tax Credit and the Dependent Care Tax Credit, removes the cap on dependents, and increases the benefit. At a cost to the state of $458 million, this would put money directly back into the pockets of 700,000 taxpayers in connection with more than 1 million dependents, helping families keep up with rising costs for child and senior care and bringing people back into the workforce to meet employer demand.

This package also proposes to increase the rental deduction, currently capped at 50 percent of rent up to $3,000, to $4,000. At a cost of $40 million, this increase will help offset the high cost of housing for 880,000 renters. Additionally, the administration is proposing to double the senior circuit breaker credit from $1,200 to $2,400 for low-income seniors with high property taxes or rent, helping seniors in 100,000 households stay in their homes.

To drive Massachusetts’ economic competitiveness, the package proposes reforms to two taxes in which the state is currently an outlier. It would reduce the short-term capital gains tax from

12 percent to 5 percent. Wisconsin and South Carolina are currently the only two other states that tax short-term capital gains at a higher rate than long-term capital gains, as Massachusetts currently does. This reform would have a gross revenue impact of $117 million in FY24, but would be budget-neutral due to excess capital gains not being used to support FY24 spending.

It would also eliminate the estate tax for all estates valued at up to $3 million with a credit of up to $182,000. Massachusetts is one of only 12 states that has an estate tax and shares the lowest threshold of those twelve with Oregon. This reform would reduce the tax burden on smaller estates, which historically have filed over 70 percent of estate tax returns, and helps seniors and families age in place and be able to stay in Massachusetts.

Other components of this tax package include:

- Housing Development Incentive Program (HDIP) - Increase the $10 million annual cap on HDIP credits to $50 million in the first year, and $30 million per year moving forward for developers as an incentive to produce more market-rate housing in the state’s Gateway Cities.

- Apprenticeships Tax Credit – Improve access to apprenticeships for workers by expanding the list of occupations that qualify for employer tax credits and doubling the statewide cap on credits to $5 million.

- Dairy Tax Credit – Increase the statewide cap from $6 million to $8 million to protect the state’s dairy farmers from fluctuations in wholesale milk prices.

- Live Theater – Promote local live theater productions with a new credit for a share of payroll, production and transportation costs for qualifying productions.

- Title V – Double the maximum credit to $12,000 (40 percent of $30,000) for expenses incurred at a primary residence for repair or replacement of failed cesspool or septic systems.

- Lead Paint Abatement – Double the allowable deductions to $3,000 for full lead paint abatement and $1,000 for partial abatement.

- Local Cider – Promote more locally produced hard cider and still wine by allowing higher-alcohol content ciders and wines (up to 8.5 ABV) to qualify for lower tax rates typically reserved for low-alcohol content products.

- Student Loan Repayment – Exempt employer assistance with student loan repayment from income taxation for student borrowers.

- Commuter Transit Benefits – Add regional transit passes and bike commuter expenses, such as bike-share memberships, purchases and storage, to those that qualify for tax deductions, alongside existing expenses like tolls and MBTA passes.

- Brownfields - Extend the brownfields tax credit program, currently set to expire in 2023, through 2028. This program allows taxpayers to claim a credit for costs related to cleanup of contaminated properties.

Statements of Support:

“Healthy, affordable homes are vital to a bright future for the Commonwealth. Hand in hand with housing production, providing immediate relief for renters and senior homeowners with low incomes, cleaning up Brownfields sites for new homes, making lead remediation more affordable, and helping people commute by regional transit and bike will support health, housing affordability, and vibrant neighborhoods.” -Rachel Heller, CEO, CHAPA

“MCOA applauds the Healey-Driscoll Administration on their proposed tax package. The increase in the Senior Circuit Tax Breaker will help 100,000 more older households remain in their communities. Each tax season, COAs assist older adults in accessing this tax credit and the increase will support the economic security of older people across the Commonwealth.” - Betsy Connell, Executive Director, Massachusetts Councils on Aging (MCOA)

“We are extremely grateful to Governor Maura Healey, Lt Governor Kim Driscoll and their teams for the proposal made today to increase the dairy tax credit from $6 million to $8 million dollars. The Administration today demonstrates their deep understanding of the dairy industry’s long history and its importance to the Massachusetts economy. The tax credit has been a key factor in stabilizing and saving the industry the last 15 years, and this proposed increase will greatly help offset the forecasted difficult times ahead in dairy costs of production and pricing.” - David Shepard, President, Massachusetts Dairy Farmer’s Association

“Associated Industries of Massachusetts is pleased that the first budget of the Healey-Driscoll administration addresses threats to the Commonwealth’s competitive edge. At a time when the cost of living in Massachusetts exceeds most other states, this package wisely identifies ways to help residents cut costs, reducing the financial burden on working families, while at the same time implementing tax changes that prevent Massachusetts from being an outlier. Based on this budget, it is clear that the Administration shares AIM’s concerns about the Commonwealth’s competitive future and this is a critical first step towards ensuring sustained growth and economic strength.” - Brooke Thomson, Executive Vice President of Government Affairs, Associated Industries of Massachusetts (AIM)

"Massachusetts is among the most expensive states to live and do business, and people are leaving at alarming rates. For an economy that has historically been built on access to the best talent in the world, this is a threat to the state’s long-term competitiveness. Tax relief is an important piece of the strategy to recruit, retain, develop, and diversify our talent pool and pipeline and the Roundtable is grateful to Governor Healey and Lt. Governor Driscoll for proposing a thoughtful and comprehensive set of tax proposals and investments to kick off this legislative session’s competitiveness policy discussion. The Roundtable looks forward to working with the Administration and Legislature to pass policy proposals targeted toward the people and employers that make our economy hum and ensuring the long-term economic vitality of the Commonwealth." - JD Chesloff, President and CEO, Massachusetts Business Roundtable

“Throughout the campaign, the Governor spoke about the need to make early education more affordable for Massachusetts’ families. Today’s expansion of the Child and Family tax credit is an important step in that direction as it offers parents a straightforward and easy-to-understand approach that prioritizes their bottom line.” -William J. Eddy, Executive Director, Massachusetts Association of Early Education & Care

"Expanding the Housing Development Incentive Program could help build more than 12,000 new multi family homes worth $4 billion over the next ten years in Gateway Cities. This could create vibrant, walkable downtowns all around the state and foster a more equitable pattern of regional investment." - Joe Kriesberg, CEO, MassInc

The tax package details can be found -> https://www.mass.gov/doc/fy-2024-budget-recommendation-brief-providing-meaningful-tax-relief/download

This press release can be found -> https://www.mass.gov/news/governor-healey-and-lieutenant-governor-driscoll-unveil-750-million-tax-relief-package

CommonWealth Magazine coverage -> https://commonwealthmagazine.org/state-government/healey-tax-plan-addresses-competitiveness-issues/

Boston Globe coverage -> https://www.bostonglobe.com/2023/02/27/business/birth-death-heres-what-gov-healeys-tax-plan-could-mean-you/